Analyzing the End-of-Year Landscape in Cryptocurrency: Insights from Coinbase Institutional

As the cryptocurrency market approaches the end of 2023, Coinbase Institutional’s “Charting Crypto: Navigating Uncertainty” report, created in partnership with Glassnode, highlights a cautiously optimistic outlook for the fourth quarter. Following a market shakeout on October 10, characterized by heavy leverage and thin order books, the report notes ongoing vulnerabilities yet maintains a positive bias on pricing developments. Investors are advised to remain vigilant as macroeconomic anxieties resurface, reflecting broader market jitters that could affect cryptocurrency trading dynamics.

Key Factors Influencing Market Outlook

Coinbase attributes the recent market fluctuations to the intersection of high leverage and low liquidity, exacerbated by certain exchanges implementing auto-deleveraging mechanisms. Such actions can lead to significant market volatility, draining liquidity and capping potential gains for market makers. Despite this turmoil, prices stabilized into the weekend, although the market atmosphere remains tentative. The interplay of liquidity issues and macroeconomic factors clearly sits at the forefront of Coinbase’s analysis.

Liquidity Trends and Monetary Policy Insights

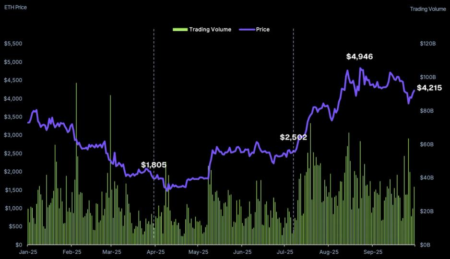

Coinbase’s examination of the Global M2 Money Supply Index reveals a supportive backdrop for cryptocurrencies. Historically, this index has shown a strong correlation with Bitcoin pricing, typically leading the cryptocurrency market by approximately 110 days. As the fourth quarter unfolds, Coinbase suggests that this supportive posture may face tightening conditions. They foresee at least two additional Federal Reserve rate cuts by year-end, potentially shifting capital out of risk-averse money-market funds and back toward cryptocurrency investments. This anticipation of regulatory easing could serve as a catalyst for price recovery in the near term.

On-Chain Activity and ETF Growth

Coinbase underscores the positive trends in on-chain activity observed through skyrocketing stablecoin supplies and near-record transaction volumes. This suggests a growing acceptance of cryptocurrencies for everyday transactions, which is a crucial marker of market maturity. Additionally, the deepening infrastructure for U.S.-based spot ETFs for Bitcoin and Ether offers enhanced accessibility for traditional investors, thereby strengthening market depth and contributing to healthier liquidity. These developments signify that the framework supporting cryptocurrency usage is evolving, facilitating more robust engagement amid ongoing volatility.

Investment Sentiment and Institutional Perspectives

The report gives a nod to the positioning preferences among institutional investors, who favor Bitcoin for its "digital gold" status amidst persistent concerns over fiscal discipline. Ethereum also appears on the radar as a constructive choice, benefiting from advancements in Layer-2 scaling solutions, leading to reduced transaction costs and improved activity. A survey embedded in the report highlights that a majority of institutions maintain a bullish outlook on Bitcoin over the next 3 to 6 months, despite identifying macroeconomic factors as the principal risk factor that could derail their forecasts.

Long-Term Perspectives on Digital Asset Treasuries

Coinbase highlights the emergence of digital-asset treasury companies (DATs) as meaningful, stable buyers of Bitcoin and Ether. With these entities now holding a significant share of the circulating supply, they demonstrate the sustained demand for digital assets. However, there remain questions about their long-term business models, especially following recent equity market fluctuations. While these players contribute positively to price stability, creeping uncertainties surrounding their operational frameworks could pose challenges moving forward.

Preparing for Potential Hazards Ahead

Despite the positive indicators, the report does not shy away from acknowledging near-term challenges that could impact market stability. Factors such as potential liquidity declines in November, uncertainties surrounding the recent U.S. government shutdown data, and questions surrounding the future role of DATs serve as reminders for investors to proceed with caution. Nonetheless, Coinbase asserts that the core components—liquidity conditions, favorable policy shifts, and the maturity of on-chain transactions—are likely to provide steady support as the year draws to a close, particularly for Bitcoin, which stands to benefit the most from these evolving circumstances.

In conclusion, as 2023 comes to a close, the interplay of market dynamics, institutional sentiment, and regulatory conditions indicate a cautiously positive outlook for cryptocurrency investments. The ongoing developments in liquidity, macroeconomic policies, and digital asset frameworks highlight the importance of strategic positioning as investors navigate the uncertainties that lie ahead. With Bitcoin and Ether at the forefront, the landscape appears ripe for potential growth if investors remain vigilant and adaptable.

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-450x270.webp)