The New SEC Chair and Its Impact on the Crypto Landscape

As the crypto space evolves at an unprecedented pace, recent developments have drawn significant attention. One major highlight is the upcoming Token 2049 gala in Abu Dhabi, where crypto leaders and innovators convene to discuss the future of digital assets. Recently, Bitcoin has shown bullish movement, surpassing $96,000, while XRP Exchange-Traded Funds (ETFs) have launched in Canada. The integration between traditional finance (TradFi) and decentralized finance (DeFi) is also gaining traction, heralding a new era for the industry.

At the center of this transition is Paul Atkins, the newly sworn-in Chair of the U.S. Securities and Exchange Commission (SEC), taking over from Gary Gensler. With an impressive portfolio of around $6 million in crypto-related investments and a firm belief in fostering innovation, Atkins might serve as a strong ally for the pro-crypto community. His term is poised to be crucial, particularly as he tackles the regulatory landscape facing the crypto market and the broader Web3 ecosystem. CoinGape recently engaged in a conversation with Bitget’s Chief Legal Officer, Hon. N, to delve deeper into Atkins’ potential impact on the industry.

Regulatory Clarity on the Horizon

During his first public appearance on April 25, Atkins emphasized the need for clear regulations within the crypto industry. As noted by Bitget’s CLO, clarity is essential for businesses looking to navigate compliance effectively. Atkins aims to eliminate the confusion that has hindered innovation in recent years, pushing for regulatory frameworks that align with modern technologies like blockchain and cryptocurrency. Moreover, he hinted at potential changes to the custody rules under existing acts and is advocating for a new crypto asset broker-dealer framework. His proactive approach suggests that he will prioritize regulatory clarity to facilitate onshore innovation and ensure that companies can thrive without navigating unnecessary hurdles.

