Demystifying Stablecoins: The Myth of Dollar Pegging

In the world of cryptocurrency, stablecoins have often been hailed as reliable assets that maintain a consistent value, typically pegged to the U.S. dollar. However, recent analyses, notably from NYDIG, have called this understanding into question, highlighting significant fluctuations in the values of popular stablecoins like USDC and USDT. According to Greg Cipolaro, NYDIG’s Global Head of Research, these assets are not as stable as presumed, debunking the notion that they resist market pressures by being tied to a fixed value.

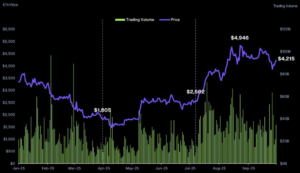

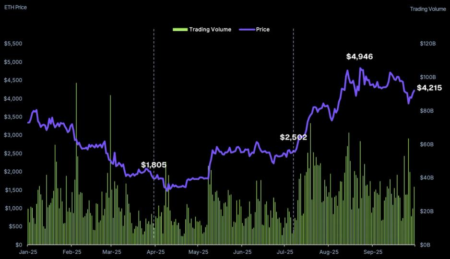

Cipolaro’s insights emerged following a significant $500 billion sell-off in the crypto market, which exposed vulnerabilities within these so-called stable assets. Specifically, during this downturn, USDC and USDT were found trading above $1, while others, like Ethena’s USDe, plummeted to as low as $0.65 on exchanges like Binance. This dramatic price behavior illustrates that, rather than being stable by design, these tokens operate within a floating market determined by supply and demand dynamics.

The concept of a "peg" implies a level of security that simply doesn’t exist in reality. Cipolaro emphasized that the stability of these coins is an illusion created by traders engaging in arbitrage. They capitalize on short-term fluctuations by buying when prices dip below $1 and selling when prices rise. In times of market panic, this system fails, leading to real-time devaluation of widely-used assets—even those considered reliable. As a consequence, users often misjudge the inherent risks associated with stablecoins, complicating their decision-making in investment scenarios.

NYDIG’s research underscores the pressing need for investor education in a fragmented ecosystem. Even in traditional markets, assets thought to be stable can devalue rapidly under extreme conditions, as evidenced by the recent crash. The collapse of USDe, particularly during the recent turmoil evidenced by Binance’s corrective measures, signaled how quickly stability can transition into instability. This reflects the chaotic nature of current market structures and the misunderstandings surrounding stablecoin value.

Interestingly, amidst the turbulence, certain sectors like DeFi have demonstrated resilience. For instance, the lending platform Aave only liquidated a minimal amount of collateral during the downturn. This contrasting stability within certain areas serves to highlight that while the stablecoin narrative may falter, some aspects of the digital asset landscape continue to thrive under pressure. NYDIG noted that its own positions remained untouched by the market sell-off, suggesting a strategic advantage in consistently evaluating risk.

As the cryptocurrency landscape evolves, investors must apply critical thinking when it comes to stablecoins. With NYDIG’s revelations shaking the foundation of traditional perceptions, clarity regarding the actual functioning of these assets has become paramount. Understanding that stablecoins function more like market-driven instruments rather than guaranteed dollar pegs is essential for any serious player in the crypto market, ultimately paving the way for a healthier and more informed trading environment.

By clarifying misconceptions surrounding stablecoins, particularly their pseudo-stability, this article seeks to provide a more nuanced perspective for investors and crypto enthusiasts alike. The volatile nature of these assets serves as a reminder that knowledge and vigilance in market behavior can go a long way in making informed investment choices in the ever-changing world of cryptocurrency.

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-450x270.webp)