The Rise of Staking-Integrated ETFs: A New Era for Crypto Investments

As the regulatory landscape for cryptocurrency evolves, upcoming exchange-traded funds (ETFs) that incorporate staking yields are poised for significant growth. According to a report published on June 3, recent decisions by U.S. lawmakers and regulators have clarified the legal status of on-chain rewards, benefitting these investment vehicles. Understanding these developments is essential for investors looking to navigate the burgeoning crypto landscape effectively.

Regulatory Developments in Staking

On May 29, the U.S. Securities and Exchange Commission (SEC) confirmed that staking does not inherently constitute a securities sale, as long as customers maintain ownership of their assets and receive necessary risk disclosures. This clarification applies to various forms of staking, including solo, delegated, or custodial services. The SEC’s stance is a pivotal step toward legitimizing staking as a viable investment strategy. Additionally, the bipartisan Digital Asset Market Clarity Act (CLARITY Act) seeks to change the oversight dynamics within the U.S. crypto industry. While the SEC will continue to oversee initial fundraising efforts, the Commodity Futures Trading Commission (CFTC) will govern most secondary market token trading. This regulatory framework aims for greater clarity, which could lead to a more robust market for staking-related products.

Potent Players in the ETF Arena

While no ETF offering staking rewards had received regulatory approval as of June 4, key industry players are preparing to capitalize on the changing landscape. Notable firms such as BlackRock, Fidelity, and Bitwise are positioning themselves to launch ETFs that bundle staking rewards. These products are likely to focus on significant staking assets like Ethereum (ETH), Solana (SOL), and BNB, as well as popular liquid staking protocols like Lido. The entrance of these financial giants into the space underscores the growing acceptance of staking as a legitimate financial instrument.

Macro Influences on Staking ETFs

The intersection of U.S.-China trade negotiations can significantly impact the trajectory of staking-integrated ETFs. A favorable scenario, where discussions "muddle through" and the Senate moderates a pending tax provision, could see Bitcoin (BTC) retest its historic highs. Meanwhile, staked currencies are expected to benefit from the regulatory clarity. In contrast, a bearish scenario involving tariff re-escalation may initially pressure equities. However, investors can still expect staking-enabled tokens and related ETFs to outperform traditional stocks. The yield component offered by these investments can serve as a buffer against potential price declines in the broader market.

Yield Opportunities in the Staking Arena

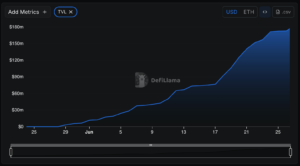

Recent data from DefiLlama reveals attractive staking yields across various platforms. For instance, Ethereum staking offers returns ranging from 2.5% to 3%, while Solana can yield between 6.5% and 8%. Binance Coin (BNB) exhibits an average yield of 2.1%. These returns are essential for investors seeking alternatives to traditional investment vehicles, especially as the equity risk premium falls below 2.5%. Given the currently subdued volatility in equity markets, staking-enabled ETFs offer a unique opportunity to combine crypto asset appreciation with a dependable income stream that does not rely on corporate earnings.

The Future of Staking-Enabled Funds

As Nansen’s report suggests, the convergence of regulatory clarity, macroeconomic diversification, and investor interest in blockchain yields creates a favorable environment for funds that channel staking rewards to shareholders. With major ETF issuers preparing to enter the market, and a supportive regulatory framework emerging, the future looks bright for staking-integrated ETFs. As investors become more educated about blockchain technology, the appetite for yield-bearing assets is expected to rise, potentially transforming the investment landscape.

Conclusion

The upcoming regulatory shifts surrounding staking rewards represent a critical inflection point for ETFs integrating these yields. As major financial firms prepare to launch staking-enabled investment products, the stage is set for a new chapter in cryptocurrency investing. With competitive yields and a clearer regulatory framework, these ETFs are likely to attract attention from both seasoned and novice investors. As such, staying informed on these developments will be crucial for anyone looking to engage with the evolving world of digital assets.