Crypto Investment Products Soar as Inflows Reach $2.7 Billion

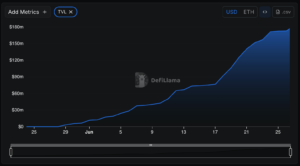

In a landmark week for the digital asset market, crypto investment products accumulated a remarkable $2.7 billion in net inflows, as reported by CoinShares. This achievement marks the eleventh consecutive week of positive inflows, collectively summing up to $16.9 billion over this period, and contributing significantly to a year-to-date total of $17.8 billion. This continuous stream of investment has propelled the total assets under management for crypto products to exceed $184 billion, highlighting the increasing investor interest in cryptocurrencies despite fluctuating global conditions.

Factors Driving Positive Inflows

James Butterfill, the Head of Research at CoinShares, identifies several key factors driving the sustained inflows into crypto products. The growing geopolitical uncertainties and evolving monetary policy expectations have stimulated a heightened demand for digital assets. While this year’s cumulative inflows are slightly lower than last year’s figure of $18.3 billion, they are consistent with early indicators from 2024, where inflows also aligned around the $18.3 billion mark by mid-year. This trend indicates a persistent resilience and attraction in the crypto market, reflecting broader investor confidence.

Bitcoin Dominance Remains Unchallenged

Bitcoin continues to dominate the inflow landscape, accounting for a staggering 83% of total crypto inflows last week, which translates to $2.2 billion specifically for Bitcoin investment products. These figures elevate Bitcoin’s year-to-date inflows to $14.9 billion, confirming its stronghold in the market. On the flip side, short-Bitcoin investment products recorded minimal net outflows of $2.9 million, adding up to a total of $12 million in outflows for the year. This trend signifies a growing positive sentiment towards Bitcoin, especially as Bitcoin-based exchange-traded funds (ETFs) gain traction.

The ETF Landscape and U.S. Market Influences

The surge in Bitcoin’s popularity is further amplified by the significant growth of U.S.-based spot Bitcoin ETFs, notably BlackRock’s IBIT, which alone attracted over $1.5 billion last week, accumulating more than $17 billion year-to-date. Since launching in January 2024, IBIT has emerged as a dominant player in the ETF sector, indicating a broader trend towards ETF investment in the cryptocurrency space. The U.S. market has significantly overshadowed other regions, with crypto products from the country attracting over $16.8 billion in capital this year, cementing its position as the leader in crypto investment flows.

Ethereum and Altcoin Performance

Ethereum also demonstrated considerable strength, with Ethereum-based funds receiving $429 million in inflows, bringing their year-to-date total to $2.9 billion. The ongoing interest in Ethereum has been particularly stimulated by the recent Pectra upgrade and its increasing institutional adoption. In contrast, other altcoins like Solana have exhibited more subdued inflows, totaling $5.3 million this week, culminating in $91 million for the year. Meanwhile, XRP and Sui have shown even stronger performance, with inflows of $219 million and $104 million respectively, indicating robust investor interest in these altcoin alternatives.

Future Outlook for Crypto Investments

Looking ahead, the current momentum in crypto investments presents an auspicious outlook for the digital asset market. The sustained inflows, especially into Bitcoin and Ethereum, signal robust investor confidence in these leading assets. While geopolitical uncertainties and shifting monetary policies pose challenges, they also reinforce the allure of cryptocurrencies as a hedge against traditional market fluctuations. As regulatory clarity continues to evolve and institutional adoption escalates, the prospects for altcoins and emerging digital assets appear optimistic as well.

Conclusion: A Thriving Crypto Landscape

In summary, the notable inflow of $2.7 billion into crypto investment products highlights a thriving digital asset landscape amidst global uncertainties. Bitcoin and Ethereum continue to dominate the market, driving significant inflows and showcasing investor confidence. With the rise of Bitcoin ETFs and increasing interest in altcoins, the cryptocurrency market is poised for further growth, evolving into a pivotal asset class for modern investors. As we move forward, observing the trends and developments in this arena will be crucial for those looking to capitalize on the ongoing crypto revolution.