Explaining the Current Setback for U.S. Stocks Amid Economic Concerns

U.S. stocks are currently undergoing a notable downturn as a combination of credit issues and a slowing economy comes to the forefront. On Thursday, prominent voices in the financial sector, such as JPMorgan CEO Jaime Dimon, highlighted the potential for deeper problems, likening credit troubles to "cockroaches," indicating that when one issue surfaces, more are likely lurking beneath. His comments were in response to recent bankruptcies, including those of auto parts supplier First Brands and subprime auto lender Tricolor Holdings. This commentary on credit concerns underscores the prevailing unease within the financial markets.

Furthermore, the impact of First Brands’ bankruptcy is debilitating for its banking partner, Jefferies (JEF). The firm has experienced a staggering 25% decline in stock value over the past month, reflecting the market’s apprehension. On Thursday alone, Jefferies saw a 9% drop, although the bank claims it is resilient enough to absorb any losses attributed to the bankruptcy. This sets a worrying precedent in the current environment where even established banks may face unexpected liabilities.

Adding to the overall sense of instability, Zions Bancorp (ZION) revealed a $50 million charge linked to loans affected by borrowers facing legal challenges, and Western Alliance (WAL) announced legal action against a commercial real estate borrower for alleged fraud. Both firms saw significant stock price reductions—down 12% and 10%, respectively—contributing to broader declines across the regional banking sector. Despite the challenges faced by these institutions, the larger stock market has currently managed to absorb the news relatively well, with the S&P 500 only down by 0.8%.

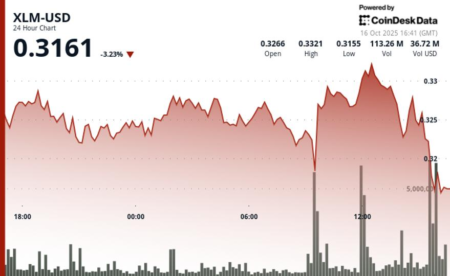

The "risk-off" sentiment among investors has also shifted certain asset prices, such as gold, which rose approximately 2.5% to near-record levels of $4,300 per ounce. This rise indicates a flight to more stable assets amidst turbulent market conditions. In contrast, cryptocurrencies like Bitcoin (BTC), which is often treated as a "risk-on" asset, faced significant losses, trading as low as $107,500—a drop of 3.2% in just 24 hours and 11% over the past week.

Despite the challenges, historical precedents suggest a potential turnaround is possible. Market disruptions, such as the Covid plunge in March 2020 and bank failures in March 2023, have historically led to sharp declines in Bitcoin, only to be followed by a significant recovery fueled by stimulus measures. As currently indicated by the bond market, there may be a similar response brewing. The 10-year Treasury yield has recently fallen to 3.97%, its lowest since a previous market panic in April, while the more sensitive two-year Treasury yield has dropped to 3.42%, signaling a favorable environment for potential monetary easing.

Market expectations are adjusting in light of these developments. Traders are now anticipating a 3.2% chance of a 50 basis point rate cut in the upcoming Federal Reserve policy meeting, a stark contrast to the previously expected likelihood of zero. Additionally, there’s now an 11% chance of 75 basis points rate cuts by the end of the year, reflecting a growing sentiment that the central bank may pivot toward a more accommodating monetary policy in response to economic pressures.

In summary, while U.S. stocks are encountering a rough patch characterized by credit concerns and signs of an economic slowdown, there are indicators that could herald a shift in market sentiment. A combination of potential monetary easing, historic market recovery patterns, and increased demand for safer assets like gold suggests that investors may find opportunities amidst current uncertainties. As always, astute investors will watch these developments closely to navigate the ever-evolving landscape effectively.