Internet Computer (ICP) Resilience Amid Market Volatility

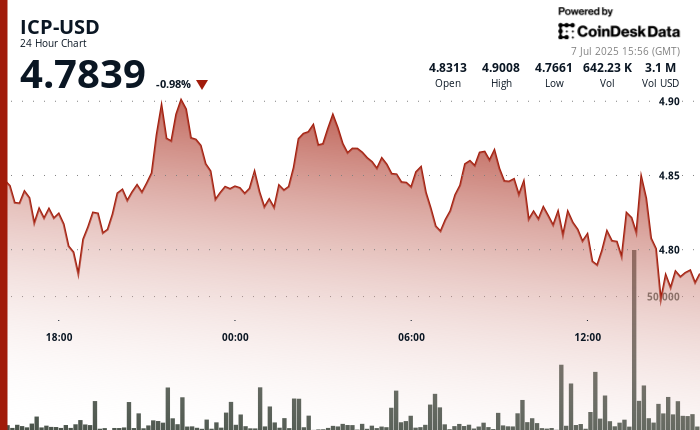

Over the past 24 hours, Internet Computer (ICP) has demonstrated significant resilience despite a turbulent trading environment spurred by macroeconomic uncertainties. Following a drop in its value to $4.78, ICP managed to rebound to approximately $4.85, ultimately concluding the day at $4.7771, marking a decline of just 0.98%. A key takeaway from recent technical analysis is that ICP has respected its critical support level at $4.80, a level tested multiple times during the session. This crucial price point serves as a potential pivot for traders eyeing upward momentum as broader market sentiments show signs of recovery.

The influence of macroeconomic factors on the cryptocurrency landscape cannot be understated. Heightened geopolitical tensions have contributed to market instability; however, a bullish sentiment arose with Bitcoin returning to $109,000 during the Asian trading hours. This resurgence in Bitcoin has led to increased trading volumes across various digital assets, including ICP, even amidst relative price steadiness. ICP’s ability to rebound from the $4.80 support while absorbing intraday fluctuations could indicate growing confidence among traders about potential upward trends.

Technical Analysis Review

In the timeframe from July 6, 15:00 UTC to July 7, 14:00 UTC, ICP demonstrated considerable trading range, fluctuating by 2.54% between $4.78 and $4.90. During the evening hours on July 6, strong resistance at $4.90 was tested and confirmed twice. Multiple bounces off the $4.80 support illustrate its significance as a launch point for upward price movements. A notable rally occurred between 13:05 and 14:04 UTC on July 7, where ICP surged 0.62% from $4.81 to $4.84, further confirming bullish momentum.

Further analysis revealed that price consolidation occurred between 13:05 and 13:20 UTC, creating ideal conditions for a breakout that began at 13:21 UTC. A sharp rally between 13:57 and 13:59 pushed ICP to $4.85, reflecting a nearly 2% jump and showcasing increasing buying interest. Notably, trading volumes surged during specific intervals, suggesting possible institutional buy-ins. For instance, a particular spike was observed from 13:41 to 13:43 UTC, with a transaction volume of 66,623 ICP. This volume trend indicates potential interest from institutional traders, which is often a positive signal for retail investors and may contribute to market stability.

Market Sentiment and Implications

Market sentiment has a profound impact on trading behavior, especially in the wake of broader financial uncertainties. ICP’s strong performance in the face of volatility might signal a shift in trader sentiment, prioritizing assets that can maintain stability during market dips. As global economic conditions remain fluid, the broader cryptocurrency market may display ongoing price fluctuations influenced by macroeconomic data releases and geopolitical events.

The respect shown for critical support levels, coupled with bullish gains, may drive exploratory purchases, especially if traders perceive that the macroeconomic environment is stabilizing. Observing ICP’s performance in this context is essential for gauging overall investor sentiment and could illuminate potential long-term trends in the broader crypto market, particularly for investors who are vigilant about price movements.

Technical Indicators

Analyzing various technical indicators can provide insights into potential future price movements of ICP. The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages are essential tools in this analysis. The RSI can offer insight into whether ICP is overbought or oversold; a reading above 70 often signals overbought conditions, whereas readings below 30 suggest oversold conditions. Moreover, MACD divergence could indicate potential reversals, providing traders with opportunities to make strategic moves.

Moreover, moving averages can help smooth out price action and provide clarity on trends. A cross of shorter-term moving averages above longer-term ones can signify bullish momentum, while the opposite can indicate bearish trends. As such, these indicators are vital for aiding traders in making informed decisions amid ongoing market fluctuations.

Future Outlook for ICP

The future outlook for ICP remains cautiously optimistic, contingent on broader market conditions and the collective sentiment among cryptocurrency traders. Observing price movements around the $4.80 support level will be crucial in determining if ICP can sustain upward momentum. If ICP continues to respect its support levels and experiences positive trading volumes, it may signal an opportunity for traders to capitalize on potential bullish trends.

Additionally, the cryptocurrency market’s interconnectedness means that influential assets like Bitcoin can significantly impact ICP’s price movements. Increased adoption or significant technological advancements related to ICP could further support its growth trajectory. Furthermore, continued monitoring of geopolitical and economic conditions will be necessary to assess potential risks that may affect price stability in future sessions.

Conclusion

In conclusion, Internet Computer (ICP) has displayed remarkable resilience over the recent trading period, successfully navigating through market volatility while respecting key support levels. The ongoing developments in broader financial conditions will play a crucial role in shaping the future trajectory of ICP. Technical indicators and market sentiment will remain instrumental in guiding trader decisions. As the cryptocurrency landscape evolves, ICP stands to benefit from both trader confidence and a recovering market environment. With the right conditions in place, ICP may continue to attract interest from both retail and institutional investors, heralding a promising outlook for the asset in the days ahead.