Metaplanet’s Rising Bitcoin Holdings: A Strategic Move in the Cryptocurrency Landscape

Metaplanet has recently made headlines by significantly boosting its Bitcoin treasury, positioning itself as one of the top players in the global digital asset market. With the latest acquisition of 1,005 BTC for approximately $108.1 million, Metaplanet’s total Bitcoin holdings have now reached 13,350 BTC. This substantial increase moves the firm ahead of notable companies such as Coinbase, Tesla, and CleanSpark, marking a pivotal moment in the firm’s journey towards its ambitious target of 30,000 BTC by 2025.

Surpassing Major Players in Bitcoin Treasury Rankings

The latest purchases by Metaplanet have propelled it to the forefront of Bitcoin treasury holders, surpassing prominent figures in the industry. Previously, Tesla held a commanding position with 11,509 BTC and Galaxy with 12,830 BTC. However, Metaplanet’s aggressive acquisitions have led to better standings, placing it just shy of industry leaders while effectively flipping Galaxy for the fifth position. This strategic advancement not only highlights Metaplanet’s commitment to cryptocurrency but also emphasizes the growing competition for Bitcoin supremacy among corporate entities.

An Aggressive Acquisition Strategy

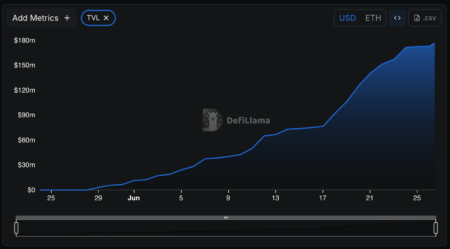

In June alone, Metaplanet executed five separate Bitcoin purchases, accumulating an impressive average of 1,000 BTC per transaction. The total of over 5,000 BTC acquired during this month positions Metaplanet favorably within the market. Yet, despite these bold moves, the firm still falls nearly 50% short of its 2025 target of 30,000 BTC. The current deficit of over 16,650 BTC indicates the necessity for continuous investment and strategic planning, especially in a rapidly evolving market.

Raising Capital Through Bond Sales

To support its ambitious Bitcoin purchasing program, Metaplanet has also announced a bond sale valued at approximately 30 billion Japanese Yen (JPY), equivalent to around $208 million. This capital will serve dual purposes: clearing existing debt of about $10 million and funding future BTC acquisitions. The strategic allocation of this capital underscores Metaplanet’s plan to leverage financial instruments to enhance its Bitcoin holdings. Moreover, the firm’s commitment to partially using proceeds for debt clearance demonstrates a responsible approach to financial management.

Positive Market Reactions and Stock Performance

The proactive measures taken by Metaplanet have not gone unnoticed in the stock market. Following its announcement of the Bitcoin purchase, the firm’s stock surged by 10% on June 30. This stock price increase is indicative of market confidence in Metaplanet’s strategy and future growth prospects. During the first half of June, Metaplanet’s stock saw remarkable growth, climbing over 80% from $7.19 to $13.30 before stabilizing around the $10 mark. As of now, shares are trading around $11.4, reflecting a 45% monthly return, which considerably outperforms Bitcoin’s modest 3% rally over the same timeframe.

Looking Ahead: Ambitious Target for 2025

As Metaplanet embarks on its journey towards achieving a staggering 30,000 BTC by 2025, critical strategic moves will be essential. The firm needs to continue refining its acquisition strategy while robustly exploring various financing options to ensure sustained growth and market influence. The ambitious target poses a hefty challenge, necessitating an aggressive and innovative approach to its Bitcoin buying process and overall financial planning.

In summary, Metaplanet’s recent endeavors exemplify its commitment to establishing itself as a formidable force in the cryptocurrency market. By surpassing major players and adopting strategic financial maneuvers, the firm is well-positioned to achieve significant milestones in the coming years. As the crypto landscape continues to evolve, Metaplanet’s journey will be one to watch, potentially setting new standards for corporate investment in Bitcoin.