Murano Global Investments: Innovating with Bitcoin in the Real Estate Sector

Murano Global Investments, a Nasdaq-listed real estate firm based in Mexico, is making headlines with its ambitious plans to incorporate Bitcoin into its corporate strategy. With a market cap of $800 million, the company aims to leverage the largest cryptocurrency as a treasury asset while continuing its real estate operations. Murano’s proactive approach not only signifies a growing trend in the real estate industry but also underscores the increasing acceptance of cryptocurrency as a legitimate financial resource.

Building a Bitcoin Treasury Strategy

The firm recently announced the establishment of a Bitcoin treasury strategy supported by a $500 million standby equity purchase agreement (SEPA). This financial maneuver aims to channel capital primarily towards Bitcoin investments. According to the company, the treasury will enhance financial resilience by acting as a hedge against inflation and systemic risk. This strategic pivot reflects Murano’s recognition of Bitcoin’s potential as a transformative asset class, with the firm positioning itself at the forefront of a pivotal financial evolution.

Integrating Cryptocurrency into Operations

In addition to bolstering its balance sheet with Bitcoin, Murano plans to integrate cryptocurrency within its operational framework. This initiative may include offering guests the option to pay for hotel services using Bitcoin. Furthermore, the firm is looking into loyalty programs that reward customers with BTC, reflecting a holistic view of embracing digital currencies as part of its customer engagement strategy. By adopting these measures, Murano Global Investments is not just changing its financial strategy but also enhancing the overall customer experience.

Leadership Insight

Elias Sacal, the chairman and CEO of Murano, expressed the company’s vision by stating, “We see Bitcoin as a transformative asset that not only offers long-term growth potential but also strengthens our balance sheet against inflation and systemic risk.” His leadership direction shows commitment to not just maintaining traditional real estate principles but also pioneering a path towards integrating modern financial innovations within established sectors.

Joining the Bitcoin for Corporations Alliance

To further solidify its commitment to Bitcoin, Murano has joined the "Bitcoin for Corporations" alliance, spearheaded by influential figures like Michael Saylor of Strategy (MSTR). This partnership indicates the firm’s eagerness to collaborate with other corporate entities that recognize the merits of Bitcoin, positioning itself among forward-thinking organizations adapting to the cryptocurrency landscape. Such alliances will provide valuable insights and synergies that can facilitate Murano’s objectives in the digital currency realm.

Recent Acquisitions and Market Reactions

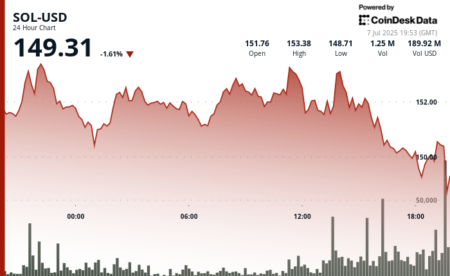

As part of its initial foray into cryptocurrency, Murano has already acquired 21 BTC, valued at over $2.1 million at current market prices. This venture into digital assets has received a mixed response from the market; the firm’s shares fell slightly over 1% after the announcement. However, this minor fluctuation should not overshadow the significance of its proactive strategy towards Bitcoin, which may yield substantial long-term benefits as cryptocurrency adoption continues to grow.

Conclusion: A Vision for the Future

Murano Global Investments stands as a pioneering case of how traditional industries, such as real estate, can evolve by embracing cryptocurrency. By building a robust Bitcoin treasury strategy and exploring operational integration of digital currencies, the firm is positioning itself to navigate the future economic landscape effectively. As more corporations recognize Bitcoin’s potential, Murano’s initiatives are not just trendsetting; they embody a shift towards a more diversified and innovative approach to finance and customer engagement.