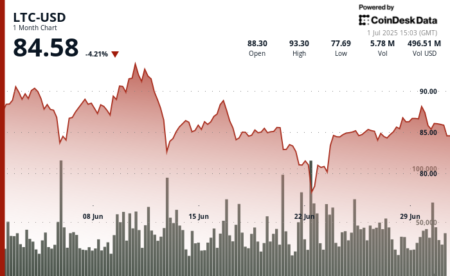

The recent drop in Bitcoin’s price has caused fear to dominate the cryptocurrency market, as indicated by the Fear and Greed crypto index reaching a score of 30. This fear stems from the significant price drop and has led investors to be cautious and hesitant to buy, potentially resulting in decreased trading volumes. The liquidation map also saw a spike in long liquidations totaling over $367 million on June 24th, contributing to the overall fear in the market.

Long liquidations, which made up the majority of the total liquidations, suggest that investors who were betting on price increases have been forced to exit their positions. This influx of sell orders can lead to a sharp decline in prices, further fueling fear among investors. In contrast, short liquidations were much lower, indicating that fewer traders betting against the market were closing their positions, possibly expecting continued growth that did not materialize.

The imbalance between long and short liquidations can exacerbate downward price movements and increase uncertainty in the market. A spike in short liquidations, on the other hand, can push prices upward by squeezing out pessimistic traders. These liquidations serve as key indicators of market sentiment and dynamics, reflecting both individual trader reactions and broader market psychology that influence future trading behavior.

Overall, the recent events in the cryptocurrency market highlight the impact of fear on investor sentiment and trading behavior. As fear continues to dominate, investors may remain cautious, leading to potential further price declines. However, a shift towards greed could occur if short liquidations increase significantly, pushing prices upward and changing market sentiment. These market dynamics and sentiment indicators play a crucial role in shaping the future of cryptocurrency trading.