XRP Derivatives Market Update: Navigating Challenges and Recovery Prospects

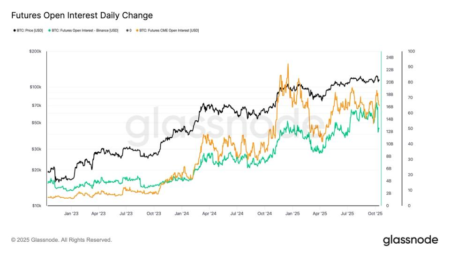

The XRP derivatives market has recently experienced significant fluctuations, prompting concerns among investors about the asset’s future performance. As of October 11, the market witnessed a staggering $610 million in liquidations, predominantly on the long side. This massive liquidation triggered a decline in Open Interest (OI), which fell sharply to just over $4 billion, thereby driving the Estimated Leverage Ratio (ELR) to its lowest levels for 2025. This sudden shift underscores a broader trend of deleveraging in the XRP derivatives market, raising questions about the potential for recovery.

As the market registered these dramatic changes, the ELR dropped dramatically from $0.59 on July 16—when XRP was trading at $3.41—to a mere $0.155, with the altcoin now priced around $2.50. This significant decrease indicates a healthy market reset following the liquidation events. Investors and market analysts are keenly observing for a potential recovery, with a critical resistance level noted between $3.1 and $3.2. For the bulls to make a successful breakout, surpassing this crucial supply zone stands as a pivotal challenge.

A key factor affecting the XRP market is the drastic reduction in Open Interest, which halved compared to the previous week. On October 9, OI was reported at $8.47 billion, but this number plummeted to $4.14 billion by the time of writing. This decline in OI often signals fear within the market, leading to a cautious sentiment among traders. Additionally, the trajectory of Bitcoin (BTC) may play a crucial role in shaping XRP’s recovery. Analysts speculate that if BTC manages to rally past $117,000, it could lead to an upward trend in other altcoins like XRP, providing the necessary space for them to recover.

In tandem with these developments, recent trends in whale activity indicate a pattern of mounting selling pressure. Binance, a leading cryptocurrency exchange, has reported increased whale inflows in October, suggesting large investors are offloading XRP. Whale-driven selling has historically contributed to broader market retracements, emphasizing the cautious outlook among retail traders. However, recent data indicates a downward trend in whale inflows, which may signal that selling pressure might soon ease.

Market sentiment remains in a state of uncertainty as traders observe the Taker Buy/Sell Ratio, which has lingered below 1 for the better part of the past month. This bearish trend illuminates the control sellers have maintained over price movements, reinforcing the cautious atmosphere that has enveloped the market. For XRP to recover and establish a bullish trend, the altcoin must overcome a local high of $3.09, flanked by psychological resistance around the $3 mark. This resistance zone will likely pose significant challenges for bullish traders as they attempt to navigate the turbulent market landscape.

As XRP approaches these critical levels, traders should exercise prudence by waiting for signs of sustained demand and improvements in Open Interest, along with reduced whale selling pressure. Understanding these dynamics will be essential for anyone looking to capitalize on any potential rebound in XRP’s performance. While the market appears wary, indicators hint at the possibility of a rebound if key resistance levels are broken and broader market conditions favor altcoins. In summary, although the XRP derivatives market currently faces challenges, there is still potential for recovery as the landscape evolves and investor sentiment begins to shift.

![Plasma [XPL] Soars 21% Following DeFi Partnerships, but THIS Factor Could Halt Its Momentum!](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Lennox-1-4-1000x600-450x270.png)