CoinDesk 20 Index: Daily Market Overview

The cryptocurrency market continues to fluctuate, and this update reflects the current performance of assets within the CoinDesk 20 Index. As of the last trading period, the CoinDesk 20 Index is valued at 3,473.18, representing a decline of 2.6% or -$93.07 from Thursday’s close at 4 p.m. ET. During this timeframe, none of the 20 assets displayed positive performance, indicating a bearish sentiment prevailing in the market. This situation is emblematic of broader trends observed in the digital asset landscape.

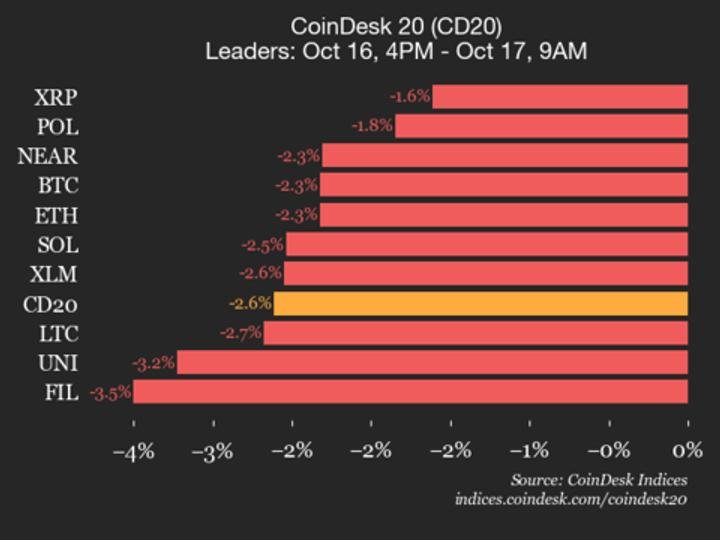

Current Leaders and Laggards

In the latest market update, XRP and POL emerged as the top-performing assets, experiencing relatively minor losses of -1.6% and -1.8%, respectively. Conversely, the market saw considerable declines for other assets, with AAVE suffering the worst hit at -10.1% and BCH following closely with a drop of -8.7%. The performance of these cryptocurrencies underscores the volatility prevalent in the market, as investors respond to various external factors and sentiments that impact trading decisions.

Understanding the CoinDesk 20 Index

The CoinDesk 20 Index is a diversified asset index that covers top-performing cryptocurrencies traded across multiple platforms globally. This index serves as a critical benchmark for gauging the health and performance of the cryptocurrency market. By encapsulating the performance of these 20 major assets, the CoinDesk 20 Index provides valuable insights for traders, investors, and analysts tracking the intricate and evolving landscape of digital assets.

Market Reactions and Trends

The lack of upward momentum across the 20 assets in the CoinDesk 20 Index raises significant questions about the future direction of this market segment. Analysts are assessing numerous factors, including regulatory developments, macroeconomic indicators, and shifts in investor sentiment, which could be contributing to this bearish trend. Awareness of these dynamics is crucial for stakeholders who are keen on making informed decisions in their trading and investment strategies.

Implications for Investors

For cryptocurrency investors, the market’s current state suggests the importance of caution and strategic planning. As evident from the sharp declines experienced by some assets, the inherent volatility of cryptocurrencies is a factor that cannot be overlooked. Investors are advised to monitor market trends and adopt diversification strategies to mitigate risks while maximizing potential gains.

Conclusion

The CoinDesk 20 Index’s daily market update reflects a challenging environment for traders and investors alike, with notable leaders and laggards marking the latest trading session. While XRP and POL showed relative resilience, AAVE and BCH faced significant declines, serving as a reminder of the volatile nature of the cryptocurrency market. As the industry continues to evolve, staying informed about these developments is vital for making strategic trading decisions in the digital asset ecosystem.