The Rise of FARTCOIN: A Potential Shift in the Memecoin Market

In the ever-evolving world of cryptocurrencies, FARTCOIN has recently made headlines with a remarkable performance in Q2, outperforming the well-established Dogecoin (DOGE) in various key metrics. This surge represents a potential shift in dynamics within the memecoin sector, as FARTCOIN recorded a staggering 148% increase in valuation, breaking past the $1 threshold, a critical psychological level that it had previously dipped below multiple times earlier in the month. In stark contrast, DOGE has shown flat performance and struggles to maintain its position above the $0.20 mark. This raises the question: Is FARTCOIN gradually distancing itself from the "just a meme" label that has often overshadowed memecoins?

FARTCOIN: Beyond Just Hype

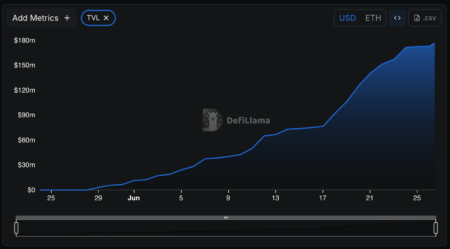

Although skeptics remain, attributing FARTCOIN’s rise to mere early-stage "hype," concrete data offers a more compelling narrative. In less than a year since its launch, FARTCOIN has successfully captured approximately 4% of DOGE’s market capitalization, showcasing significant liquidity for a newcomer in the memecoin market. With minimal slippage of just 0.5% on a $1 million sell, it exhibits robust financial strength. While FARTCOIN has yet to reach its January market cap peak of $2.09 billion, its performance suggests a healthy ongoing consolidation phase rather than a euphoric market top.

A critical indicator of FARTCOIN’s strength is its HODLer retention rate, which has climbed to nearly 90%, the highest since its debut. Additionally, liquidity in derivatives is rebounding towards a mid-June peak of $800 million, indicating a renewed speculative interest. In contrast, DOGE’s futures activity has dwindled, leading to flat Open Interest. This divergence suggests that FARTCOIN not only has technical backing but is also attracting capital that may have previously been invested in DOGE.

A Stronger On-Chain Structure

The structural metrics of FARTCOIN offer a fascinating contrast to DOGE’s recent performance. In analyzing FARTCOIN’s price movements on the 1D chart, a clear divergence emerges. While the wider market struggled from late January to early April, FARTCOIN established a defined consolidation phase that served as a catalyst for its impressive surge. Starting in early March, FARTCOIN executed a parabolic rally, soaring over 400% within just two months and reaching a peak of $1.58 by late May.

Conversely, DOGE has been mired in a downtrend, consistently posting lower lows and failing to secure crucial support levels. Following a retreat to $0.12, DOGE appears to be reverting to its pre-election base, lacking the dynamic movement that FARTCOIN has demonstrated. Recently, FARTCOIN has bounced off a strong support level at $0.80, achieving a 24% increase in just one week, signalling a genuine structural resilience.

Market Sentiment Shift

This structural divergence may signify a larger trend within the memecoin landscape. Although DOGE has long held the title of meme-king, waning technical performance and declining on-chain metrics suggest that investors’ allegiances may be shifting. FARTCOIN’s ability to capitalize on this transition raises the question of whether it is evolving into the memecoin that DOGE had the potential to be but failed to actualize. The budding investor enthusiasm surrounding FARTCOIN paints a picture of a community looking for substance over mere amusement.

Although it’s crucial for market participants to remain cautious, the growing support for FARTCOIN hints that it could become more than a fleeting trend. Its impressive metrics, along with the increasing interest from both strategic and speculative investors, indicate that FARTCOIN may be well-positioned for sustained growth. As FARTCOIN continues to carve its path, it serves as a reminder that the memecoin landscape is anything but static.

Speculation and Future Potential

As the market continues to evolve, one cannot ignore the role of speculation in cryptocurrencies. However, FARTCOIN’s structural integrity and robust performance metrics suggest that its rise may not solely rely on speculative enthusiasm. The strong retention among HODLers could point to solid long-term investments that are less likely to evaporate once the initial excitement wanes. This distinction sets FARTCOIN apart from several other memecoins that have faltered after their hype cycles.

Moreover, as FARTCOIN attracts fresh capital, it might even foster more innovations within the memecoin sector. Other projects aiming to capture investor interest will need to analyze FARTCOIN’s strategy and execution, which could prompt a new wave of quality projects in this niche market. The viability of such a transition confirms that the memecoin ecosystem is evolving and maturing, distinguishing itself from the early pandemonium to a more structured environment where merit and functionality can drive success.

Conclusion: A New Era for Memecoins?

In summary, FARTCOIN’s recent ascent raises intriguing questions about the future of memecoins. While DOGE remains a staple in the market, its stagnation and lack of structural strength signal a potential downturn, creating an opportunity for newer projects like FARTCOIN. This shift could mark a transformative stage in the memecoin narrative, with FARTCOIN emerging as a serious contender in a space that often prioritizes community-driven humor over substantive value.

As both investor interest and analytical research keep growing around FARTCOIN, the landscape may well witness a broader transformation away from the blinkered perception that memecoins are merely novelties. With its technical strengths and evolving community backing, FARTCOIN not only champions the potential of memecoins but may also redefine what it means to succeed in this vibrant and volatile market. As we look forward, FARTCOIN could very well establish a new paradigm in the memecoin arena, where novelty meets sustainability.