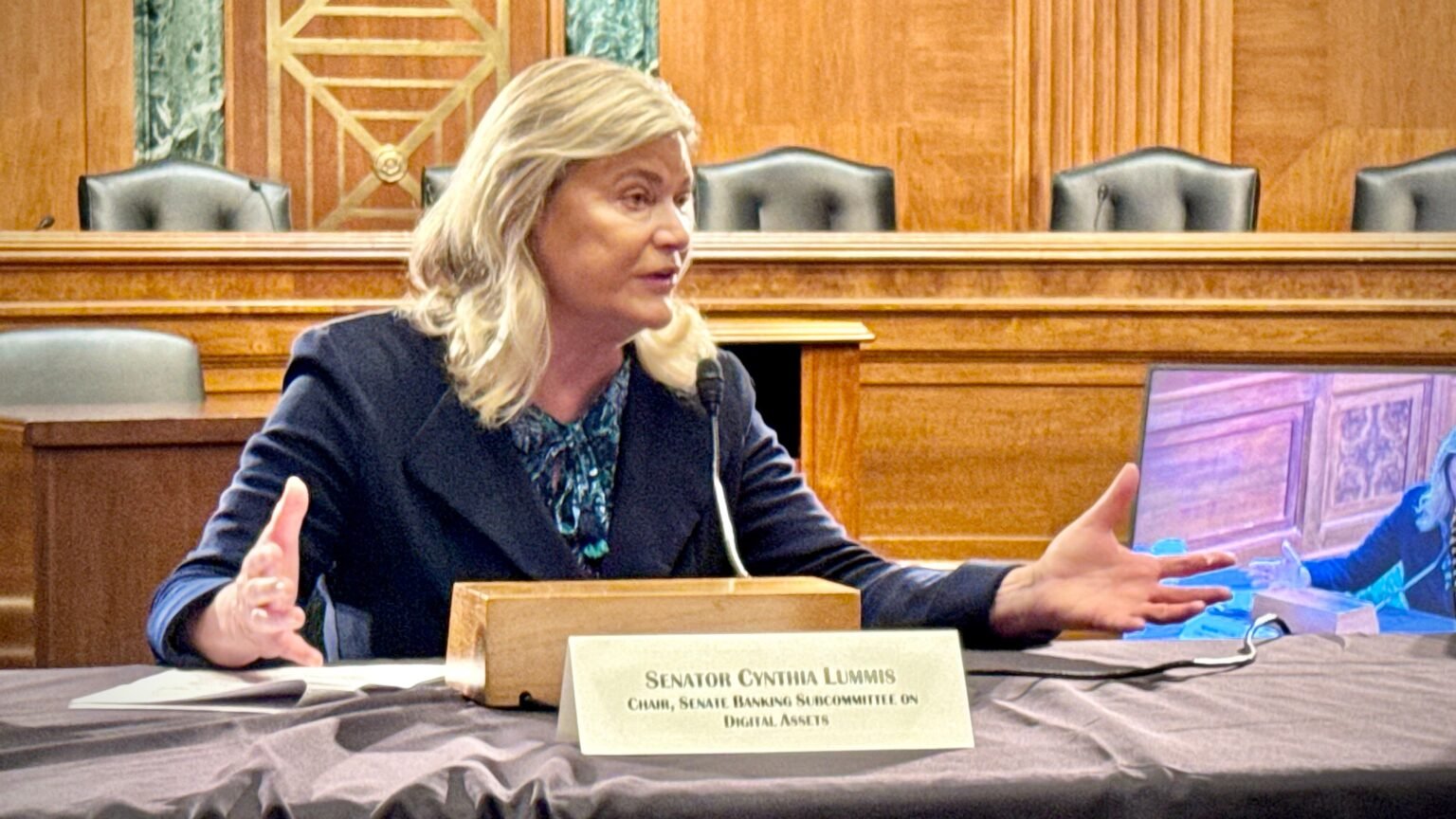

Senator Cynthia Lummis’s Proposed Crypto Tax Reform: A Game Changer for Digital Assets

Introduction

U.S. Senator Cynthia Lummis is making headlines with her ambitious plan to introduce significant tax reform for cryptocurrency under the scope of a major budget bill aligned with former President Donald Trump’s agenda. This bold initiative seeks to ease the tax burdens associated with common crypto transactions, aiming to enhance the appeal of digital assets for both experienced traders and newcomers.

Key Proposals of the Amendment

The proposed amendment includes several pivotal reforms critical for the cryptocurrency ecosystem:

- Tax Waiver on Small Transactions: The measure would remove tax obligations for small crypto transactions under $300, with a yearly cap of $5,000. This could eliminate the financial complexities associated with capital gains for casual users, incentivizing more people to participate in crypto markets.

- Revised Taxation for Staking and Mining: Currently, rewards from staking and mining are taxed upon both acquisition and sale. Lummis’s initiative aims to rationalize this approach, imposing taxes only at the point of sale. This aligns with many industry advocates’ calls for tax policies matching actual income realization.

Reducing Barriers to Entry

The potential for tax-free small transactions is essential for lowering barriers of entry into the cryptocurrency space. Many people have been hesitant to explore digital assets due to the complications of capital gains tax. By simplifying tax implications, this measure encourages broader participation, potentially leading to an influx of new investors in the crypto market. This change could significantly enhance the adoption rates of cryptocurrencies among everyday consumers.

Addressing Other Taxation Issues

Lummis’s amendment is comprehensive, targeting a range of tax issues in the crypto realm:

- Crypto Lending: The proposal outlines how certain lending activities would be taxed, offering clarity to users about their tax obligations.

- Wash Sales: Lawmakers have struggled with the loophole allowing investors to conduct tax-loss harvesting through the strategic buying and selling of assets at a loss. This amendment addresses that challenge, reinforcing accountability in trading practices.

Legislative Context

The "Big Beautiful Bill," under which Lummis aims to introduce her amendment, is a contentious piece of legislation. It’s been met with resistance from some congressional members, particularly Democrats concerned with potential cuts to essential services like Medicaid and green energy initiatives. The high stakes are evident; the U.S. House of Representatives barely passed its version of this bill, which will need to be revisited if the Senate introduces changes.

Conclusion: A Step Forward for Crypto Legislation

Senator Lummis’s effort to push for tax reforms within cryptocurrency could mark a significant milestone in U.S. policy. By addressing taxation on small transactions and providing clarity on staking and mining, this initiative not only fosters a more accessible environment for crypto users but also offers potential benefits for the broader economy. If enacted, these reforms could pave the way for a more inclusive and efficient digital asset landscape, potentially bolstering the status of cryptocurrencies in mainstream finance.