HBAR Faces Market Volatility Amid Institutional Dynamics

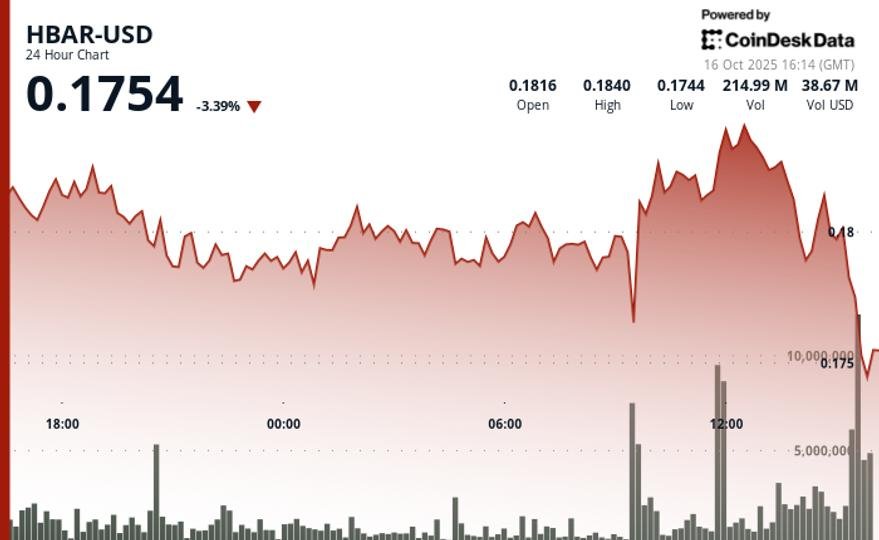

The cryptocurrency market is notorious for its volatility, and HBAR (Hedera Hashgraph) recently experienced a significant fluctuation within a narrow price range of $0.176 to $0.185 in a intense 24-hour trading session. Initially stumbling due to profit-taking by corporate investors, HBAR rebounded in the morning of October 16, with trading volumes surpassing 129 million. This surge in activity demonstrated a keen interest from institutional traders, making the subsequent reversal in price even more notable.

Despite an early recovery, the momentum faded quickly as aggressive sell pressures led to a rapid decline in the final trading hour. Notably, trading volumes spiked above 3 million between 14:02 and 14:04 when HBAR’s price dropped from $0.183 to $0.1805. This decline reflects a broader trend of liquidation among institutional players, who appeared to be adjusting their exposure to blockchain assets amid increasing market uncertainty.

Analysts suggest that this price movement underscores a shifting dynamic in institutional sentiment surrounding enterprise blockchain assets. The resilience of HBAR’s price within the $0.176 to $0.178 range signals a level of support from its corporate base, yet the persistent resistance in the $0.183 to $0.185 range indicates growing caution among investors. The fluctuating levels illustrate a market grappling with both profit-taking and the need for structural rebalancing.

From a technical perspective, the trading range was characterized by a 5% spread within the $0.18 enterprise low and the $0.19 corporate high. This trading range clearly manifests the institutional interest at play. Key support levels were identified around $0.18, where multiple buying opportunities arose. Conversely, resistance levels emerged near the $0.18 to $0.19 range during HBAR’s recovery phase, suggesting that corporate participants are keenly analyzing their positions.

The aforementioned trading activity is corroborated by the substantial increase in volumes observed during the 09:00 to 12:00 window. This period indicated heightened engagement from institutional traders, asserting their presence in the market. If this volume surge is taken as an indicator, it underscores a positive outlook for HBAR despite its recent struggles.

However, market exhaustion became evident during the closing minutes of trading when no institutional volume was reported. This lack of activity may imply that many traders had already settled their positions and consequently, may signal a temporary halt in momentum for HBAR. The overall pattern suggests a nuanced sentiment among institutional investors as they navigate the complexities of blockchain-linked tokens amidst increasing volatility.

As the market continues to develop, the balance between profit-taking and strategic investment will be crucial. Stakeholders should remain vigilant, as institutional behaviors can shape short-term price actions significantly. With growing volatility and fluctuating trading volumes, HBAR’s journey will be one to watch closely in the upcoming weeks, as institutional sentiment appears to hold significant sway over its price trajectory.