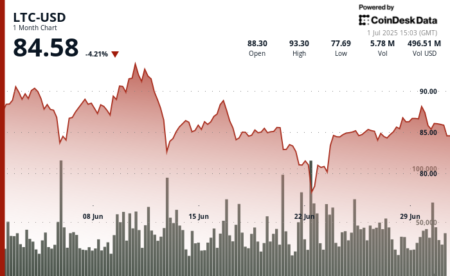

Will Bitcoin Break Through $108K or Face a Downturn Again?

Bitcoin (BTC), the leading cryptocurrency, continues to wrestle with key resistance levels as it approaches the $108K mark. Following a low of approximately $99.7K on June 23, BTC showed signs of recovery; however, a bearish trend emerged after encountering significant resistance around $108.8K. Current analyses suggest that if the pressure from retail investors persists, Bitcoin could retrace back to the $100K zone despite recent bullish momentum. This article delves into the current state of Bitcoin, market dynamics, and potential outcomes for investors.

Bitcoin’s Resistance Challenge

Bitcoin’s price action appears to be painted by historical trends of resistance, particularly at the $108.8K range. As of June 30, BTC approached this critical resistance but ultimately closed lower at $107,135. Many traders recall past instances where similar price levels have triggered sharp pullbacks, sparking growing concerns about a potential reversal. Amid these developments, the Stochastic RSI indicates a bearish signal, notably with a Death Cross formation—where the %K line falls below the %D line while still in overbought territory. This setup showcases weakening momentum, suggesting an increased likelihood of a downturn.

Derivatives Market Sentiment

The futures and options markets offer further insight into traders’ sentiments toward Bitcoin. As of June 30, Binance and OKX platforms reported a heightened bearish outlook. Binance displayed a Long/Short account ratio of 0.61, with only 37.97% of accounts taking long positions. This bearish sentiment was echoed on OKX, where the ratio dropped to 0.59. Such figures indicate that a significant majority of traders are placing their bets against Bitcoin, highlighting a pervasive sense of pessimism in the market. The high trading volumes—$13.05 billion on Binance and $6.62 billion on OKX—paired with an increased interest in short positions, further underline the potential downside risks.

Whales Step Back, Retail Traders Take Control

Another noteworthy trend emerging in the Bitcoin market is the apparent decline in whale participation. As seen on June 30, both the Futures Average Order Sizes and Open Interest exhibited significant reductions. This decline suggests that major market players are sidelining their trading activities, allowing retail investors to dominate the scene. With Open Interest falling to $34.7 billion, down from prior peaks, it indicates decreasing liquidity in the market. Retail traders now appear to be shaping market narratives, which adds the potential for further bearish pressure in Bitcoin futures.

The Role of Retail Investors

The dynamics of retail engagement seem to be shifting Bitcoin’s market landscape. With whales exiting their positions, retail traders have become increasingly influential. This shift is consequential; if retail investors persist in fostering bearish sentiment while whale activity remains subdued, Bitcoin could indeed slip back toward the psychologically important $100K level. The entry of retail investors traditionally leads to increased volatility, which may compound the possibility of a price correction in the near term.

Conclusion: An Uncertain Future for Bitcoin

As Bitcoin navigates its resistance challenges around the $108K mark, the interplay between retail and institutional investors has emerged as a pivotal element in determining price direction. The current evidence of bearish signals, coupled with a rise in short interest on major exchanges, raises questions about the sustainability of Bitcoin’s recent bullish momentum. While significant price movements are commonplace in the cryptocurrency market, traders should approach the forthcoming weeks with caution, keeping a close eye on market sentiment and technical indicators.

Final Thoughts

In summary, as Bitcoin battles resistance and showcases potential reversing trends, the market’s pulse is firmly in the hands of retail traders, with whales seemingly stepping back. Should bearish momentum persist, Bitcoin may be more likely to retreat toward the $100K zone, reflecting the delicate balance of power between these different market participants. Investors must remain vigilant, combing through data and signals while preparing for the volatility that typically accompanies this dynamic asset.