Dogecoin Price Stabilization Amid Market Volatility: Key Insights

On Friday, Dogecoin (DOGE) experienced a volatile trading session, experiencing a notable price drop to $0.176 before regaining stability within the $0.18–$0.19 range. Over the course of the session, DOGE fluctuated by approximately 7% as broader market anxieties were triggered by significant macroeconomic news and large sell-offs by cryptocurrency whales totaling $74 million. Understanding these dynamics can provide essential insights for investors and traders interested in DOGE and the broader cryptocurrency market.

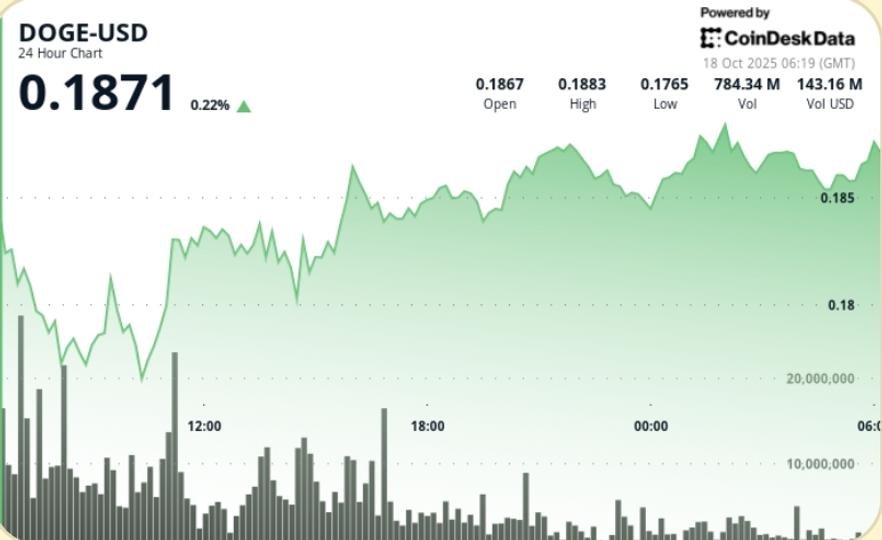

Current Trading Range and Volume Insights

As of October 18, DOGE traded between $0.176 and $0.189, establishing a range of 6.7%. The heightened trading activity coincided with a significant sell-off that drove trading volumes above 1.4 billion during a one-hour period. A critical support level emerged around $0.18, where substantial buying interest helped to absorb sell pressures. This support trend indicates that despite initial panic, strong accumulation by buyers has become evident. Investors are closely watching these developments as they signal market sentiment can shift quickly.

The Impact of Macro Conditions on DOGE

The volatility experienced by DOGE can be attributed to external macroeconomic factors, particularly the announcement of a 100% tariff on Chinese imports by the Trump administration. This announcement sent risk assets tumbling across Asian markets, created a ripple effect of anxiety, causing many investors to reassess their exposure to cryptocurrencies. As DOGE faced liquidation pressure, it encountered resistance but rallied as whales and market makers stepped in to absorb the excess supply, underscoring an interesting dynamic of buying amidst broader market fears.

Dogecoin’s Performance Metrics

Intraday performance metrics for DOGE reveal a sharp decline from $0.188 to $0.176 at 07:00 UTC, accompanied by notable volume spikes. As the trading session progressed, DOGE steadily reclaimed levels around $0.184 and $0.187, indicating resilience. During the critical final hour of trading, the DOGE price tested a low of $0.1853, supported by a 10.5 million volume spike, before closing near $0.186. Nonetheless, the cryptocurrency faced resistance around $0.188–$0.189, marking a critical zone to monitor for breakout potential.

Technical Analysis Insights

Technical indicators reveal critical support and resistance levels for DOGE. Support is notably held at the $0.175–$0.180 range, where buyers exhibit high conviction. Resistance sits within the $0.188–$0.190 band; breaking through this range could target levels of $0.20 or above. Additionally, during the recent period, a pattern of narrow-band consolidation following early morning declines points to a potential "volatility coil," where traders are anticipating a breakout. The Relative Strength Index (RSI) remains neutral at approximately 49, and the Moving Average Convergence Divergence (MACD) is flattening, indicating that neither a bullish nor bearish trend holds dominance.

Factors Influencing Trader Behavior

Traders are poised to watch various factors that could significantly impact the price of DOGE. The confirmation of $0.18 as a short-term support level is crucial, especially leading into weekend trading sessions. Another critical aspect to monitor is whale behavior—whether accumulation will persist following the reported $74 million liquidation. Additionally, optimism surrounding potential ETF policies and the Federal Reserve’s commentary on tariffs will likely have implications for speculative flows in the market.

Future Outlook for Dogecoin

The outlook for Dogecoin appears cautiously optimistic as the market finds its footing after experiencing volatility. If DOGE can establish $0.18 as a firm base and break above $0.19, it may catalyze a retest of the $0.20–$0.21 range, attracting additional retail and institutional interest. As traders navigate this landscape, understanding macroeconomic conditions, trading volumes, and cryptocurrency-specific trends will be integral for making informed decisions. Overall, while challenges remain, the ability of DOGE to stabilize amidst market turbulence offers valuable insights for prospective investors in the cryptocurrency space.