Bitcoin Price Surges Toward $2 Trillion Market Cap: An Analysis of Recent Trends

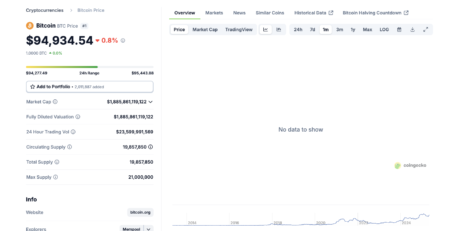

On April 30, Bitcoin (BTC) experienced a significant increase in market activity, gaining approximately 1% with a price surge that brought it to nearly $95,400. This uptick coincided with notable institutional investment, as BlackRock’s iShares Bitcoin Trust (IBIT) recorded an astonishing $1 billion in daily net inflows. This influx underscores the growing confidence among institutional investors in Bitcoin as a macro hedge and alternative asset, setting the stage for a potential breakout toward a $2 trillion market cap.

Institutional Inflows: A Robust Sign for Bitcoin

BlackRock’s recent achievement represents the largest single-day inflow since IBIT’s launch in January. On Monday, another $970 million was funneled into the Bitcoin ETF, highlighting a remarkable trend in investor confidence. Analysts have noted that such substantial inflows not only signify trust in Bitcoin’s long-term viability but also suggest that institutional adoption is gaining momentum. One such analyst, Geoff Kendrick from Standard Chartered, is maintaining a positive outlook on Bitcoin, projecting a price of $120,000 by Q2 2025, fueled by increasing institutional interest and macroeconomic uncertainties.

Macroeconomic Factors Driving Demand

The backdrop of growing institutional investments aligns with concerning U.S. labor market data. On April 29, reports indicated that job openings fell to 7.2 million, below the expected 7.5 million. This decline, the lowest since 2021, is part of a broader trend of weakening macroeconomic indicators. Such data often leads the Federal Reserve to consider expansionary monetary policies, which typically favor risk-on assets like Bitcoin. Analysts argue that if this pattern continues, Bitcoin could see significant upward momentum, potentially pushing it toward Kendrick’s forecast of $120,000.

The $2 Trillion Market Cap Milestone

As BTC currently hovers around $94,000, it is on the brink of breaking past the $2 trillion market cap threshold. Given that only a modest increase of 5–6% is needed, the outlook looks positive, especially if institutional investments continue to pour in. The combination of strengthening corporate interest in Bitcoin alongside weakening U.S. economic indicators could catalyze a breakout, positioning Bitcoin as a cornerstone asset for many institutional portfolios.

Technical Indicators Point to Continued Momentum

Near the current price of BTC, technical indicators are also painting a bullish picture. BTC is consolidating figures around $94,200 after testing weekly highs of $95,500. The upper Bollinger Band resistance is identified at $98,554, while the midline, currently around $88,979, indicates a healthy support level. The Relative Strength Index (RSI) remains at 65.59, suggesting the potential for continued bullish momentum without entering overbought territory. A decisive close above the $95,000 mark could propel Bitcoin toward the next resistance level of $98,500.

Conclusion: What’s Next for Bitcoin?

Looking ahead, the future of Bitcoin appears promising as institutional confidence builds and macroeconomic conditions create a conducive environment for bullish price action. With ongoing corporate demand and positive forecasts, Bitcoin is set to become an increasingly dominant player in the financial landscape. The next few weeks will likely be critical in determining whether BTC can sustain its upward trajectory.

FAQs

-

Why is Bitcoin’s price rising?

- Bitcoin’s recent gains can be attributed to BlackRock’s $1 billion ETF inflow, signaling strong institutional demand.

-

What are analysts predicting for Bitcoin’s market cap?

- Analysts forecast Bitcoin could surpass a $2 trillion market cap, driven by ETF inflows and weakening labor market data.

- What price targets should investors watch?

- A daily close above $95,000 may signal bullish momentum toward $98,500, with a potential target of $120,000 if inflows continue.

In summary, Bitcoin is on a path of robust growth, driven by institutional investments and favorable macroeconomic conditions. Investors should remain vigilant as this journey unfolds, capitalizing on emerging opportunities while being mindful of potential risks.