Ethereum Whale Borrowing Signals Shift in Market Sentiment

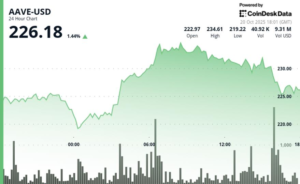

Recent activity by a major crypto whale has caught the attention of market analysts, particularly in relation to the Ethereum ecosystem. This whale entity borrowed a staggering 64,000 ETH, approximately valued at $280 million, from the Aave lending protocol. To facilitate this, they used a hefty sum of $420 million in USDC (a stablecoin) as collateral. Such significant movements not only raise eyebrows but also paint a broader picture of the current market dynamics surrounding Ethereum.

Analyzing the Whale’s Move

The large-scale borrowing and subsequent transfer of the ETH to Binance suggest that this whale intends to sell the assets immediately. This behavior aligns with classic short-selling strategies, where a trader profits from a decline in asset prices. Specifically, if the price of ETH continues to fall below its current value of around $3,950, the whale stands to gain substantially from this short position. The stakes are high, as the market volatility could either result in a massive payday or a considerable loss depending on future price movements.

Market Sentiment Turns Cautious

The recent actions of this whale coincide with a notable shift in market sentiment. According to data from Coinglass, the long-to-short ratio for Ethereum sits at 0.98, with shorts constituting 50.4% of leveraged positions as of October 20. This slight dominance in short positions indicates a growing caution among traders, especially following Ethereum’s decline from early October highs above $4,300. The anxiety in the market has led many to reassess their positions, creating an environment where bearish sentiment seems to take hold.

Potential Risks and Opportunities

As the price of ETH continues to fluctuate, the whale’s short position could prove lucrative if the asset’s value drops. However, volatility poses risks, with a potential sharp price rebound triggering liquidations that might force the whale to close their position at a loss. Reports indicate that the current liquidation threshold for shorts stands at approximately $80 million, whereas long positions are valued at around $60 million. This precarious balance further illustrates the tension within the market as traders weigh their options.

Broader Context of Market Weakness

Ethereum’s recent downturn reflects broader trends in the cryptocurrency market, particularly following a Bitcoin-led correction in the previous week. The overall market capitalization has experienced declines, pushing the Fear and Greed Index deep into "fear" territory, signaling a decline in trader confidence. Such macro dynamics create an atmosphere where cautious trading prevails. Investors are now waiting to see if the whale’s actions represent the onset of institutional short positioning or if they signify potential recovery opportunities fostered by an oversold market.

Looking Ahead: The Future of Ethereum

As Ethereum faces pressure, traders and analysts are keenly observing funding rates across major exchanges, which remain positive despite the prevailing fears. The general sentiment hints that underlying fundamentals may support a rebound, even amidst bearish sentiment. Market participants remain on edge—watching for pivotal price actions that could dictate direction. Ethereum’s capacity to navigate through this turbulent phase will likely define its future trajectory and re-establish trader confidence.