Crypto Week: A Landmark Moment in U.S. Digital Asset Regulation

The U.S. House of Representatives has declared the week beginning July 14 as “Crypto Week,” igniting discussions around three significant pieces of legislation aimed at regulating digital assets. These are the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate’s GENIUS Act. This initiative is poised to establish the United States as a leading player in the rapidly evolving world of cryptocurrency and digital finance.

Regulatory Clarity for Digital Assets

A primary feature of Crypto Week is the review of the bipartisan CLARITY Act, designed to eliminate years of regulatory confusion surrounding digital assets. The Act clearly defines the roles of both the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in overseeing the realm of digital finance. By categorizing digital assets into three distinct types—securities, commodities, and stablecoins—the CLARITY Act ensures that Bitcoin and similar assets fall under the jurisdiction of the CFTC, while securities remain under the SEC’s purview. This clear bifurcation brings much-needed certainty to entrepreneurs and investors alike, fostering a more conducive environment for innovation.

Moreover, the dual-track registration system introduced by the Act allows businesses to register with the agency that most aligns with their operations, enhancing regulatory clarity. By instituting robust anti-fraud and consumer protection measures, the CLARITY Act serves as a catalyst for responsible innovation, reducing the risk of regulatory enforcement that has previously hampered industry growth.

Supporting Stablecoins in Mainstream Finance

Another crucial piece of legislation—the GENIUS Act—has recently garnered bipartisan support in the Senate, aiming to lay down the first comprehensive federal framework for payment stablecoins. With explicit definitions of who can issue stablecoins and stringent capital and reserve requirements, the GENIUS Act enables both federal and state regulators to oversee these transactions effectively. This framework not only legitimizes dollar-backed digital assets but also facilitates their seamless integration into mainstream financial channels.

In doing so, the GENIUS Act enhances consumer protections while fostering an environment ripe for innovation. With clearly defined rules, the U.S. stands to attract a broader range of users, both institutional and retail, thereby solidifying the dollar’s position in global digital commerce. Such stability and clarity are essential as more consumers gravitate toward digital finance solutions.

Safeguarding Financial Privacy and Autonomy

The third legislative priority during Crypto Week, the Anti-CBDC Surveillance State Act, addresses rising concerns about government surveillance and personal privacy. By prohibiting the Federal Reserve from issuing a central bank digital currency (CBDC) to individuals, the Act seeks to maintain Americans’ financial autonomy in an increasingly digitized world. This move resonates strongly with the crypto community, which fears potential overreach from state-issued digital currencies.

By blocking the issuance of a retail CBDC, the U.S. sets a clear precedent in favor of privacy and individual sovereignty. This legislation not only reassures crypto advocates but also reflects a broader commitment to free-market principles, suggesting a future where individual freedoms are balanced with technological advances.

The Legislative Landscape: Maturity and Recognition

The proposed legislation being reviewed during Crypto Week represents the culmination of years of hearings, bipartisan negotiations, and advocacy from the cryptocurrency industry. This moment is not merely about regulatory clarity; it signifies the maturation of the crypto market and a growing acknowledgment of its economic importance. As lawmakers engage in these discussions, they signal to the global market that the U.S. is intent on creating a robust framework for digital assets.

The advancement of these bills during Crypto Week highlights how the institutional landscape is changing to accommodate the unique challenges posed by digital finance. In turn, this encourages the development of new technologies and business models, ultimately paving the way for a more dynamic economy.

Investor Sentiment and Future Outlook

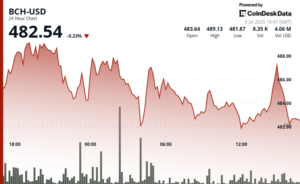

Prominent crypto trader and influencer Cas Abbe has expressed optimism regarding this week’s discussions, suggesting that "the next few weeks are going to be really bullish for the crypto market." The potential for regulatory clarity, enhanced consumer protections, and the safeguarding of financial privacy could create a favorable environment for both existing and new investors.

As these legislative measures gain traction, the effects will likely ripple through the cryptocurrency market. Increased regulatory clarity could inspire more significant investment from institutional players, while consumer confidence may rise, leading to broader adoption of digital assets. This week could serve as a turning point not just for U.S. regulations but for the crypto landscape as a whole.

Conclusion: A Pivotal Moment for Digital Assets

In summary, Crypto Week is set to be a pivotal moment for the future of digital assets in the United States. Through a careful examination of the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act, lawmakers are taking critical steps to foster innovation while ensuring consumer protection. Collectively, these legislative efforts represent a significant leap toward establishing the U.S. as a global leader in cryptocurrency and digital finance. As discussions unfold, the question remains: how will these decisions shape the future of the crypto market and its role in the broader economy?