Bitcoin vs. Gold: A Comparison of Market Dynamics and Future Potential

Introduction

Bitcoin and gold have long been viewed as major players in the investment landscape, with investors utilizing both as hedges against economic uncertainty and currency devaluation. As of now, Bitcoin boasts a market cap of approximately $2.21 trillion, significantly lower than gold’s substantial market valuation of around $30.34 trillion. Despite this stark difference, Bitcoin is increasingly being considered a viable alternative to gold, particularly amidst its characteristic volatility. In this article, we delve into the comparisons between Bitcoin and gold, explore the potential for Bitcoin to serve as a safe haven, and assess its future trajectory in the financial ecosystem.

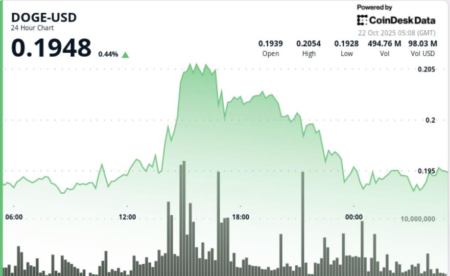

Current Market Dynamics

Bitcoin’s current trading price of $107,848.24 reflects a 2.91% decline over the past day, showcasing its inherent volatility. Prominent figures in the cryptocurrency space, such as Binance CEO Changpeng Zhao, remain optimistic about Bitcoin’s potential to surpass gold in value. Zhao’s assertion that Bitcoin could ultimately “flip” gold serves as a rallying point for cryptocurrency advocates. Bitcoin’s journey so far has shown significant growth, particularly since its inception when gold was valued around $8 trillion, suggesting a compelling case for a future where Bitcoin could close the gap with gold.

The Concept of ‘Flippening’

Currently, Bitcoin’s market cap stands at approximately $2.21 trillion compared to gold’s $29.75 trillion, creating a considerable disparity. However, conversations around the “flippening”—where Bitcoin overtakes gold—are gaining traction. This concept is increasingly being viewed as feasible, particularly as Bitcoin has historically shown a higher annualized growth rate compared to gold. As economic conditions fluctuate, both assets are viewed as part of the “debasement trade,” offering investors protection against currency devaluation, especially concerning the US dollar.

Investor Sentiment and Reactions

The community’s reactions to Zhao’s bullish predictions vary. Some investors express cautious optimism, pointing out the significant obstacles Bitcoin must overcome, including potential regulatory challenges and competition from tokenized assets. An analyst noted that Bitcoin, at a gold-to-Bitcoin ratio of 0.03941, still has a long way to go. Predictions indicate that if Bitcoin’s market cap reaches a consistent demand level, its price could soar to $1.49 million, depending on various economic factors. Such insights underscore the need for careful monitoring of market sentiment as the cryptocurrency landscape evolves.

Potential as a Safe Haven

Recent market turmoil and capitulation signals could point to a potential market bottom for Bitcoin, enhancing its profile as a safe haven. While gold has long been the gold standard for “safe haven” assets, Bitcoin’s unique characteristics—such as its decentralized nature and scarcity—are gaining credibility in this realm. Notably, data indicate a possible shift in investor sentiment as panic-driven selling begins to ease, hinting at Bitcoin’s resilience amid market fluctuations. This growing recognition may further elevate Bitcoin’s legitimacy as a store of value compared to gold.

Future Outlook

The future of Bitcoin as a contender against gold hinges on several tripwires, including institutional adoption and mainstream acceptance. Central banks’ reserve allocations to Bitcoin, energy producers participating in cryptocurrency mining, and increased inflows from ETFs and corporate treasury investments could all play pivotal roles in shaping Bitcoin’s trajectory. Although it remains behind gold in terms of overall market cap, Bitcoin’s gradual ascent is a testament to its evolving status in the financial world. As more investors explore alternatives to traditional hedges, Bitcoin’s potential as both an asset and a safe haven continues to gain attention.

Conclusion

In summary, while Bitcoin currently lags substantially behind gold in terms of market capitalization, indications point towards its potential to challenge gold’s long-standing dominance. With growing institutional interest, increased recognition as a safe haven, and sustained development within the cryptocurrency landscape, the concept of Bitcoin flipping gold is no longer a distant dream. As investors navigate the complexities of an evolving financial landscape, Bitcoin’s promising trajectory deserves careful consideration for those seeking to diversify their portfolios and hedge against uncertainty. The future of these two assets will undoubtedly be shaped by ongoing market dynamics and investor sentiment, making it an exciting arena to watch.