Good Morning, Asia: Market Insights and Predictions for Today

As the sun rises over Asia, the financial world is on edge with significant developments in U.S. markets creating waves across global trading spaces. Amid predictions of a prolonged U.S. government shutdown, market participants are keenly watching how these events will unfold, particularly as they affect cryptocurrency, commodity markets, and more traditional stocks.

U.S. Government Shutdown Predictions

Market sentiment is increasingly leaning towards a historic U.S. government shutdown, with prediction markets like Polymarket and Kalshi signaling expectations of a 40-day hiatus, surpassing the previous 35-day record set in 2019. Traders on Polymarket foresee a resolution occurring around November 15, while Kalshi records an average resolution date of November 11. Both platforms reflect growing concern over the potential impact on various economic sectors. Currently, nearly a million federal workers are either furloughed or working without pay—a critical juncture for governing bodies, yet the Federal Reserve remains insulated from immediate impacts. This independence allows the Fed to continue its policy meetings and interest rate adjustments even amid political strife.

Federal Reserve’s Position and Market Impact

As the shutdown lingers, the Federal Reserve finds itself in a unique position. While crucial economic reports related to jobs, inflation, and GDP may face delays, prediction platforms suggest a remarkable 96% chance of a 25-basis-point rate cut at the upcoming FOMC meeting scheduled for October 29. An additional cut of a quarter-point in December also appears to be a foregone conclusion with an 85% probability. However, analysts caution about making policy decisions based on potentially incomplete data, which could generate additional volatility in financial markets.

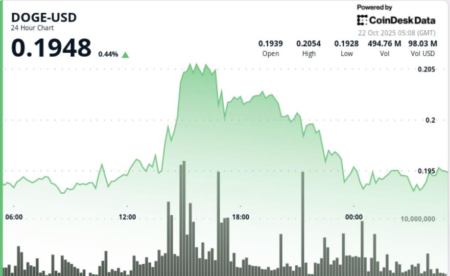

Cryptocurrencies and Market Volatility

The implications of the government shutdown extend beyond traditional markets into the world of cryptocurrencies. Bitcoin, currently trading above $108,000, has seen a minor slip of 1.8%, driven primarily by overarching uncertainties and dwindling ETF inflows. This bearish sentiment echoes past experiences; during the 2018-2019 shutdown, Bitcoin marked its bear-market bottom at just above $3,000, only to rebound strongly post-reopening. In contrast, gold prices climbed above $4,200 per ounce, indicating strong investor demand despite recent dips due to profit-taking after significant rallies.

Recent Market Activity: Gold and Silver

Market volatility has reached significant heights, with gold prices recently dropping 5.5% to $4,121.50 and silver plummeting 7.5% to $48.37 in their most considerable one-day declines seen in years. Despite these short-term downturns, analysts maintain a bullish outlook for both precious metals in the long term, emphasizing their role as safe havens during periods of uncertainty. The fluctuations present an opportunity for traders to capitalize on market dynamics as global economic conditions evolve.

Asia’s Financial Landscape: Nikkei 225 Rises

Turning our focus to Asia, Japan’s Nikkei 225 posted gains after newly released data revealed a 4.2% year-on-year growth in exports for September, breaking a four-month trend of decline. This growth was driven by stronger shipments to Asia, even as demand from the U.S. weakened. In contrast, imports increased by 3.3%, indicating a robust economic pulse within the region. Overall, this positive development provides some relief in an otherwise turbulent financial environment.

Concluding Thoughts

As we navigate these turbulent markets shaped by historic shutdowns and economic stimuli, both traders and investors remain acutely aware of the potential implications for their portfolios. Keeping an eye on crypto, precious metals, and other asset classes will be crucial as we head into the coming weeks. The intersection of politics and financial performance continues to dominate, making each day ripe with opportunities for informed market players.