Understanding Bitcoin’s Resilience Amid Recent Market Corrections

In a dramatic turn of events, Bitcoin (BTC) recently faced a significant nosedive over the weekend, dropping to $106,189, prompting discussions among traders about the infamous “dead cat bounce.” Contrary to such sentiments, the market revealed a different narrative. By Monday evening, BTC made a substantial recovery, closing at $113,650—a remarkable 7% surge within just 48 hours, showcasing the inherent volatility and resilience of cryptocurrencies. Ethereum (ETH) mirrored Bitcoin’s recovery almost perfectly, bouncing from $3,830 to $4,103, reflective of the broader market dynamics at play.

The preceding week’s volatility was largely driven by chaotic tariff decisions that resulted in nearly $20 billion worth of over-leveraged positions being wiped out. This created a fragile environment where traders were jittery and cautious. Tuesday morning saw Bitcoin slipping below the crucial psychological level of $108k, triggering an intense wave of forced selling worth approximately $528 million. This sell-off cleared out many weak hands from the market, allowing newly positioned spot buyers the opportunity to push prices upward. As forced sellers exited, strength began to re-emerge in the BTC and ETH markets.

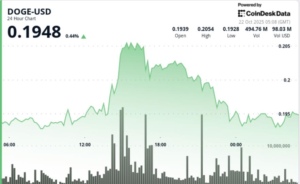

Data from Binance illustrates this wave of selling clearly. Following Sunday’s drop, attempts to re-test lower levels were made but failed, particularly for Ethereum, which closed barely in the red. The early session dip on Tuesday fell just below previous lows before an unexpected bullish momentum pushed both Bitcoin and Ethereum to break through significant resistance levels around $110,000 and $4,000, respectively. Instead of yielding to bearish sentiment, the cryptocurrency market showcased its characteristic volatility by supporting higher lows.

Looking ahead, the key focus for Bitcoin is whether it can maintain its floor between $111,000 and $112,000. If it slips below these levels, attention will swiftly revert to the $108,000 mark, a level critical for market stability. Conversely, if Bitcoin retains this support zone, it could aim for the next price target of $117,000, indicating increased bullish potential. For Ethereum, maintaining a trading position above $4,000 is crucial, serving as a psychological benchmark to divide weakness from strength.

While Tuesday’s rally does not fully erase the damages from last week, it certainly reshapes the immediate narrative for both BTC and ETH. This unexpected resurgence indicates the market’s ability to recover from adversity, leading to speculation that this “dead cat” might just have several lives left. With the inherent unpredictability of the cryptocurrency sphere, traders remain cautiously optimistic about future trade setups.

At the time of writing, Bitcoin holds its position as the top cryptocurrency by market capitalization at $2.21 trillion, although it recorded a slight decline of 0.2% over the past 24 hours. With a daily trading volume of $93.69 billion, which constitutes 59.15% of the overall crypto market dominance, Bitcoin remains a focal point in the ever-evolving landscape of cryptocurrencies. As market participants navigate these volatile shifts, understanding the dynamics and developments within Bitcoin and Ethereum remains essential for strategic trading and investment decisions.

In summary, while market corrections can provoke uncertainty, the latest movements in Bitcoin and Ethereum reveal the underlying strength and adaptability within the cryptocurrency sector. As traders adjust their strategies in response to new market conditions, the resilience of Bitcoin strongly illustrates the complexities and potential for profit inherent in digital currencies. As the market continues to evolve, staying informed about these pivotal price levels and market sentiments can empower investors to make well-rounded decisions.