Analyzing XRP’s Market Movements: A Resilient Performance Despite Economic Tensions

Market Overview and Key Price Movements

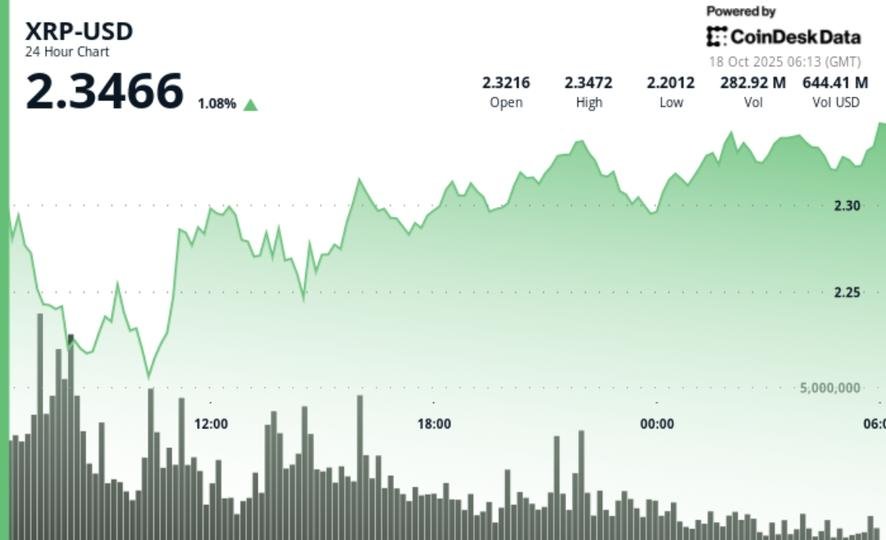

XRP resiliently navigated through turbulent waters on October 17-18, showing a defensive trading approach amidst larger macroeconomic concerns. After hitting a low of $2.19, XRP rebounded to around $2.33, reflecting a 1% gain from its opening session. The 24-hour session exhibited a price oscillation between $2.19 and $2.35, a significant range influenced by external factors like rising U.S.–China tariff fears and pending SEC deadlines for spot XRP ETFs. As institutional buyers began to absorb selling pressure, a notable surge in trading volume peaked at 246.7 million during the morning hours.

Institutional Confidence Amid Economic Uncertainty

This decisive recovery in XRP’s pricing can be attributed to the renewed institutional interest, even as the broader cryptocurrency market cap took a hit, dropping roughly 6% to $3.5 trillion. Concerns regarding U.S.–China trade relations have created risk-off flows in the market, prompting investors to tread cautiously. As Ripple prepares for a substantial $1 billion fundraising initiative for its treasury division, this development has helped to maintain market confidence despite the turbulent economic backdrop.

Detailed Price Action Analysis

During early trading hours, XRP witnessed a sharp decline from $2.33 to $2.19, but regained stability thanks to strong buying programs. As the market depth improved, XRP’s price climbed steadily, hitting resistance levels around $2.35–$2.38. In the last hour of trading, the asset briefly dipped to $2.32 before rebounding back to $2.33. Such price actions underline a critical consolidation period between $2.32 and $2.34, suggesting a solid absorption of the asset near these prior lows.

Technical Indicators and Market Sentiment

Key technical indicators paint a mixed picture for XRP. The support zone remains firm at $2.23–$2.25, with strong long interests evident beneath the $2.20 mark. Nevertheless, resistance is capped within the $2.35–$2.38 range, where future breakout confirmation above the $2.40 level is needed to imply a bullish trend. The relative strength index (RSI) is neutral, indicating neither overbought nor oversold conditions, while MACD signals are stabilizing, hinting at possible upward momentum in the near term.

What Traders Should Focus On

As we head into the SEC’s review period for six pending spot XRP ETF applications, traders are keenly watching how XRP performs in the upcoming days. There is particular focus on whether support at $2.30 will hold through the weekend. Additionally, the implications of Ripple’s treasury raise could induce significant changes in secondary market liquidity. Broader economic sentiment pertaining to U.S.–China trade negotiations will also be a critical factor influencing XRP’s market trajectory.

Looking Ahead: The Path for XRP

In conclusion, XRP’s recent defensive trading patterns underscore a strong underlying support structure despite external challenges. As key market drivers like ETF approvals loom, traders should keep a close eye on whether XRP can break resistance at $2.40, which would indicate renewed interest towards higher price targets like the $2.70–$3.00 range. Strong institutional backing and ongoing adjustments to macroeconomic factors will likely dictate XRP’s next moves in this dynamic marketplace.