Weekend Dogecoin Trading Update: Key Insights and Market Dynamics

As the weekend approaches, Dogecoin (DOGE) has showcased a significant trading pattern, slipping approximately 3% as institutional desks unwind risk across major cryptocurrencies. The selling pressure intensified near the $0.20 resistance level after several unsuccessful breakout attempts. Amid prevalent macroeconomic stress, traders remain defensive, leading to a cautious sentiment that permeates the altcoin market.

Market Background

The recent retracement in Dogecoin’s value can be traced back to a week filled with volatile cross-asset flows driven by concerning U.S.–China tariff headlines. Consequently, institutional sentiment has shifted towards a risk-off stance. Macro funds have begun to reduce their exposure to cryptocurrencies, paralleling broader deleveraging trends seen in altcoin futures. Additionally, the regulatory environment, particularly related to anticipated U.S. Treasury rules, further complicates market conditions. Corporate treasuries are being urged to reassess and limit their crypto allocations, contributing to the bearish outlook.

Price Action Overview

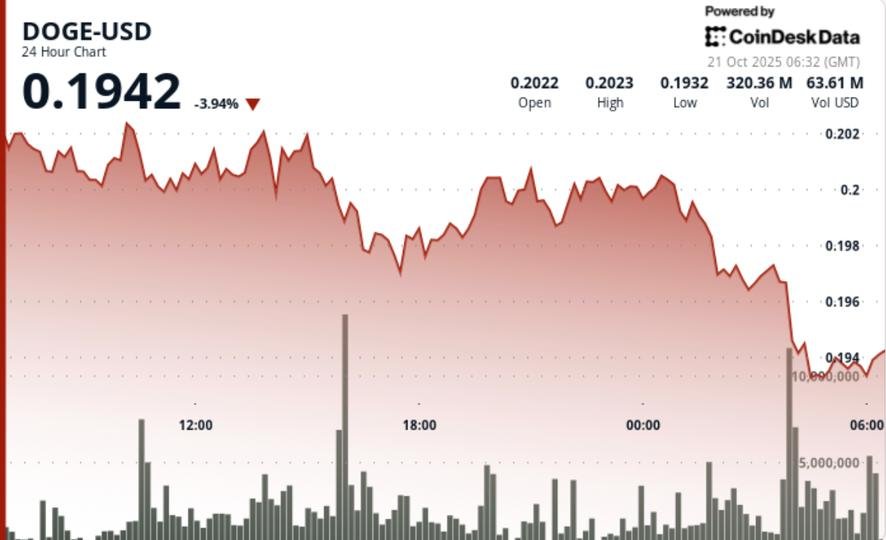

Dogecoin experienced notable price fluctuations between $0.204 and $0.197 from October 20 to 21, establishing a range of about 3% with substantial afternoon trading volume. A particularly active trading block at 15:00 UTC saw 818 million DOGE exchanged, which is nearly three times the daily average. Large sellers have actively capped any upward movement above the $0.20 mark. By late U.S. trading hours, DOGE slipped towards $0.197, struggling to find substantial support due to thin trading volume.

In the final hour (01:10–02:09 UTC), an additional decline of 1% was recorded as algorithmic triggers activated below the $0.20 resistance. The volume surged to 40.5 million during this period, confirming programmatic liquidations before markets gradually stabilized around the $0.197 level.

Technical Analysis

In terms of technical indicators, the immediate structure appears bearish with DOGE continuously trading below the critical $0.20 handle. The frequency of rejections at this resistance level forms a solid barrier, with the next support anticipated in the $0.194 to $0.196 range. Both the Relative Strength Index (RSI) and other momentum indicators remain negative, edging closer to oversold territory. Traders are highlighting a potential risk for a short squeeze should the price reclaim any level above $0.201.

Market Sentiment and Trader Watchlist

Traders and analysts are keenly observing the market for signs of stabilization around the $0.195 support level. A clear and robust recovery above $0.201, particularly being backed by solid volume, could ignite a wave of short covering, potentially driving the price toward the next resistance levels of $0.208 to $0.21. Conversely, a failure to maintain support at $0.194 would expose the asset to a deeper decline, potentially revisiting the $0.187 region, which represented last month’s structural base.

The overarching macro sentiment continues to dictate market direction. Any signs of easing tensions in trade rhetoric between the U.S. and China may lead to a risk rebound, potentially benefiting Dogecoin and similar altcoins like SHIB.

Conclusion

This weekend’s trading environment for Dogecoin reflects broader market dynamics, characterized by cautious institutional behaviors amid macroeconomic pressures. As sentiment remains bearish, traders are advised to remain vigilant while assessing technical indicators and market signals. The potential for upward movement hinges significantly on the ability of DOGE to reclaim key resistance levels, while the bearish sentiment underscores a pressing need for careful market navigation.

With evolving geopolitical and economic conditions continuing to play a pivotal role in the cryptocurrency landscape, traders should stay informed and ready to adapt their strategies as necessary.