Dogecoin Surges: Breaking Through Resistance Levels Amidst Increased Trading Activity

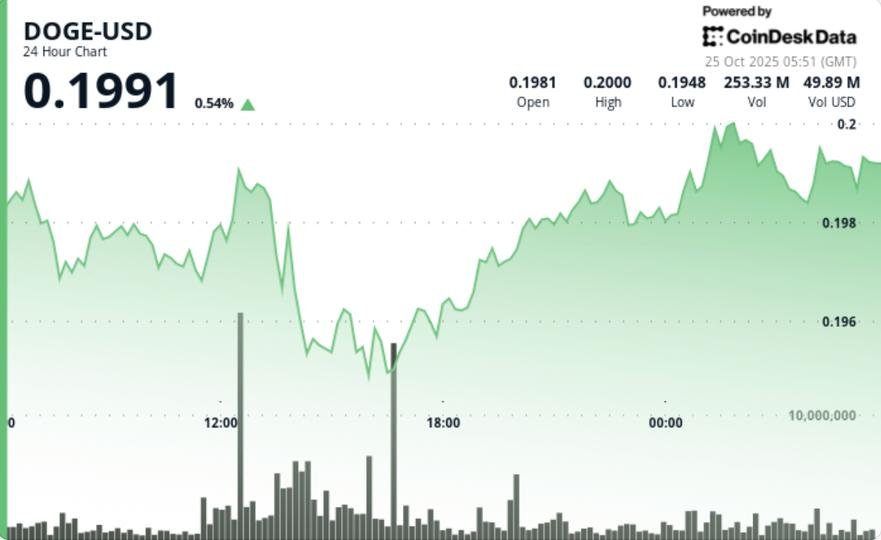

In a remarkable turn of events, Dogecoin (DOGE) has shown significant upward momentum by advancing 1.8%, breaking through critical resistance levels, and trading volumes surging 170% above the average. This price action not only highlights the continued relevance of the meme-inspired cryptocurrency but also indicates a renewed interest from institutional players. As DOGE rallies from $0.19, it remains pertinent to analyze the technical formations and market activity driving this development.

Breaking Key Resistance Levels

On Tuesday, DOGE rose from $0.19 to around $0.1988 after decisively overcoming a pivotal resistance zone. This move was characterized by heightened trading volume of approximately 674.52 million tokens—nearly three times the 24-hour average. This spike in activity signals that institutional investors are re-engaging with the token after a period of consolidation below the $0.195 mark. Technicians note that DOGE has been establishing a series of higher lows since finding support at the $0.19 base, solidifying a bullish technical structure.

Price Action and Market Dynamics

The breakout phase began in the early hours of October 23, when DOGE experienced explosive trading activity, jumping from $0.1963 to $0.1995. The substantial volume during this period points to increased institutional interest, potentially indicative of longer-term bullish sentiment. Following this initial surge, DOGE entered a consolidation phase around the $0.2000 threshold, where buyers defended their positions against profit-taking attempts. Notably, the market’s behavior during this period suggests equilibrium between buyers and sellers, a characteristic that usually precedes further upward movement.

Technical Indicators Point to Potential Gains

From a technical standpoint, DOGE is currently aligning with a bullish continuation pattern that is forming within an ascending channel. The breakthrough above the $0.1988 resistance further validates this positive outlook. Indicators like the MACD and RSI showcase modest bullish divergence, which underscores the token’s potential for further gains. Market depth data reveals significant bid liquidity around the $0.1980-$0.1985 range, reinforcing the argument for sustained bullish activity if DOGE maintains its upward trajectory.

Trader Sentiment and Future Price Prospects

Market participants are closely monitoring whether DOGE can maintain levels above the $0.1985-$0.1990 support zone. A confirmed breakout above $0.2003 would likely attract more momentum buyers and could trigger algorithmic trading strategies that push prices toward higher resistance bands at $0.2030-$0.2050. Furthermore, on-chain data shows an increase in whale wallet inflows by 2.1% over the last two days, indicating ongoing accumulation and potential for further price appreciation.

Conclusion: What Lies Ahead for Dogecoin?

In conclusion, the current trading landscape for Dogecoin signals a promising phase characterized by increased institutional interest and favorable technical indicators. However, maintaining momentum above the key support zones will be crucial for the continuation of this uptrend. While the potential for a retest of the $0.21 handle exists, traders must remain vigilant of short-term volatility. Continued monitoring of market dynamics and accumulation patterns will be essential as DOGE navigates its path forward in the ever-evolving cryptocurrency landscape.