Semler Scientific’s Bold Bitcoin Acquisition Strategy: A Leap into the Future

Semler Scientific, once a lesser-known player in the medical device industry, has announced an audacious plan to acquire a staggering 105,000 Bitcoin (BTC) by the end of 2027. This ambitious goal positions Semler to potentially become the second-largest corporate holder of Bitcoin globally, trailing only MicroStrategy. The announcement, made on June 20, 2023, ignited investor enthusiasm, leading to an almost 12% surge in Semler’s pre-market shares. At current market prices, this target represents over $11 billion, a remarkable figure for a company that recorded revenues under $60 million in the previous financial year.

From Diagnostics to Bitcoin Investments

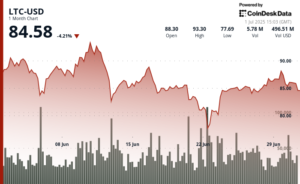

Historically, Semler has focused on producing diagnostic tools, particularly in the realm of cardiovascular health. However, following its decision in May 2024 to adopt Bitcoin as its primary treasury reserve asset, Semler’s business strategy has undergone a significant transformation. The company’s initial purchase of Bitcoin amounted to $40 million, igniting a financial overhaul. By April, Semler held 4,449 BTC, worth approximately $471 million, having acquired these coins at an average cost of $88,263 each. As per their roadmap, the firm plans to accumulate 10,000 BTC by the end of 2025, 42,000 BTC by 2026, and hit the remarkable benchmark of 105,000 BTC by December 2027 — a feat that would require an unprecedented acquisition pace of over 100,000 BTC within a three-year timeframe.

Funding a Bitcoin Strategy

To realize its ambitious Bitcoin acquisition goal, Semler is following a playbook similar to MicroStrategy’s strategy. The company is utilizing a blend of at-the-market (ATM) share sales, senior convertible notes, and revenue from operations to fund their purchases. In early 2025, Semler raised $88.5 million through convertible debt and continues to explore capital markets for further funding. The significance of this financial maneuvering was underscored on June 19, when Semler appointed Bitcoin analyst Joe Burnett as its new Director of Bitcoin Strategy. This role marks a pivotal shift, as the company aims to become a premier player in the growing field of corporate Bitcoin investments, with Burnett stating, “It’s time to build one of the most valuable companies in the world.”

Evaluating the Risks

While Semler’s aggressive Bitcoin strategy has attracted attention, it prompts important questions regarding liquidity and execution. Their plan to acquire 0.5% of Bitcoin’s total supply brings potential liquidity challenges, as such a massive accumulation could disrupt market dynamics. Additionally, there are internal risks: critics caution that a substantial focus on Bitcoin might distract from Semler’s core operations in medical technology, a field that demands considerable investment in research and development. Furthermore, with new regulations requiring fair-value accounting for digital assets, fluctuations in Bitcoin prices could significantly affect Semler’s financial performance and earnings stability.

Market Trends and Comparisons

Comparisons between Semler and MicroStrategy are inevitable, especially given that Michael Saylor’s company currently holds approximately 592,100 BTC. Like Semler, MicroStrategy has utilized a similar funding strategy involving equity issuance and debt. However, a critical distinction lies in Semler’s relatively modest operating base against its expanding Bitcoin holdings. If Bitcoin appreciates in value, Semler could see its market valuation soar, potentially decoupling from its core sales performance, similar to what has been observed with MicroStrategy. This trend highlights Bitcoin’s increasing relevance in corporate finance, positioning Semler as a potential trailblazer for other companies considering similar strategies.

Semler’s Future: A Transformative Gamble

As Semler positions itself at the forefront of Bitcoin investment, the company faces the dual risk of either redefining its identity or losing direction. The value of its Bitcoin holdings already exceeds its traditional medical device business, hinting at a future where digital asset management might eclipse its origins in medical diagnostics. By aiming for a $10 billion Bitcoin target, Semler is essentially betting on its ability to reinvent itself in a rapidly evolving financial landscape, akin to MicroStrategy.

In conclusion, Semler Scientific’s aggressive Bitcoin strategy signifies a bold pivot that could either set new industry standards or prove perilous. While the outcome remains uncertain, one thing is clear: Semler is poised to make a significant impact in the corporate world of cryptocurrency, and its journey will be watched closely by both investors and industry peers. As the company dives deeper into its Bitcoin ambitions, only time will tell if this gamble pays off in the long run.