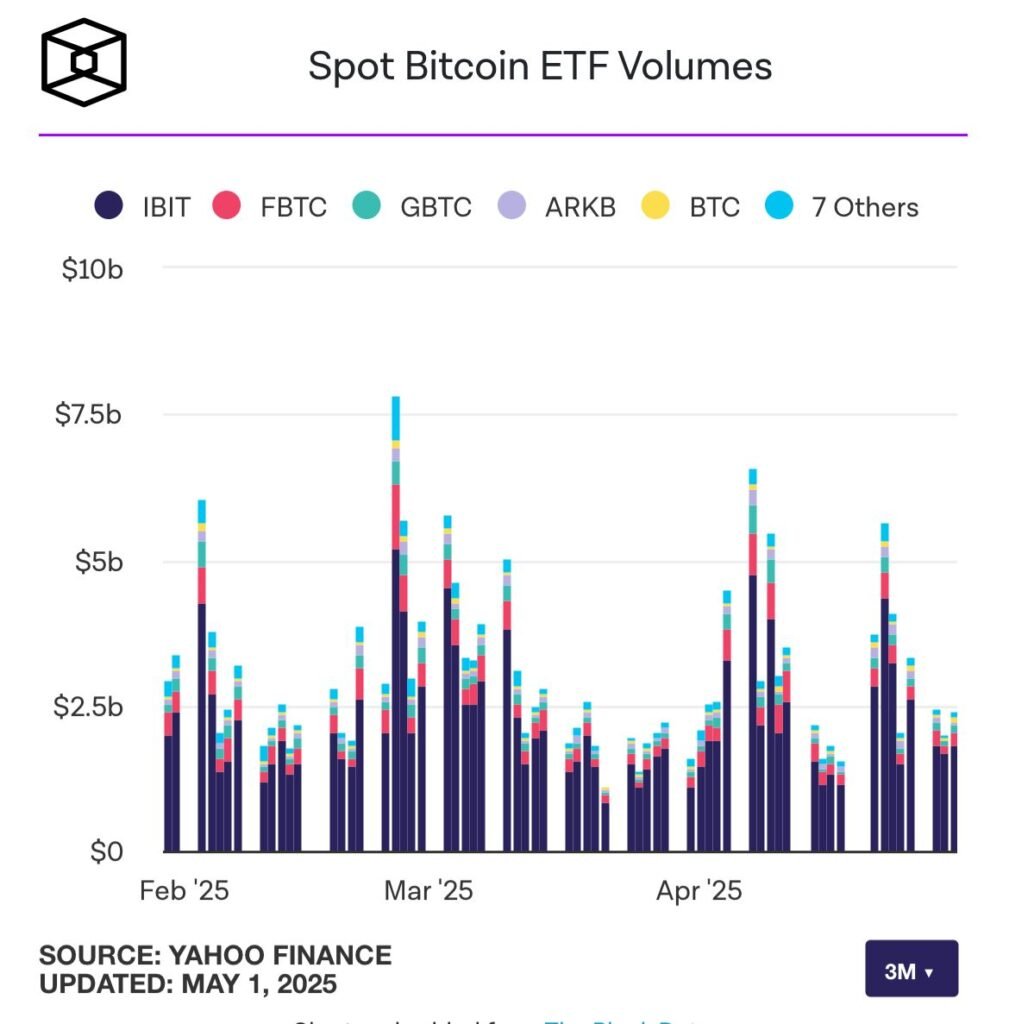

The Surge in ETF Applications

Atkins’ tenure is also marked by an increase in Interest surrounding Exchange-Traded Funds (ETFs). With over 70 pending applications at the SEC, including notable filings from Nasdaq and Bitwise, there is a growing anticipation for conditional approvals on these altcoin funds. According to Bitget CLO, Atkins might empower SEC staff to establish straightforward guidelines, enhancing investor opportunities in crypto ETFs. This growing interest is evident, with global ETF net sales reaching approximately $314.5 billion in Q1 2025. The increased focus on crypto-related ETFs may pivot the SEC towards a more welcoming stance for digital asset investments, contingent upon regulatory assurances.

Legislative Priorities for the New SEC Chair

Atkins’ leadership will be instrumental in determining the future of crypto regulation. As the SEC recently initiated several enforcement actions against major crypto firms, upcoming legislation will play a pivotal role in shaping the industry. Advocated by Bitget’s CLO, Atkins should prioritize legislation addressing stablecoin regulations, a tokenization framework, and revised custody rules. Establishing clear guidelines for stablecoins will help secure consumer trust and allow banking regulators to step in effectively. Additionally, implementing Safe Harbor Pilots could enable a smoother transition for digital assets, providing a structured timeframe for compliance and data collection.

Clarifying the Security vs. Commodity Debate

One of the most contentious topics in crypto regulation has been the classification of digital assets as either securities or commodities. This ongoing debate has led to numerous legal challenges in the industry. Bitget CLO suggests that Atkins is in a unique position to clarify these distinctions, potentially allowing for more straightforward regulations that separate securities from commodities. Recent guidance indicates a shift towards recognizing fully-backed stablecoins as non-securities, which could lead to more defined roles for the Commodity Futures Trading Commission (CFTC) and the SEC. By leveraging the Howey test, Atkins aims to focus on investment contracts and restrict securities regulations to tokens marketed with profit expectations.

Transforming the SEC into a Collaborative Entity

The potential for change under Atkins’ leadership lies in fostering a collaborative regulatory environment. The Bitget CLO envisions a future where the SEC acts more like a partner than an adversary in the crypto space. With planned industry roundtables focused on tokenization and DeFi, Atkins is expected to create clear and targeted regulations rather than broadly punitive measures. This shift would also lend itself to global cooperation, encouraging joint efforts with international regulatory bodies to create coherent rules for digital assets worldwide.

To ensure successful outcomes, Atkins should initiate pilot programs that provide a controlled environment for testing new regulations. Short-term Safe Harbor Pilots for stablecoins, tokenized securities, and ETFs could significantly improve regulatory compliance and pave the way for innovative developments.

Conclusion

As Paul Atkins settles into his role as SEC Chair, the crypto community holds its breath, hopeful for a more favorable regulatory climate. His approach to regulatory clarity, ETF opportunities, and legislative priorities promises to redefine the relationship between the SEC and the crypto industry, potentially transforming it into a collaborative ally. With focused efforts on critical issues, Atkins may be the catalyst needed to spur innovation and stability in the thriving world of cryptocurrencies and decentralized finance.

Disclaimer: This article expresses the author’s opinion and is subject to market conditions. Conduct thorough market research before investing in cryptocurrencies. Neither the author nor the publication assumes responsibility for personal financial losses.