The Vision of Hal Finney: Bitcoin-Backed Banks and Their Emergence

Introduction to Hal Finney’s Predictions

In the crypto realm, Hal Finney stands as a pivotal figure, not just for receiving the first Bitcoin transaction from its creator Satoshi Nakamoto but also for his impactful predictions surrounding Bitcoin’s evolution. In a post dated December 30, 2010, Finney contemplated Bitcoin’s limitations, most notably its scalability issues in managing global transactions. Yet, he painted a hopeful picture, predicting the rise of Bitcoin-backed banks. Today, as we advance toward 2025, his forecast appears to be materializing.

Understanding the Limitations of Bitcoin

Hal Finney highlighted significant constraints that Bitcoin faced even in its nascent stages. He recognized that while Bitcoin was a groundbreaking digital asset, it lacked the necessary scalability for widespread transactional use. In his vision, Bitcoin would evolve to function as a "base money," complemented by banks that specialize in Bitcoin to tackle these shortcomings. Finney inferred that such institutions could operate similarly to historical gold banks, supporting BTC not as a direct transaction medium but as a reserve asset.

The Emergence of Bitcoin-Backed Financial Institutions

Fast forward to 2025, and Finney’s theoretical vision is converging toward reality. Bitcoin-backed banks are beginning to take shape through various initiatives, including Bitcoin custody services and Exchange-Traded Funds (ETFs). These financial products allow investors to gain exposure to Bitcoin without needing to hold the asset directly, reflecting Finney’s idea of using Bitcoin as a reserve. Recent developments include the establishment of digital banks like Erebor and KBC Bank, aligning closely with Finney’s original model of Bitcoin-backed digital credits.

Noteworthy Initiatives in 2025

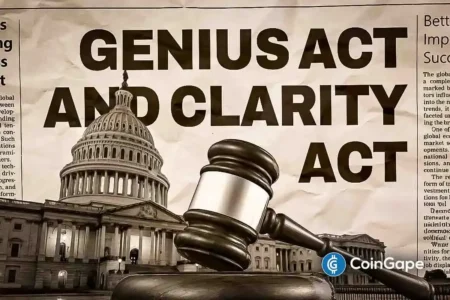

Several tech giants, including Peter Thiel’s Fund, are advancing plans to launch a U.S.-backed bank, Erebor, which is set to focus on Bitcoin and stablecoins. They are pursuing a national banking charter and aim to incorporate stablecoins into their operations, echoing Finney’s vision. Additionally, companies like Ripple are applying for banking licenses, paving the way for a future where Bitcoin-backed banks are not just theoretical concepts but functional financial institutions.

The Importance of Finney’s Prediction

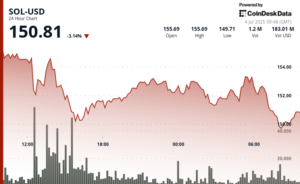

Hal Finney’s predictions have far-reaching implications for the future of finance. His insights transcend mere speculation; they provide a robust framework for understanding Bitcoin’s trajectory. As Bitcoin has achieved milestones like reaching an all-time high price of $111,000 and gaining global acceptance, the next logical step is the establishment of Bitcoin-backed banks. Finney’s foresight in predicting this evolution helps contextualize Bitcoin’s role from a personal investment tool to a pillar of modern banking.

Conclusion: The Future of Bitcoin-Banked Institutions

Hal Finney’s predictions from over a decade ago are crystallizing as institutions actively integrate Bitcoin into traditional banking frameworks. This trend signifies a monumental shift in the financial landscape, with Bitcoin-backed banks poised to address the limitations outlined by Finney. The development of these banks could revolutionize how digital assets interact with global finance, making Finney’s vision more relevant than ever as we approach 2025.

In summary, Hal Finney’s foresight and understanding of Bitcoin’s potential limitations have paved the way for a promising future in Bitcoin-backed banking. The ongoing advancements are a testament to the evolving nature of financial technology and the growing significance of cryptocurrencies in our economy.