Understanding Dogecoin’s Recent Market Pressure: Key Factors to Consider

Dogecoin (DOGE), the once-famed meme cryptocurrency, has recently come under scrutiny due to significant market movements triggered by whale transfers. A notable inflow of 132 million DOGE, valued at approximately $27 million, to trading platform Robinhood has raised concerns among investors regarding a potential surge in large-scale selling. This influx is underscored by historical patterns where large holders, or "whales", typically move their assets to exchanges in preparation for selling, often resulting in short-term price declines. Coupled with decreasing retail demand, the current scenario illustrates the growing influence these whales have on market dynamics. With liquidity thinning across exchanges, even modest sell orders may lead to increased volatility in DOGE’s price.

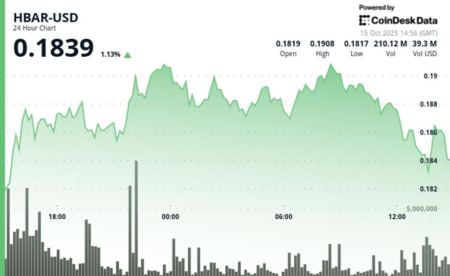

In the ongoing market landscape, Dogecoin’s resilience has been put to the test as it continues to trade within an ascending channel despite facing repeated resistance around the $0.22 mark. The price has hovered between $0.18 and $0.20, which is seen as a critical demand zone where bulls have made efforts to stave off further losses. The Relative Strength Index (RSI) stands at 39.99, reflecting a prevailing bearish sentiment and weak buying momentum. Nevertheless, as long as DOGE remains above $0.18, the broader channel structure opens up possibilities for a rebound. Should the price manage to close consistently above $0.22, it could dispel the current bearish bias, potentially paving the way for a short-term relief rally.

Market sentiment appears to be dominated by seller activity, as highlighted by the Spot Taker CVD data from CryptoQuant. Over the past 90 days, sell-side dominance has reigned in the derivatives market, indicating that sellers have retained control. This imbalance between taker buys and sells suggests reduced trader confidence, leading many leveraged long positions to close. In turn, this ongoing selling pressure has diminished liquidity depth, heightening the likelihood of sharp intraday price swings. Nevertheless, the potential for a sudden short squeeze could offer temporary relief for bulls, even though the overwhelming trend remains bearish.

Adding another layer to the cautious outlook on Dogecoin is the concerning rise of its NVT Ratio, which has surged to 287, indicating a significant gap between market value and on-chain activity. This spike suggests that the network may be overvalued, accompanied by diminished transaction efficiency. Historically, such elevations in the NVT Ratio have preceded market corrections, as speculative sentiment outpaces genuine utility. For Dogecoin to stabilize its valuation metrics and rebuild investor confidence, a notable uptick in transaction volume is essential. Until such developments occur, the elevated NVT ratio remains a warning signal for potential investors.

As we analyze Dogecoin’s future trajectory, the landscape appears increasingly precarious due to the continued whale activity and intensified sell-side dominance. The cryptocurrency’s ability to consistently maintain its position above the crucial $0.18 level could dictate its short-term direction. A steadfast defense at this level may ignite renewed buying interest, nudging DOGE towards the elusive $0.22 resistance. Conversely, any breakdown below this support could unleash further losses toward lower levels, amplifying the current bearish sentiment. Consequently, the prevailing market atmosphere necessitates a cautious approach from traders, particularly as they await signs of a potential rebound.

In summary, Dogecoin is facing significant market challenges influenced by whale transactions, diminishing retail demand, and various technical indicators signaling potential overvaluation. Understanding these dynamics is essential for traders and investors as they navigate the complexities of this cryptocurrency landscape. While Dogecoin has the potential to rebound if key support levels hold, the current market sentiment remains bearish, warranting a wait-and-see strategy for those engaged in trading or investing in this asset. Keeping a close eye on transaction volumes and market liquidity will be vital for anyone looking to capitalize on DOGE’s volatility in the coming weeks.