SBI Holdings Transfers $703 Million in XRP: What It Means for Investors

SBI Holdings, a crucial partner of Ripple, has initiated a substantial transfer of 320 million XRP, valued at approximately $703 million. This significant transaction has sparked intrigue among investors, particularly given the upcoming release of 1 billion XRP from Ripple’s escrow on July 1, 2025. With speculation surrounding the motives behind this transfer, including potential custodial restructuring, it’s essential to analyze the implications for both SBI and the broader cryptocurrency market.

The Massive Transfer: Context and Implications

On July 1, Whale Alert reported the transaction of 320 million XRP moved between wallets initially thought to be anonymous. Further inquiry traced the source to SBI VC Trade, a subsidiary of SBI Holdings and Ripple’s long-term partner. The received wallet, speculated to be an internal account, raises questions about the strategic purpose behind such a colossal transfer. This move coincides with Ripple’s scheduled release of 1 billion XRP tokens from escrow, prompting discussions about its potential impact on XRP’s market dynamics.

This large-scale transfer also reflects the growing adoption of XRP as a bridge currency. The clear regulatory framework in Japan—where regulators classify XRP as a crypto asset rather than a security—provides a stable environment for Ripple and SBI to innovate and develop robust XRP-based payment solutions.

Ripple’s Escrow Release: Background and Timing

Ripple’s practice of releasing large amounts of XRP from escrow has been a key element of its operational strategy since 2017. The imminent release of 1 billion XRP on July 1 is part of this ongoing process, designed to manage the circulating supply of XRP and ensure its value remains stable. The release follows a trend: in June, Ripple unlocked another 1 billion tokens, valued at around $2.21 billion, in three separate transactions.

The timing of SBI Holdings’ transaction, occurring just ahead of this major escrow release, raises eyebrows among market analysts and investors alike. While the market might fear potential dilution from the influx of tokens, some see SBI’s act as a bullish indicator of XRP’s potential, suggesting a coordinated strategy that may favor long-term price performance.

Analyzing the Transfer’s Timing and Strategy

The creation of a new wallet (r9zKp3…) on June 30 is particularly noteworthy, as it implies that the transfer may be geared towards custodial reallocation or strategic restructuring within SBI’s operational framework. Many analysts are questioning whether this transaction signifies a more extensive plan to utilize XRP as a bridge currency more extensively or to prepare for new institutional services.

Given the current global landscape of cryptocurrency regulation, especially advancements in Japan, SBI’s actions could suggest confidence in XRP’s viability as a standard currency for future transactions. This reinforces the asset’s potential to serve institutional clients and bolsters its status as a reliable medium for cross-border payments.

Investor Sentiments: Reasons for Optimism

It’s crucial for investors to sift through the noise surrounding SBI’s significant transaction. Despite the immediate concerns raised by the $703 million transfer, there is little reason for alarm. Reports suggest that the transaction is more about internal management and strategic planning than an adverse market move.

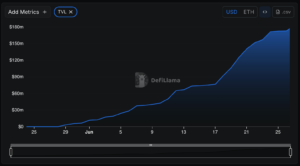

The initial market reaction has been relatively positive, with XRP’s trading volume increasing by approximately 37%, reaching about $1.91 billion. Price trends reveal an 8% surge in XRP over the past week, signaling a stable reaction despite minor fluctuations. This upward trajectory reflects a growing confidence in XRP’s long-term potential, especially as entities like SBI continue to integrate it into their financial frameworks.

Regulatory Clarity in Japan: A Positive Outlook

One of the factors underscoring the optimism around SBI’s transaction is Japan’s clear regulatory stance towards XRP and cryptocurrency in general. By classifying XRP as a crypto asset rather than a security, Japanese regulators have provided a stable environment for domestic and international market players.

SBI’s embrace of XRP as the default bridge currency for payments highlights its pivotal role in reshaping payment systems within Japan and potentially beyond. This regulatory clarity affords Ripple and SBI the ability to develop and implement XRP-based solutions, paving the way for increased adoption and usage without the burden of legal uncertainties prevalent in other markets, like the U.S.

Conclusion: What Lies Ahead for XRP Investors

In summary, SBI Holdings’ transfer of 320 million XRP represents a strategic maneuver possibly tied to broader initiatives within the firm and its partnership with Ripple. While concerns have been raised regarding the timing of the transaction in relation to Ripple’s escrow release, the general sentiment appears to lean towards optimism. The large-scale transfer seems to indicate internal restructuring aimed at enhancing XRP’s utility as a bridge currency within a favorable regulatory context.

As the cryptocurrency landscape continues to evolve, the involvement of major players like SBI and their strategic moves could significantly influence XRP’s adoption rates and market dynamics. For XRP investors, monitoring these developments and understanding the implications of regulatory frameworks, market reactions, and partnership dynamics will be crucial in navigating future opportunities and challenges within this rapidly changing sector.