Bitcoin’s Weekend Recovery: Insights and Trends

In an encouraging turn of events, Bitcoin (BTC) and the broader cryptocurrency market made noteworthy gains over the weekend, recovering after a significant dip that wiped out $500 billion in market value. Currently, Bitcoin is priced at $110,770, reflecting a 3% rise in the past 24 hours, despite being down 4% for the month. This bounce back can be attributed to an overall improvement in global risk sentiment, with equity markets strengthening and investors showing interest in higher-risk assets like cryptocurrencies once again.

Factors Behind the Market Recovery

The recent recovery in Bitcoin prices is largely influenced by external macroeconomic factors. U.S. President Donald Trump’s more favorable stance on tariffs, coupled with signs suggesting that the Federal Reserve may implement easier monetary policies in the upcoming months, has provided a calming factor for investors. As analysts note, while Bitcoin has experienced a temporary correction, its long-term trajectory remains promising, dictated by monetary policies, the strength of the U.S. dollar, and other variables including Bitcoin Exchange-Traded Fund (ETF) flows and geopolitical risks.

Knowing the Market Structure

Despite the short-term bullish momentum, Coinbase Institutional experts warn of persistent headwinds that may impact market structure. Concerns regarding thin liquidity, a robust U.S. dollar, and uncertainties surrounding the Federal Reserve’s interest rate policies continue to be significant. The recent rise in U.S. Treasury yields, alongside geopolitical tensions related to the Israel-Gaza conflict and ongoing issues in Ukraine, have prompted institutional investors to adopt a cautious outlook.

Corporate Accumulation and Institutional Confidence

Interestingly, despite these challenges, institutional accumulation of Bitcoin persists. Recent data from BitcoinTreasuries shows that corporate entities have increased their Bitcoin holdings by 8.4% in the last month, reaching a total of 4.04 million BTC. The launch of cryptocurrency exchange-traded products (ETPs) by major firms like BlackRock and 21Shares on the London Stock Exchange further signifies growing access to crypto markets for retail investors, thereby fostering enthusiasm within the institutional domain.

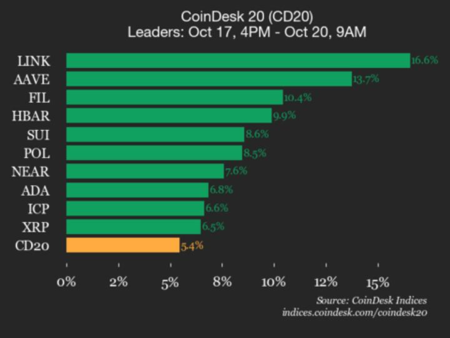

Altcoin Market Sentiment

The broader altcoin market saw a upswing as well, with notable gains in several cryptocurrencies, including the popular memecoin, Floki. However, despite these rebounds, the overall preference remains toward Bitcoin over altcoins, as indicated by CoinMarketCap’s altcoin season index. Bitcoin’s market dominance has risen to 58.8%, up from 57.2% last month, showcasing a growing preference among investors for the leading cryptocurrency.

Technical Analysis and Derivative Positioning

Current technical indicators reveal a cautiously optimistic sentiment within the market. With the average crypto relative strength index (RSI) at 54.2, the market remains in a transitional phase, distancing itself from critical support levels but struggling to reach major resistance levels. Nevertheless, Bitcoin’s options positioning remains bullish, with a significant buildup at the $140,000 strike price, indicating that traders are still factoring in upside momentum as they extend their bullish bets.

Conclusion

As Bitcoin experiences a rebound amidst a tumultuous market landscape, the key takeaway lies in its resilience. Institutional demand remains strong, with corporate holdings on the rise, which could bolster long-term confidence. While current conditions present challenges related to liquidity and macroeconomic factors, the overall sentiment points toward an optimistic outlook for Bitcoin and the broader cryptocurrency landscape in the weeks ahead. Investors should remain vigilant, keeping an eye on upcoming macroeconomic events and emerging trends to navigate this dynamic environment effectively.

![Synthetix [SNX] Soars 25% with $57 Million Inflow: Are Investors Getting Greedy?](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/snx-1000x600-300x180.png)

![Synthetix [SNX] Soars 25% with $57 Million Inflow: Are Investors Getting Greedy?](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/snx-1000x600-450x270.png)