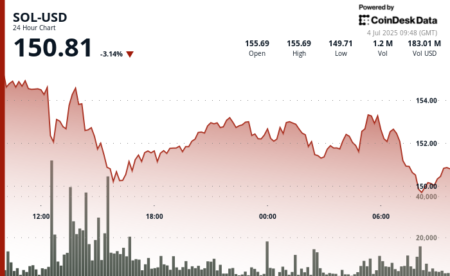

Bullish Trends and Bearish Sentiment: Navigating the TIA Market Dynamics

In the ever-evolving cryptocurrency landscape, Celestia [TIA] has recently emerged as a point of interest among traders. Over a 24-hour period, TIA experienced a remarkable rally, climbing 16%, despite prevailing bearish sentiments that had earlier dragged its value down by 26%. This surge can largely be attributed to bullish derivative traders who are actively opening long positions in anticipation of further price increases. However, the contrasting actions of spot investors, who have begun offloading their holdings, pose intriguing questions about the market’s future trajectory.

The Current Market Landscape

The recent activity within the TIA market is a classic example of divergent sentiment between different trading cohorts. As bullish derivative traders place their bets on the asset’s upside potential, spot market investors have displayed bearish behavior, selling nearly $2.97 million in TIA over the last 48 hours. The reasoning behind this selling pressure can be deciphered through two probable scenarios: profit-taking or a lack of confidence in TIA’s sustained rally. While some may argue that the sell-off reflects skepticism regarding its future, evidence leans toward profit-taking being the dominant factor. This suggests that those holding TIA are capitalizing on recent gains while still observing a potential upward trend.

Investor Sentiment and Future Outlook

Despite the sell-off by spot investors, sentiment data sourced from CoinMarketCap provides a glimmer of optimism. Notably, 78% of investors express confidence in TIA’s continued uptrend. If this positive sentiment persists, it may lead to an influx of liquidity into TIA, providing the necessary fuel for further price appreciation. Such accumulated interest highlights the potential for a rebound, emphasizing the dual narratives at play within the market: while short-term selling exists, long-term bullish perspective remains robust.

Derivative Market Insights

The derivatives market is currently witnessing a significant surge in long positions, adding weight to bullish expectations surrounding TIA. When examining the Open Interest Weighted Funding Rate on CoinGlass—a critical barometer of market sentiment—it reveals a positive reading of 0.0057%. This indicates a predominance of long contracts over short ones, suggesting that traders are increasingly confident about TIA’s upward movement. Additionally, the Taker Buy/Sell Ratio, which serves as a gauge of buying interest, remains above 1, reflecting that buy pressure is currently dominating the market.

Price Targets and Technical Analysis

Technical analysis of TIA’s price movement provides valuable insight into its future trajectory. AMBCrypto’s assessment highlights a potential price target of $1.89 based on the Bollinger Bands (BB) indicator, which offers a dynamic perspective on market resistance and support. TIA’s recent price action demonstrates a bounce from the lower band, overcoming middle band resistance, and presently navigating toward the upper band at $1.89. Supporting this optimistic outlook is the Relative Strength Index (RSI), which, while still below the neutral 50 mark, showcases an upward trend. A continued rise into the 50-70 range would further strengthen the case for TIA reaching the $1.89 target.

Conclusion: Key Takeaways

In summary, TIA presents a compelling study in market dynamics, showcasing contrasts between bullish derivative traders and bearish spot investors. While the latter’s sell-off raises questions about confidence, sentiment indicators suggest an overarching optimism that could trigger renewed investment in TIA. The derivatives market’s bullish inclination and technical indicators support a potential price rise to $1.89. As traders monitor these developments, the TIA landscape remains one to watch, illustrating the complex interactions that define the cryptocurrency market. Keeping an eye on sentiment and technical indicators will be crucial for investors aiming to navigate this volatile environment effectively.