Daily Market Update: Insights from CoinDesk Indices

Current Market Overview

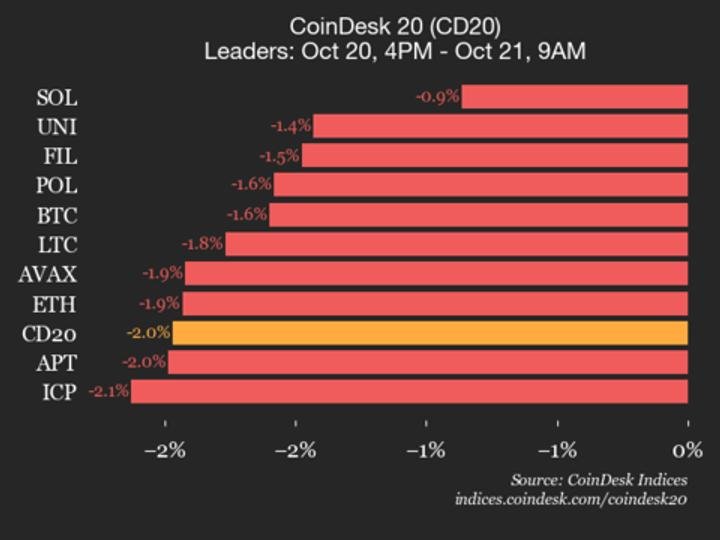

In the latest update from CoinDesk Indices, the CoinDesk 20 Index is trading at 3608.8, reflecting a decline of 2.0%, which equals a drop of 72.51 points since 4 p.m. ET on Monday. This dip reveals a broader trend where none of the 20 assets within this index saw positive movements, indicating a challenging day for cryptocurrency investors. As market fluctuations become a routine part of the landscape, understanding the dynamics and implications behind these numbers is essential for both seasoned investors and newcomers alike.

Performance Leaders and Laggards

Among the assets tracked in the CoinDesk 20 Index, Solana (SOL) and Uniswap (UNI) emerged as the day’s relative leaders, with declines of only 0.9% and 1.4%, respectively. These smaller losses may provide a glimmer of hope amidst an otherwise downturn-heavy market. Conversely, Chainlink (LINK) and XRP faced steeper declines, down 3.5% and 3.2%, respectively. Such performances highlight the volatility inherent in cryptocurrency markets and suggest that while some assets may hold ground better than others, overall sentiment remains bearish.

The Importance of the CoinDesk 20 Index

The CoinDesk 20 Index is a significant benchmark for the cryptocurrency market, allowing investors to gauge the performance of key assets at a glance. It includes a diverse array of cryptocurrencies, traded across various platforms and regions globally, making it an invaluable resource. The index aims to provide a reliable metric for analyzing market movements and trends, thus helping investors make informed decisions based on comprehensive insights into the cryptocurrency ecosystem.

Market Trends and Investor Sentiment

The current downturn in the CoinDesk 20 Index reflects broader market trends, often driven by macroeconomic factors, regulatory news, and shifts in investor sentiment. The lack of upward movement in any of the observed assets suggests a cautious outlook among investors. While some traders may take this as an opportunity to enter positions at lower prices, others may choose to remain hesitant until the market shows clearer signs of recovery.

Strategizing for the Future

For investors looking to navigate this landscape, it is crucial to stay updated on market developments and consider the potential implications of ongoing fluctuations. Strategies may include diversifying portfolios, focusing on assets with stronger fundamentals, or employing risk management techniques to safeguard against further declines. As the cryptocurrency market is known for its rapid shifts, remaining adaptable and informed will be key to thriving in these uncertain times.

Conclusion: Staying Informed and Prepared

In conclusion, the current performance of the CoinDesk 20 Index serves as a reminder of the inherent volatility within the cryptocurrency market. With SOL and UNI showing relatively small declines and LINK and XRP lagging behind, investors must carefully consider their strategies amidst this uncertainty. Staying informed about market trends, understanding the factors that drive asset prices, and employing sound investment principles will be vital for those looking to navigate the complexities of this dynamic financial landscape. As the market evolves, ongoing research and adaptability will be crucial components of successful crypto investing.