Katana Launches DeFi-First Layer-2 Mainnet: What You Need to Know

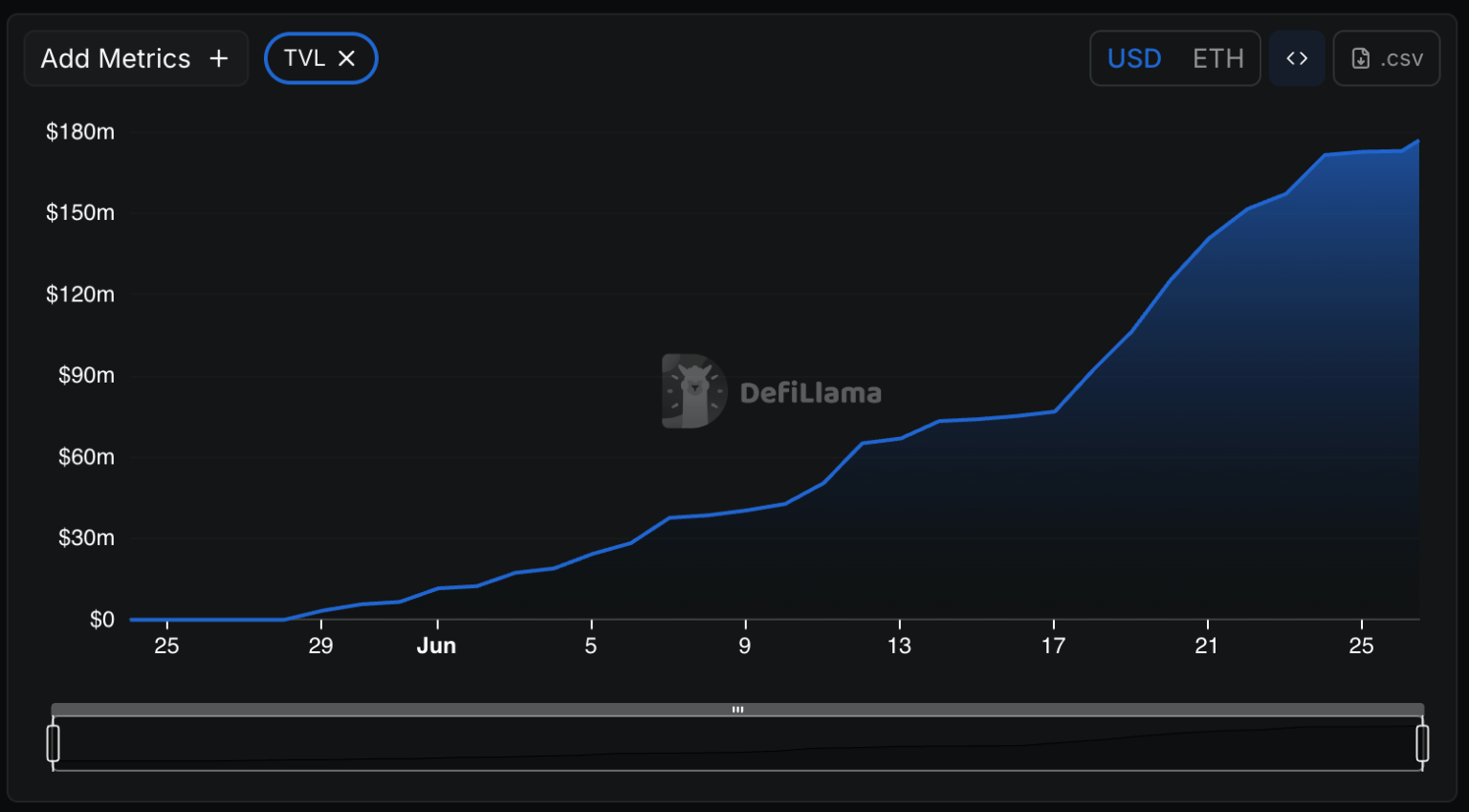

In a significant advancement for decentralized finance (DeFi), Katana has officially launched its mainnet after amassing a remarkable $180 million in pre-deposits. This surge in deposits took place shortly after the platform was unveiled to the public less than a month ago. Data from DefiLlama indicates that deposits skyrocketed from $75 million to $180 million between June 1 and the launch, underscoring the excitement and belief in Katana’s capabilities.

One of the standout features of Katana is its reward system for depositors. Those who participate will receive unique randomized NFTs known as "Krates," along with a portion of 70 million Katana tokens (KAT), which are integral to the platform’s ecosystem. With its launch, Katana opens its gates to yield farmers who can enhance their earnings by staking on various platforms, including Morpho and Sushi. This innovative approach aims to address a crucial challenge in the DeFi sector: liquidity.

The Liquidity Challenge in DeFi

Liquidity is often cited as a significant hurdle in the DeFi landscape. A shortage can lead to various complications, such as slippage, inefficient pricing, and unsustainable yield rates. Katana presents several mechanisms to tackle these issues, notably VaultBridge—a product that facilitates yield generation on assets deposited onto Ethereum. The platform also employs chain-owned liquidity (CoL), ensuring that Katana retains all net sequencer fees, which then convert into liquidity reserves. This multifaceted strategy positions Katana as a potential game-changer in the liquidity space.

As Marc Boiron, one of Katana’s co-founders, stated, "Katana represents the endgame for how blockchains create value in DeFi." With the launch aligning with yield farming incentives, liquidity providers on platforms like Morpho and Sushi can expect to reap token rewards, further incentivizing participation in the ecosystem.

Focus on Cross-Chain Functionality

Though Katana operates on Ethereum, its architecture is designed to be blockchain-agnostic. This means that users can generate yields across various blockchains, including Solana, thanks to partnerships with protocols like Jito, a liquid staking initiative. This capability aims to broaden the appeal and usability of Katana, allowing users to capitalize on diverse yield opportunities across multiple blockchain ecosystems.

Community Engagement and NFT Rewards

The NFT reward system is particularly noteworthy. By issuing "Krates," Katana engages its community and encourages further participation. These rewards not only provide added value to depositors but also promote a sense of belonging among users within the ecosystem. As the DeFi landscape becomes increasingly competitive, Katana’s approach to community building and incentivization appears well-suited to foster user loyalty and commitment.

A Vision for the Future of DeFi

Katana aims to redefine the role of layer-2 solutions within DeFi. By addressing liquidity challenges and offering enticing rewards, the platform positions itself as a key player in enhancing the efficiency of decentralized finance. As the DeFi sector continues to grow, Katana’s innovative strategies and commitment to user engagement could serve as a benchmark for future projects.

Conclusion: Why Katana Matters

In summary, Katana’s launch represents a pivotal moment for the DeFi ecosystem. With substantial backing, innovative features, and a clear focus on liquidity, the platform is poised for significant impact. As it enables yield farming across multiple blockchains and rewards engagement through NFT distributions, Katana’s approach may contribute to the next wave of growth in decentralized finance. Users and investors alike should keep an eye on this platform as it pioneers new paths in the world of DeFi.