Sui (SUI) Faces Bearish Sentiment Amid Token Unlock and Market Uncertainty

The current market landscape for Sui (SUI) suggests a bearish outlook, with price predictions indicating a potential drop of 10-12%. Following a recent breakdown of support, the sentiment around SUI has shifted noticeably. Significant short positions near the $2.848 mark, totaling $16.66 million, reflect the negative market perspective surrounding this digital asset.

Recent Performance and Token Unlock

Sui has recently been maneuvering within a descending channel pattern. It saw a notable rally exceeding 20%, approaching the upper boundary; however, strong selling pressure halted this momentum. This selling pressure primarily stems from historical resistance levels and a massive token unlock scheduled by the Sui Network. On July 1st, Sui plans to unlock approximately 58.35 million tokens valued at $164.44 million, amounting to 1.72% of SUI’s total market capitalization.

Analysts have pointed out that such large token unlocks often pose a risk of increased selling pressure. This token unlock could serve as a catalyst for a short-term price dip, primarily due to the augmented supply flooding the market just as investor confidence is wavering.

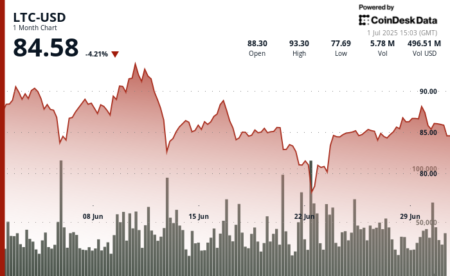

Current Market Position and Trading Volume

At the time of writing, SUI was trading at $2.72 following a 1.75% dip over the last 24 hours. This drop has been accompanied by a decrease in investor and trader participation. Data from CoinMarketCap reveal a 10% reduction in trading volume compared to the previous day. This decline is a telling sign of lower confidence levels and diminished interest in trading SUI, further fueling the bearish narrative.

Technical analysis indicates that SUI is experiencing the repercussions of the impending token unlock, as well as the breakdown of a critical support level. The price has remained below the significant ascending trendline, suggesting that if a four-hour candle closes beneath this trend, a further decline to the $2.40 level is firmly possible.

Bearish Market Dynamics

The bearish sentiment surrounding SUI has analysts concerned, and this is corroborated by recent data from the on-chain analytics firm CoinGlass. Their analysis highlights that traders are increasingly over-leveraged at the $2.67 support level, with $12.45 million in long positions registered. Simultaneously, a reported $16.66 million in short positions at the $2.848 level indicates that short sellers hold dominant control over market sentiment.

Given the abundance of short positions in the market, traders currently seem to align with the bearish outlook, reinforcing the belief that breaking above the $2.848 level will be an arduous task for SUI in the near future.

Diagonal Trends and Slight Accumulation

While selling pressures dominate the current climate, data shows some investors have recognized the opportunity to accumulate SUI at a reduced price. Reports indicate outflows of approximately $16.40 million worth of SUI tokens are occurring across various exchanges. This trend reflects a willingness among certain market participants to accumulate at lower prices, potentially positioning themselves for future gains should market conditions improve.

The confluence of substantial outflows amid the prevailing short-term bearish sentiment suggests that while the market may be fearful, some investors believe it is a strategic opportunity for long-term accumulation.

Conclusion: What Lies Ahead for SUI?

In summary, Sui (SUI) currently finds itself at a critical juncture, with bearish trends prevailing due to a breakdown of support alongside a significant token unlock. The price is likely to experience further downward pressure, potentially reaching the $2.40 threshold if selling continues.

Nonetheless, fleeing from the market entirely may not be wise for long-term investors who can capitalize on lower prices. While the current sentiment leans toward being bearish and cautious, the interest from long-term accumulators reflects a differing perspective that suggests opportunities lie ahead. The future of SUI may hinge on its ability to navigate through these turbulent waters and regain the trust of both its existing and potential investors.