XRP Price Movements: Analysis and Market Outlook

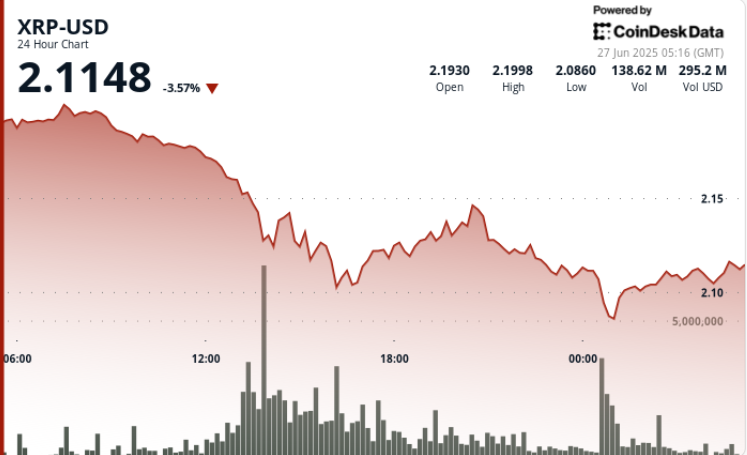

XRP experienced a significant downturn in value over the past 24 hours, plunging 5.3% from a high of $2.21 to a session low of $2.08 before slightly bouncing back to settle at $2.10. This price drop unfolded even amid large-scale whale activities, which typically influence market dynamics, and a backdrop of easing geopolitical tensions, particularly after a reported ceasefire agreement brokered by former U.S. President Donald Trump between Iran and Israel. Despite these potentially market-stabilizing developments, XRP’s performance illustrated the fragility of its momentum, marked by mounting technical resistance at the $2.17 level.

Market sentiment saw a modest uplift in the wake of geopolitical news; however, XRP failed to leverage this sentiment effectively. Whale activity raised eyebrows, as Ripple transferred an enormous $439 million worth of XRP to an undisclosed wallet, coupled with other significant movements that saw roughly $58 million shifted to centralized exchanges. These developments point towards potential redistribution of holdings that traders are wary of. The precarious state of XRP was further evidenced by its inability to break through the critical $2.14 resistance level, continuing to hint at underlying bearish momentum. Cryptocurrencies are becoming increasingly sensitive to both macroeconomic and combination of trading behavior, making market monitoring essential.

Looking at the price action, XRP’s decline unfolded over a substantial intraday range of $0.13, with the steepest price drop occurring between 12:00 and 16:00 UTC on June 26. During this time, trading volume surged markedly, surpassing 99 million XRP and leading to a rapid decrease in price down to $2.10. Throughout the session, resistance was evidently established at the $2.17 mark, with multiple rejection wicks at values above $2.12. This volatility has left a strong imprint on market charts, as the asset returned to a session low of $2.08 shortly before midnight UTC. A modest recovery followed, bringing XRP back up to $2.10 but indicating signs of buyer fatigue as volume dipped late in the session.

From a technical analysis standpoint, XRP’s performance over the past day has been concerning. The notable 5.3% fall from its recent high has solidified resistance at $2.17, while key support levels were tested between $2.08 and $2.09. Recovery attempts at levels $2.14 and $2.12 fell short, creating a prevailing sentiment of caution among traders. The last hour of trading showed a slight gain of 0.54%, with XRP moving from $2.09 to $2.10. However, with the volume roaring to 930K XRP during that brief window, it suggests a mixed outlook due to the overall decrease in buying interest late in the session.

The analysis suggests that current trading ranges are indicative of a consolidation phase near the $2.10 mark. The crucial price levels that traders are now eyeing include a sustained hold above the $2.08 support zone, while any bullish sentiment would greatly benefit from a breakout above the $2.17 resistance. The cryptocurrency’s behavior within the descending channel pattern is under scrutiny, with technical analysts projecting whether XRP may break out or continue to spiral downward in the months leading up to September.

To sum up, XRP’s recent performance is a combination of macroeconomic factors, whale movements, and sentiment-based trading, all contributing to its fragile momentum. The intense selling pressure underscores the importance of monitoring both support and resistance levels closely. As the crypto market adjusts to external headlines and internal factors, XRP traders remain on alert. Moving forward, the focus will be on whether XRP can overcome its immediate hurdles and gain back lost ground, or if the prevailing bearish sentiment will persist in the days ahead. Continued vigilance in analysis and an actionable strategy will be paramount for those looking to navigate this volatile market landscape effectively.