Title: The Impact of Trump Tariffs on China and the Cryptocurrency Market

In recent developments, U.S. President Donald Trump has intensified his stance on tariffs against China, suggesting a potential increase of up to 155% if a trade deal fails to materialize by November 1. This proclamation comes during a bilateral meeting with Australia’s Prime Minister, as Trump expresses cautious optimism about reaching a fair agreement with Chinese President Xi Jinping. As the backdrop to these assertions, the cryptocurrency market has experienced significant fluctuations, notably affecting Bitcoin’s value, which recently fell to around $104,000, reflecting the broader implications of trade tensions on financial markets.

During a lunch meeting, President Trump emphasized the necessity for a trade deal with China while indicating that failure to reach an agreement could lead to historically high tariffs. The proposed 155% duty would be an unprecedented move, highlighting the escalating conflict in trade relations. In the past, the U.S. imposed a 100% tariff, which Trump previously hinted might not be permanent. The forthcoming meeting with Jinping on October 31 carries substantial weight, occurring just a day before these tariffs are slated to come into effect, positioning it as a critical juncture for U.S.-China trade discussions.

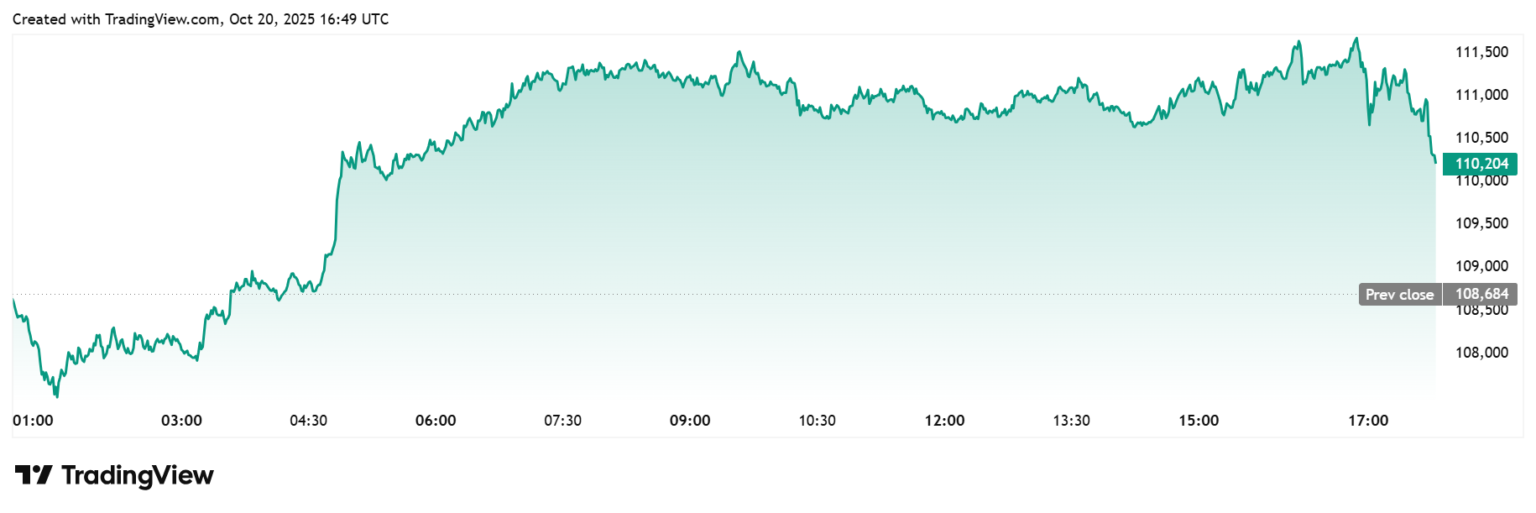

Despite Trump’s statements of hope regarding negotiations, the crypto market has been shaken by the uncertainty surrounding these tariffs. Following the announcement of the potential tariff increase, Bitcoin witnessed a downward trend, falling from approximately $111,000 to a concerning low of $104,000 last week. This volatility emphasizes the sensitive nature of digital assets to geopolitical dynamics. As investors respond to market signals influenced by trade policies, Bitcoin’s fluctuation mirrors the anxieties surrounding U.S.-China negotiations and their broader economic implications.

As Trump continues to navigate the delicate balance of diplomacy and economic strategy, he remains steadfast in his approach to tariffs on other countries as well, including India. He has maintained substantial tariffs on India, tying them to the latter’s reliance on Russian oil. This interconnectedness highlights the global implications of U.S. trade policies and their impact on various markets, including cryptocurrencies, which are often viewed as safe havens during volatile economic periods.

The potential ramifications of Trump’s tariffs extend beyond the cryptocurrency market, affecting international relations and economic stability. Investors are keenly aware that worsening trade relations can lead to increased market volatility. The recent fluctuations in Bitcoin’s value serve as a microcosm of how sensitive digital currencies are to trade tensions. As a result, understanding the geopolitical landscape becomes essential for investors in the crypto space.

In conclusion, the ongoing threat of increased tariffs on China must be viewed through a comprehensive lens that considers both international trade and the cryptocurrency market’s responsiveness to such developments. As the U.S. edges closer to critical negotiations, the outcome could shape not only the future of U.S.-China relations but also the stability of cryptocurrencies like Bitcoin. With the upcoming summit and subsequent decisions expected to resonate in global markets, stakeholders must stay vigilant as they navigate this complex economic landscape.