Dogwifhat (WIF) Navigates Market Volatility

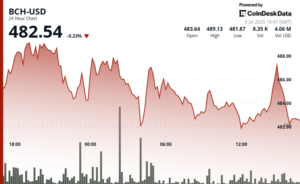

In the ever-changing landscape of cryptocurrencies, Dogwifhat (WIF) stands out, particularly amid recent market fluctuations. Currently, WIF is consolidating around $0.8319, showing a slight decline of 1.17% over the past 24 hours according to CoinDesk Research’s analysis. In contrast, the broader memecoin sector, as reflected by the CoinDesk Memecoin Index (CDMEME), has experienced an uptick of 1.79% during the same period. Such movements indicate that while WIF faces challenges, it has demonstrated relative stability within the memecoin space.

Price Range and Technical Analysis

WIF’s recent price action has created a trading range of 5.1%, fluctuating between $0.821 and $0.864. The critical support level has been confirmed around $0.835, backed by significant trading volume. Earlier this week, WIF enjoyed a sharp rally that brought the price to $0.92, prompting some profit-taking. However, what remains significant is WIF’s ability to maintain its position above this newly established local floor, pointing toward potential recovery.

Whale Accumulation and Market Trends

On the blockchain analytics front, it has been observed that whale wallets have accumulated over 39 million WIF tokens. This trend correlates with a broader shift among Solana-based assets, particularly as BONK has recently surged due to speculative actions related to ETFs. Interestingly, WIF is retracing key zones with a noted decrease in trading volume and minimal short liquidations, suggesting a strategic move by large investors perceiving potential upside in the token.

Macro-Economic Influences

The overall market sentiment has been positively impacted recently by the passage of President Trump’s “One Big Beautiful Bill”, which has temporarily eased risk in financial markets. Coupled with robust U.S. jobs data, this has contributed to a decrease in macroeconomic selling pressures. This broader context is crucial for WIF, as even though the wider crypto market grapples with shifts in trade and monetary policy, WIF’s on-chain fundamentals remain strong and potentially advantageous.

Retail Interest and Derivatives Market

The recent boom in derivatives markets cannot be ignored; Binance has now enabled a cumulative $650 trillion in BTC futures volume, highlighting a significant uptick in trading activity. This surge is drawing attention to retail-driven tokens like WIF, which show signs of resilience despite market volatility. If WIF can sustain this established support level and if trading volume increases again, a price retest of $0.86 might be imminent—a sign of potential bullish momentum.

Conclusion

Overall, Dogwifhat is navigating a volatile landscape with a blend of technical strength and whale accumulation signals. As it consolidates above critical support, market participants are closely watching for any signs of rebound. Whether WIF can capitalize on the recent positive macroeconomic sentiment and gain renewed interest from retail investors will dictate its future trajectory. The evolving landscape provides ample opportunity for both investors and analysts alike, as WIF’s story unfolds amidst the broader trends in the memecoin market.

Disclaimer: This content has been reviewed to ensure accuracy and adherence to editorial standards.