REX-Osprey Launches First US Ethereum Staking ETF: A New Era for Crypto Investment

REX-Osprey has made a significant stride in the cryptocurrency investment landscape by launching the first US exchange-traded fund (ETF) that pairs direct exposure to Ethereum with staking rewards. Announced on September 25, this innovative product, trading under the ticker ESK, operates under the familiar regulatory framework provided by a 1940 Act ETF. As investors seek new avenues for exposure to digital assets, ESK offers a compelling option for those who wish to participate in Ethereum’s growth while also earning staking rewards through Ethereum’s proof-of-stake mechanism.

A Unique Offering: Combining Spot Ethereum and Staking Rewards

The ESK fund uniquely blends spot Ethereum (ETH) holdings with a staking component, allowing shareholders to receive monthly distributions derived from staking rewards. Unlike many conventional staking products that require private agreements or custodial services, REX-Osprey emphasizes transparency by passing 100% of the staking rewards directly to investors. This commitment to rewarding shareholders enhances the appeal of ESK for both traditional and crypto investors, positioning the ETF as a new benchmark in the industry. Greg King, the Chief Executive of REX Financial, articulates the mission behind ESK, stating, "We’re giving investors access to Ethereum plus staking rewards in the most broad-based U.S. ETF format."

Building on Previous Success: A Focus on Staking

The launch of ESK is part of REX-Osprey’s ongoing efforts to innovate within the crypto investment space. This encompasses the previous release of the first-ever Solana Staking ETF in July, which not only marked a milestone for Solana but also introduced staking-related distributions within the framework of a domestic crypto ETF. The Solana fund experienced tremendous success, amassing over $300 million in assets under management and transitioning to a Regulated Investment Company (RIC) structure for tax efficiency. The growth of these products demonstrates a thriving interest in creative financial instruments that merge traditional investment frameworks with the burgeoning cryptocurrency market.

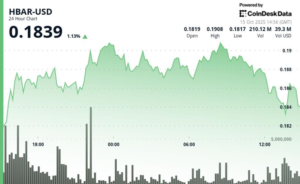

Current Market Dynamics: Ethereum ETF Inflows Slow

Despite the groundbreaking nature of the ESK fund, it enters a challenging market. Recent data shows that investor interest in spot Ethereum ETFs has experienced a notable slowdown, with September witnessing only $110 million in net inflows across nine U.S. Ethereum spot products. This represents a stark decline from the $3.8 billion and $5 billion recorded in August and July, respectively. Interestingly, inflows were observed on just seven trading days, juxtaposed against outflows taking place over ten sessions. Such dynamics highlight a cautious sentiment among investors, making the timing of ESK’s launch a strategic one.

The Potential for Future Growth: SEC Approval and Market Sentiment

Although recent inflow figures may appear muted, the cumulative flows into Ethereum ETF products remain robust at $13.62 billion, managing a combined total of $27.42 billion in assets. These figures underscore the underlying demand for crypto investments, which can significantly improve if the U.S. Securities and Exchange Commission (SEC) grants approval for funds to integrate staking into their offerings. The SEC recently extended the review period for this integration, leaving investors and market participants eagerly anticipating this pivotal decision that could reshape the landscape for cryptocurrency investment products.

Conclusion: ESK Represents a New Investment Paradigm

In conclusion, REX-Osprey’s launch of the ESK ETF marks a noteworthy advancement in the world of cryptocurrency and investment. By effectively combining spot Ethereum exposure with staking rewards in a regulated ETF format, the ESK fund provides a unique and attractive opportunity for investors looking to capitalize on the growth of Ethereum without the complexities commonly associated with digital asset custody. As the market navigates its current challenges, ESK’s unique offerings may well position it favorably as investors seek new pathways to engage with the evolving crypto landscape. As interest in Ethereum and decentralized finance continues to grow, products like ESK will likely play a vital role in defining future investment strategies.