JD.com and Ant Group Advocate for Yuan-Backed Stablecoins to Challenge USD Supremacy

In a significant shift in the global financial landscape, Chinese tech giants JD.com and Ant Group are calling for the development of Yuan-backed stablecoins to counter the increasing dominance of U.S. dollar-pegged digital currencies. As the U.S. moves ahead with the recently enacted GENIUS Act, which bolsters the dollar’s digital footprint, China is looking to enhance its international monetary influence through stablecoins that are pegged to the offshore Yuan. This initiative not only aims to expand the role of the Yuan in global payments but also to counter the rising dominance of stablecoins like Tether’s USDT and Circle’s USDC, which collectively account for over 99% of the market.

The Growing Push for Yuan Stablecoins

According to reports by Reuters, JD.com and Ant Group have formally requested China’s central bank to approve the development of these Yuan-backed stablecoins, which would primarily operate through Hong Kong. The motivation behind this push is clear: the desired Yuan stablecoins would enhance China’s monetary footprint internationally while offering a competitive alternative to the robust U.S. dollar-denominated stablecoin market. The stablecoin sector is currently valued at approximately $247 billion but is projected to grow dramatically—potentially hitting $2 trillion by 2028, as estimated by Standard Chartered.

Perspectives from Industry Leaders

Leading figures in the Chinese financial technology landscape have voiced strong opinions on this matter. Wang Yongli, Co-chairman of Digital China Information Service Group and former Vice Head of the Bank of China, emphasized that failing to develop efficient cross-border payment systems in Yuan would be a strategic risk compared to their U.S. counterparts. Similarly, Xiao Feng, Chairman of HashKey, pointed out that China can no longer afford to remain passive in this space. Their comments underscore the urgency and importance of advancing China’s digital currency agenda.

Policy Shifts and International Aspirations

If successful, this advocacy for Yuan-backed stablecoins could signify a fundamental policy shift, especially in light of Beijing’s restrictive stance on cryptocurrencies following its 2021 ban. This initiative reflects a broader ambition to elevate the Yuan’s status as a global reserve currency and to establish a more prominent position in digital finance. However, China’s quest faces formidable challenges, including stringent capital controls that limit the Yuan’s liquidity and global access. SWIFT data indicates that the currency’s share in global payments dropped to 2.89% in May, marking its lowest level in nearly two years, while the U.S. dollar retains a firm share of 48.46%.

Response to Dollar Dominance

With U.S.-backed stablecoins gaining traction, many Chinese exporters have started favoring USDT for cross-border payments. In reaction to this trend, JD.com and Ant Group are accelerating their plans to launch their own stablecoins, aiming to reclaim their positions in international trade settlements. JD.com intends to introduce a Hong Kong dollar-pegged stablecoin by the end of the year, while Ant Group is actively pursuing necessary licenses in financial hubs like Hong Kong, Singapore, and Luxembourg. These efforts are strategically positioned to challenge the digital dollar’s supremacy and to establish the Yuan as a contender in the evolving landscape of stablecoins.

The Broader Geopolitical Context

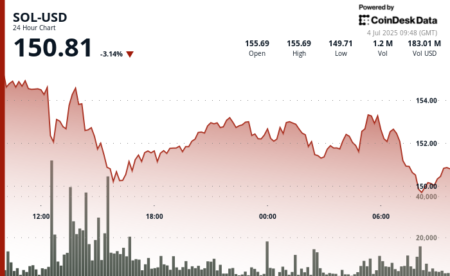

These developments come amidst a backdrop of renewed optimism in U.S.–China trade talks, which have shown brief moments of positive momentum, such as contributing to Bitcoin’s surge over $110K. However, this enthusiasm has since subsided due to the absence of meaningful progress in negotiations. The fluctuating environment of stablecoin geopolitics indicates the interconnected nature of global finance, where shifts in one region can significantly impact the digital currency ecosystem at large.

In conclusion, as JD.com and Ant Group gear up to challenge the dominance of U.S.-backed stablecoins, the introduction of Yuan-backed alternatives may reshape the global digital currency landscape. While there are hurdles to overcome, the push signals a notable transformation in China’s approach to international finance, aiming to enhance the global standing of the Yuan in the digital age.