Stellar Lumens (XLM): Market Volatility and Institutional Growth

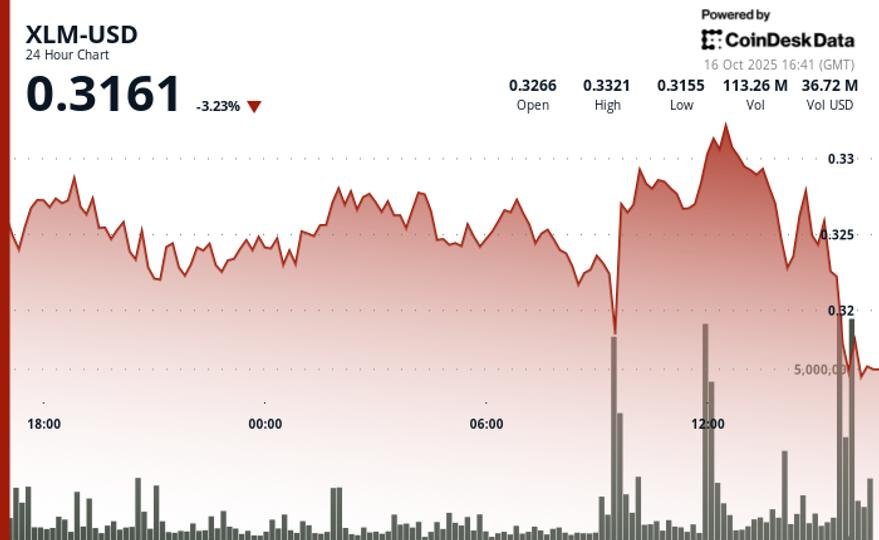

Stellar Lumens (XLM) has seen significant fluctuations recently, particularly within a 23-hour trading period ending on October 16, where the price oscillated between $0.32 and $0.33—representing a 5% range. Despite initial weaknesses in price, institutional buying provided a robust rebound, suggesting renewed interest and support from corporate investors. Trading volumes notably increased during this period, highlighting heightened institutional engagement in the cryptocurrency markets.

After rebounding to $0.33 during midday trading due to that institutional support, the momentum unfortunately dwindled. In the final hour, XLM retraced back to just under $0.32, breaking beneath earlier support levels and indicating the market’s sensitivity to liquidity conditions. This decline is significant as it highlights the delicate balance of trading dynamics in the cryptocurrency arena and emphasizes the impact of institutional buying power on smaller tokens like XLM.

Amidst this volatility, Stellar’s ecosystem continues to develop positively with the recent launch of Europe’s first physically-backed Stellar Lumens Exchange Traded Product (ETP) by WisdomTree. This move is noteworthy as it provides new avenues for regulated exposure to XLM, making it more attractive to institutional investors despite the token’s current price fluctuations. The ETP trades across Swiss SIX and Euronext exchanges, further expanding the accessibility of XLM within institutional portfolios.

However, the digital payments landscape is facing increasing competitive pressure. New entrants like Digitap are taking advantage of innovative compliance models, challenging established players such as Stellar and Ripple. These developments are reshaping the enterprise blockchain payments sector, emphasizing the need for Stellar to remain agile and adapt to market trends to maintain and grow its competitive advantage.

Analyzing the market structure, XLM maintained a tightening price band, with a mere $0.02 variation between session highs and lows. The initial recovery capacity seen after a drop at 09:00 UTC showcases the potential for rebounds supported by substantial trading volumes, which reached approximately 73.74 million units during the recovery phase. Support was consistently observed around $0.32, serving as a critical pivot point for traders aiming to capitalize on XLM’s price movements.

Despite the positive signals from institutional activities, the closing session indicated a decline in trading volume, suggesting liquidity issues may arise if supporting buyers withdraw. This diminished volume activity raises concerns about the potential for further price drops, especially as the asset closed at $0.33, nearing resistance levels that traders will closely monitor moving forward.

In conclusion, while Stellar Lumens navigates a volatile market landscape, its recent institutional engagements and the introduction of regulated financial products are key indicators of its underlying growth potential. However, with the competitive environment evolving rapidly, Stellar must innovate and leverage institutional interest to capitalize on its blockchain capabilities, ensuring it remains a significant player in the digital payments sector.