Understanding Fibonacci Retracement in Bitcoin Trading

In the world of Bitcoin trading, identifying key price levels is crucial for making informed decisions. Among the various tools available to technical analysts, Fibonacci retracement has gained prominence due to its mathematical elegance and practical reliability. This technique not only helps traders pinpoint potential reversal levels but also assists in setting up entry and exit strategies. Let’s delve into the intricacies of Fibonacci retracement and why it matters in cryptocurrency trading.

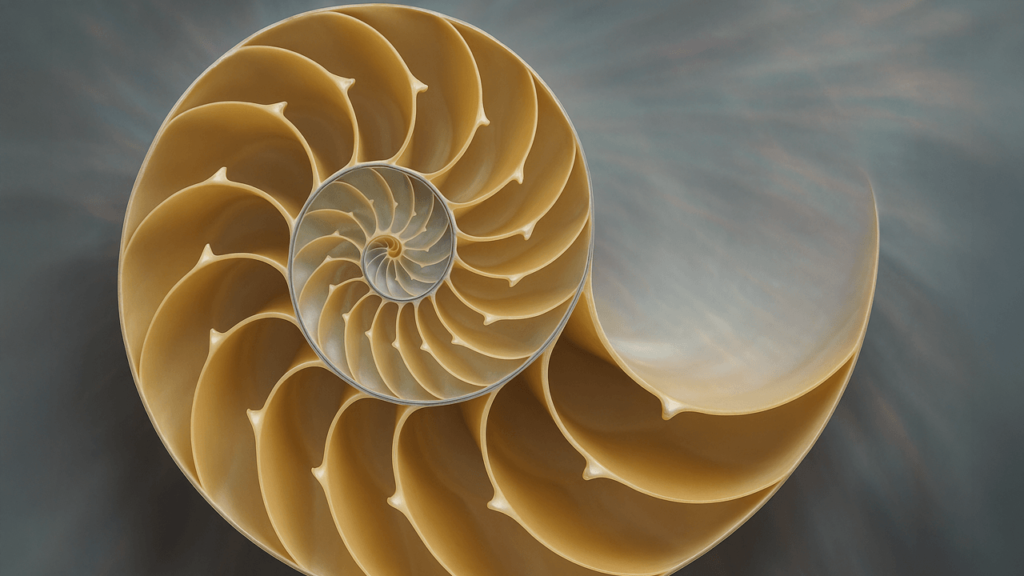

What is Fibonacci Retracement?

Fibonacci retracement is a technical analysis tool that uses horizontal lines to indicate potential support and resistance levels. These levels are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. In trading, key Fibonacci levels—specifically 23.6%, 38.2%, 50%, 61.8%, and 100%—are plotted between a high and a low point on a chart. As prices fluctuate, traders use these levels to identify possible reversal points, making it easier to navigate volatile markets like Bitcoin.

The Importance of Fibonacci Levels in Trading

The significance of Fibonacci retracement lies in its widespread usage among traders. When a price approaches a Fibonacci level, it’s likely to experience increased buying or selling pressure. This occurs because many traders place their orders around these levels, creating a self-fulfilling prophecy. Therefore, understanding and identifying these key levels can empower traders to make more strategic decisions, minimizing risks while maximizing potential gains. This method not only offers predictive insights but also helps traders establish robust risk management protocols.

Applying Fibonacci Retracement in Bitcoin Trading

To effectively apply Fibonacci retracement in Bitcoin trading, professionals typically start by identifying a significant price movement, either upward or downward. The trader will plot the Fibonacci levels based on this movement by drawing a line from the swing high to the swing low. The resulting levels will indicate where the price may stall or reverse. Once these levels are established, traders can monitor price action around them, looking for signs of reversals or breakouts. This approach can greatly enhance a trader’s ability to time entries and exits more efficiently.

Risks and Considerations

While Fibonacci retracement offers valuable insights, it is important to recognize its limitations. The tool is not foolproof and should not be used in isolation. As with any technical analysis tool, combining Fibonacci retracement with other indicators—such as moving averages or momentum indicators—can provide a more holistic view of the market. Furthermore, market conditions and news events can render these levels less effective, making it essential for traders to remain adaptable and aware of external influences that may impact price action.

Enhancing Your Trading Strategy

Integrating Fibonacci retracement into a comprehensive trading strategy can provide a competitive edge in the Bitcoin market. By using it in conjunction with other technical indicators, traders can confirm potential reversal points and enhance their decision-making process. Moreover, employing this technique for risk management—by setting stop-loss orders just beyond key Fibonacci levels—can help protect against sudden market movements. Continuous learning and adjustment based on market conditions will ultimately lead to improved outcomes in trading.

Conclusion

Fibonacci retracement remains a fundamental tool in the toolkit of Bitcoin traders, thanks to its proven ability to identify critical price levels. Its mathematical basis and widespread adoption among traders lend credibility to its effectiveness. By understanding how to apply this technique accurately and recognizing its limitations, traders can better navigate the complexities of the cryptocurrency market. Ultimately, mastering Fibonacci retracement can pave the way for more informed trading decisions and greater financial success in the world of Bitcoin.