Current Trends in the Cryptocurrency Market: A Deep Dive

In the ever-volatile cryptocurrency landscape, Bitcoin (BTC) recently slipped below the $105,000 mark, erasing early-week gains and reflecting broader turmoil across financial markets. The price drop of nearly 8.89%, as reported by the CoinDesk 20 index, correlates with increasing credit market stress and a significant uptick in forced liquidations, resulting in over $1.2 billion wiped off leveraged crypto positions over just 24 hours. Concerns about corporate debt viability have intensified, amplified by recent bankruptcies such as those of First Brands and Tricolor, dragging down risk asset prices across the board.

The Ripple Effects of Corporate Stress

JPMorgan’s CEO, Jamie Dimon, cautions that these downturns might reveal underlying issues in the credit markets, likening them to "cockroaches" — an indicator that others may follow. This pervasive anxiety has been spilling over into the cryptocurrency market, causing leveraged traders, who anticipated a turnaround, to reevaluate their positions hastily. Disturbingly, nearly 79% of liquidated trades were long positions, showcasing excessive optimism. While Bitcoin has fared relatively better than most altcoins in this tumultuous environment, many alternative coins have witnessed double-digit percentage losses.

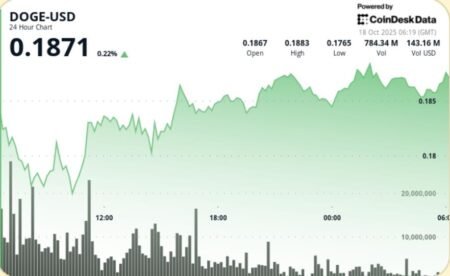

The Altcoin Market Facing Severe Pressure

Thomas Chen, CEO of Function, highlighted the precarious situation of altcoins in leverage-heavy conditions. He pointed out that when Bitcoin dips, altcoins — often regarded as riskier assets — can plummet by 40–50%. This trend raises questions about market confidence and the overall health of alternative cryptocurrencies, often getting liquidated quickly in bearish conditions. With Bitcoin showing resilience, the altcoins remain more vulnerable to market fluctuations.

Macroeconomic Challenges and Market Reactions

The macroeconomic landscape isn’t helping matters; ongoing fears regarding a prolonged US-China trade conflict, vulnerabilities within regional banks, and waning trust in long-term sovereign bonds are creating a shaky foundation for investments. This wave of uncertainty has driven investors towards traditional safe havens like gold, which has soared toward $4,400. Even gold-backed tokens like XAUT and PAXG have outperformed much of the broader cryptocurrency market. Chen notes that markets typically overreact but usually circle back to correcting these extremes.

What’s on the Horizon?

As we enter a new week, significant events are worth noting. On October 17, SynFutures (F), a perpetual swaps decentralized exchange (DEX) powered by Base, is set to host a Q&A session. In addition to cryptocurrency events, macroeconomic discussions are also taking center stage, including a meeting between Ukrainian President Volodymyr Zelenskyy and former President Donald Trump at the White House. Keeping an eye on these developments can furnish investors with insights into potential market shifts.

Technical Insights and Future Outlook

Despite recent volatility, the Bitcoin futures market has demonstrated stability, with open interest hovering around $25.7 billion. Funding rates are now flat across major venues, indicating a more cautious sentiment. Additionally, the Bitcoin options market reveals a complex situation: while there is a slight bearish bias in volume, a high 25 delta skew suggests that many traders are still positioning for a short-term rally. With Bitcoin’s critical support levels set at $100,000 and $98,000, its ability to hold these lines will be crucial in determining the market’s trajectory. Analysts urge caution but remain skeptical that we may be entering a robust recovery phase.