Bitcoin Cash Market Update: Trends and Insights

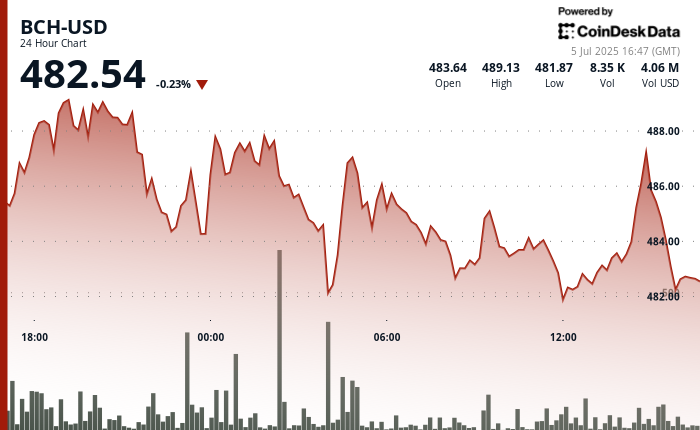

Bitcoin Cash (BCH) experienced a slight downturn on July 5, trading at $482.54, a 0.23% decrease from the previous day. This decline followed a brief surge where BCH reached a multi-month high of $526.5 on July 1—a leap of over 75% over the past three months, primarily driven by market enthusiasm, whale accumulations, and speculative trading. The overall cryptocurrency market saw some strength, with a 0.27% increase noted in the CoinDesk20 Index during the same period.

Despite the recent highs, on-chain metrics for Bitcoin Cash indicate lackluster activity. The number of daily active BCH addresses has dropped to a six-year low, highlighting concerns that the price rally is somewhat speculative rather than based on growing network usage. Nonetheless, technical analysis has revealed promising indicators, such as a "golden cross" on BCH’s hourly chart, where the 50-day moving average has crossed above the 200-day moving average—a signal historically associated with bullish trends.

Investor interest remains strong, particularly in BCH derivatives; open interest in these contracts surged by 27.4% over the prior week to $578 million. Analysts focus on the $478 to $508 price range, marking it as a crucial support zone that may provide stability against the current pullback. A notable uptick in whale transactions, with exchanges exceeding $100,000, was reported—a figure that rose by 122.45%, indicating potential bullish sentiment from larger investors.

As of July 5, further intrigue arose with a significant transaction involving 10,000 BCH valued around $5 million that occurred just before a monumental movement of 80,000 dormant BTC worth over $8.5 billion. Experts speculate that this BCH transaction may have acted as a test of wallet access before executing the large Bitcoin transaction. This interplay between BCH and BTC highlights the interconnected dynamics of major cryptocurrencies.

Meanwhile, the Bitcoin Cash Foundation recently released an update concerning its latest software version, Knuth v0.68.0. This upgrade aims to streamline the node’s codebase while setting the stage for future improvements in UTXO efficiency. Although no major adoption headlines have emerged recently, smaller projects within the BCH community continue to explore avenues such as micropayments and NFTs, indicative of ongoing innovation even amid current market uncertainties.

In summary, Bitcoin Cash finds itself at a crossroads, marked by recent speculative trading and dwindling on-chain activity. The interplay between market sentiment, technical indicators, and underlying fundamentals will likely shape BCH’s trajectory in the upcoming weeks. Investors and enthusiasts are keenly observing these developments, as any signs of sustainable utility could either bolster further price increases or signal a significant shift in market dynamics. As the cryptocurrency market continues to evolve, Bitcoin Cash’s adaptability and community innovation may play crucial roles in its future success.