Crypto’s Black Friday: The Largest Liquidation in Digital Asset History

On October 10, 2023, the digital asset market experienced an unprecedented liquidation cascade, infamously dubbed "Crypto’s Black Friday." Within a single day, over $19 billion in leveraged positions were liquidated, marking a monumental moment in the history of cryptocurrencies. The event primarily stemmed from macroeconomic factors, as President Trump announced a proposed 100% tariff on Chinese imports. This announcement triggered widespread risk aversion, not only across cryptocurrencies but also equities and commodities. The sell-off escalated sharply during a mere 25-minute window, culminating in staggering declines for major assets like Bitcoin, Ethereum, and Solana.

Market Dynamics and Scale of Deleveraging

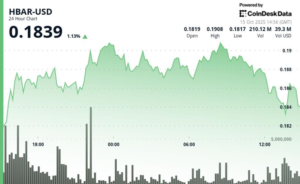

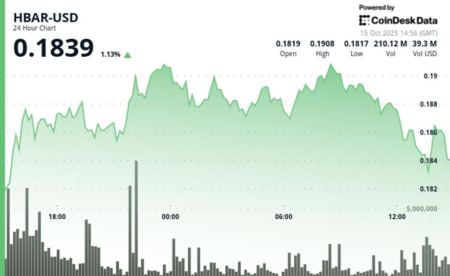

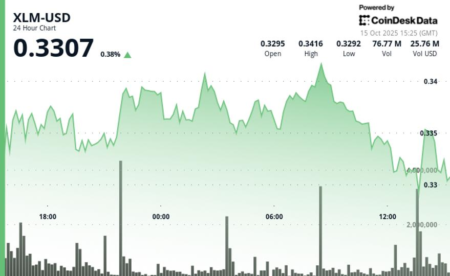

Analyzing the market’s dynamics reveals the staggering scale of this deleveraging event. According to CoinDesk Data, on October 10, total perpetual futures open interest dropped by 43%—from $217 billion to $123 billion within 24 hours. The breakdown showed that approximately $16 billion of the total was rooted in long liquidations, with most traders utilizing 2x leverage or higher, often without stop-loss strategies. The rapid unwinding of positions occurred predominantly in altcoins, resulting in some tokens plummeting over 75% in value within minutes. Transparency on decentralized platforms like Hyperliquid provided insightful data on the liquidation queues, contrasting sharply with centralized exchanges that aggregate and may underreport liquidation volumes.

Structural Stress and Order Book Collapse

The extreme volatility brought to light a significant structural stress in the crypto ecosystem, revealing just how interconnected liquidity, collateral, and oracle mechanisms are. Once liquidation levels were breached, market depth across major exchanges collapsed by more than 80%. In some shocking instances, even well-known assets like ATOM temporarily displayed near-zero bids, signaling a mass withdrawal of liquidity by market makers who pivoted to limit their risk exposure. The feedback loops generated from shared collateral across different venues only exacerbated the volatility, making even robust platforms vulnerable during market exit scenarios.

Fair-Value Pricing in Times of Extreme Volatility

In navigating this heightened volatility, trading benchmarks like CoinDesk Reference Rates acted as critical stabilizing tools. By aggregating prices from hundreds of sources and applying rigorous filters, these multi-venue benchmarks presented a more normalized view of asset prices during the chaotic sell-off. Despite localized price dislocations, these reference rates illustrated that market-wide valuations remained considerably more stable. They serve as a neutral reference point for traders and fund managers, ensuring there is reliable data available even as screens flash red.

Closing Thoughts: Learning from Dislocation

The significant disruptions seen on this fateful day set forth a pivotal moment for the cryptocurrency market. It accentuates the potential risks that leverage, liquidity shortages, and fragmented market infrastructures pose. Centralized platforms that act as ‘black boxes’ will need to adapt, while decentralized exchanges like Hyperliquid provide a clearer on-chain view of forced liquidations. The real challenge ahead is for the crypto industry to learn from these shocks, improving risk controls, establishing unified collateral standards, and enhancing transparency mechanisms.

Building a Resilient Future for Crypto Markets

As the dust settles from Crypto’s Black Friday, the industry faces a crucial choice: regard this event as a singular anomaly or utilize it as a cornerstone for constructing a more resilient future. Key areas for improvement include enhancing exchange architecture, deepening order books, and refining oracle designs to ensure higher uptime. The pivotal role of reference rates in establishing fair valuations during market turmoil cannot be overstated; however, true resilience will stem from systemic revamps across the cryptocurrency landscape. Safeguarding against further cascading liquidations will require robust infrastructure, real-time transparency, and improved market dynamics.

![Plasma [XPL] Soars 21% Following DeFi Partnerships, but THIS Factor Could Halt Its Momentum!](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Lennox-1-4-1000x600-450x270.png)