Bitcoin and Crypto Market Update Amid Tariff Speculations

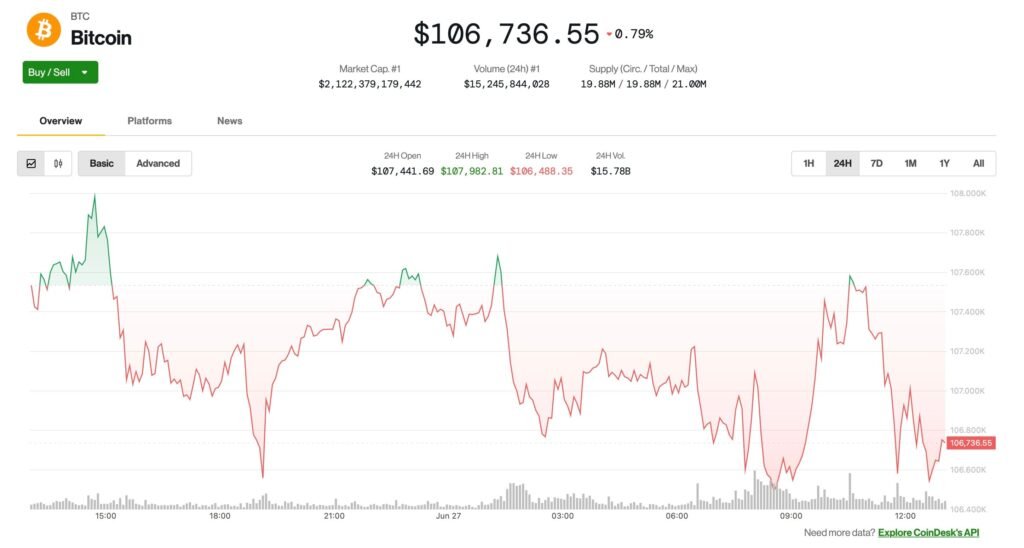

On Friday, the cryptocurrency market remained relatively stable despite the looming threat of renewed tariffs. Bitcoin saw a slight decline of 0.7% over the last 24 hours, trading at around $106,700. This trend mirrored the performance of the CoinDesk 20 index, which also recorded a decrease of 0.7% during the same period. Among the cryptocurrencies, Sui stood out with a notable gain, climbing 3.3%. Meanwhile, crypto-related stocks experienced more significant fluctuations, with Coinbase and Circle suffering losses of 6% and 16% respectively.

The market’s subdued reaction came in light of U.S. President Donald Trump’s announcement regarding the termination of trade discussions with Canada over a proposed Digital Services Tax aimed at U.S. tech companies. Trump indicated that the U.S. would inform Canada about impending tariffs within the next week, reigniting concerns around trade relations. However, analysts from Coinbase suggest that both traditional and crypto markets are largely unfazed by these developments, attributing this to a lack of immediate economic repercussions evident in current data.

Coinbase analysts highlighted market complacency regarding the tariffs, suggesting they may not have as profound an inflationary impact as previously anticipated. This sentiment reflects a broader trend where market participants appear to overlook geopolitical tensions and associated risks. The insistence on a "wait and see" approach indicates that traders are inclined to maintain positions rather than react impulsively to political announcements.

In the realm of cryptocurrency mining, firms experienced relatively consistent performance. Core Scientific’s shares saw a significant jump of over 30% on Thursday after reports surfaced of AI Hyperscaler CoreWeave’s interest in acquiring the company. However, Hut 8 witnessed a decline of 6.5%, contributing to a mixed bag of results for crypto mining stocks. This variability demonstrates the complexities and unique challenges faced by mining companies amidst fluctuating prices and regulatory landscapes.

The broader economic implications of the ongoing tariff discussions remain to be seen, and market analysts express skepticism about any drastic changes in inflation dynamics. This skepticism could be beneficial for crypto assets that particularly thrive on investor sentiment, as a stable or bullish outlook encourages further investment into the crypto market.

As the situation evolves, investors are keeping a vigilant watch on both economic indicators and announcements from government officials. The markets appear poised for potential shifts, driven by both external political pressures and internal market dynamics. This combination of factors will likely shape the crypto landscape in the weeks to come, highlighting the importance of strategic planning and informed decision-making for market participants.