XRP Surges Past $2.50: A Technical Breakdown

XRP has recently gained significant traction, successfully climbing above the $2.50 mark on Thursday, demonstrating a strong upward movement fueled by increased trading volume. This rise follows an extensive period of consolidation between $2.35 and $2.50, and comes amidst an overall risk-on sentiment across the cryptocurrency market, which has seen Bitcoin also making notable gains. Traders are now moving towards high-cap tokens known for their robust setups, highlighting XRP’s specific performance amidst this broader market rally.

News Background: Confirming a Bullish Pattern

The surge in XRP’s price can be attributed to the completion of an inverse head-and-shoulders pattern, a reliable bullish signal recognized by technical analysts. This pattern had been forming in the weeks leading up to this breakout, and its confirmation was evident with XRP’s decisive move exceeding the $2.50 resistance level. This development opens the door for potential price continuation toward the $2.65 to $2.80 range, indicating that if buying pressure continues, these targets may soon be achievable.

Market Positioning: Factors at Play

Recent macroeconomic shifts played a significant role in XRP’s price action. Softer U.S. inflation figures and declining Treasury yields have collectively enhanced risk-on sentiment, encouraging traders to reallocate capital into altcoins, particularly XRP. The token has outperformed significant indices, such as the CoinDesk 5, by approximately five percentage points, demonstrating that traders are specifically accumulating XRP rather than relying solely on sector trends. This asset-specific accumulation signifies strong interest from buyers.

Price Action: The Breakout Explained

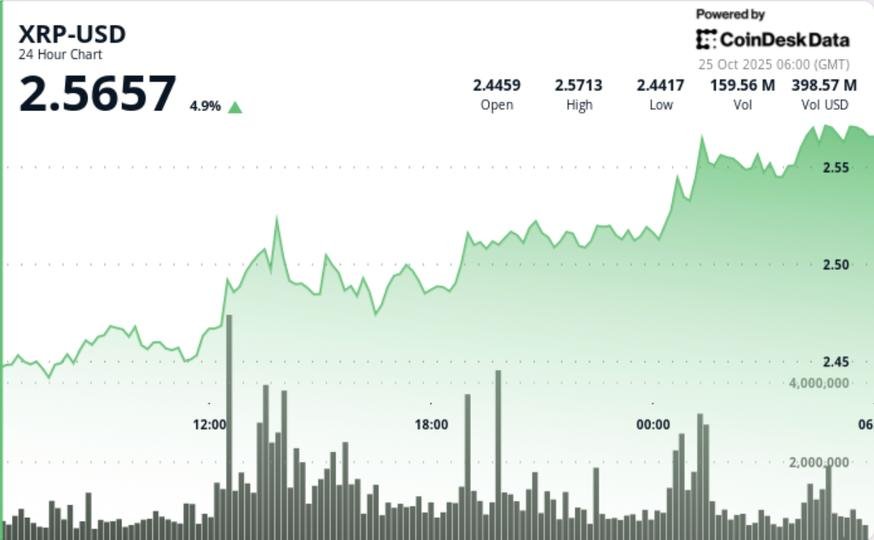

During the trading session, XRP’s price rose from $2.50 to a session high of $2.57, driven by a notable increase in intraday volume, which reached 142 million—31% above its seven-day average. This upward movement was characterized by a series of higher lows—at $2.44, $2.48, and $2.51—indicating methodical accumulation leading into the $2.50 breakout point. Despite a brief instance of profit-taking at around $2.58, XRP maintained its position above the critical breakout support of $2.50, suggesting that institutional investors may be increasing their holdings during pullbacks.

Technical Analysis: Key Indicators to Watch

From a technical standpoint, XRP’s recent movements have established a bullish bias, thanks to the confirmed inverse head-and-shoulders formation. Momentum indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) have both shifted upward, reinforcing the bullish outlook. Immediate resistance is identified at $2.60, with secondary targets positioned near the $2.80 mark. However, a failure to maintain a closing price above $2.50 could jeopardize this bullish structure, potentially reverting prices towards support levels around $2.40 to $2.42.

Future Outlook: What’s Next for Traders?

Traders are closely monitoring the $2.50 level to determine if it will hold as a new base, which has now become a pivotal point for confirming short-term trends. Data indicating a 3.3% decline in exchange reserves for XRP since early October historically correlates with bullish signals linked to whale accumulation. Current open interest appears stabilized, and funding rates are neutral, implying that the recent price movement is primarily driven by spot trading as opposed to derivatives. Sustained trading volume above 130 million over the weekend could validate continued upward movement towards the $2.70 to $2.80 range, while declining participation might lead to a retracement back to the $2.40 to $2.55 range.

Conclusion: XRP’s Potential in the Current Market

XRP’s recent performance signifies a compelling narrative in the cryptocurrency space, standing out amidst a favorable macroeconomic environment and solid technical indicators. The confirmed breakout above $2.50 showcases growing confidence in the token, suggesting potential for further gains if buying momentum is sustained. As the market evolves, keeping an eye on support levels and volume trends will be crucial for traders looking to capitalize on XRP’s price movements in the subsequent periods. With strategic positioning and technical analysis, traders can navigate the complexities of the evolving cryptocurrency landscape, especially in relation to XRP’s promising trajectory.