CoinDesk 20 Daily Market Update: Leaders and Laggards in Focus

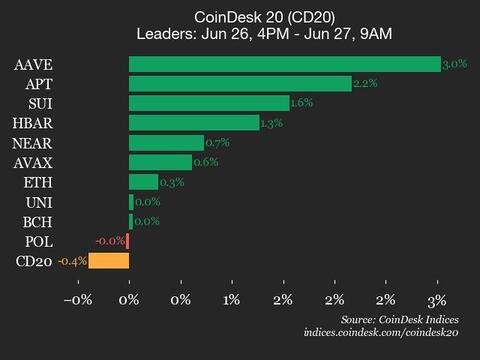

CoinDesk Indices has released its daily market update, providing key insights into the performance of cryptocurrencies within the prominent CoinDesk 20 Index. Currently, the CoinDesk 20 stands at 2955.67, reflecting a slight decline of 0.4% or $11.81 since Thursday at 4 p.m. ET. While the index as a whole has dipped, notable movements can be observed among specific assets within the index.

Performance Highlights: Leaders and Laggards

In the present market landscape, nine of the twenty assets in the CoinDesk 20 Index are showing gains. Leading the charge are AAVE, which has surged 3.0%, and APT, climbing 2.2%. This positive momentum reflects increased investor confidence and potential growth opportunities within these assets. Conversely, FIL and XRP have emerged as laggards, declining 2.0% and 1.8% respectively. These fluctuations underscore the volatility inherent in cryptocurrency markets and necessitate careful consideration for both investors and analysts.

Understanding the CoinDesk 20 Index

The CoinDesk 20 Index is a broad-based benchmark comprising significant digital assets traded across multiple platforms and global regions. This index serves as a reliable indicator of overall market trends and performance. In a rapidly changing financial environment, the CoinDesk 20 provides valuable insights into both emerging opportunities and potential risks facing the cryptocurrency market.

Market Sentiment Overview

While certain assets are experiencing upward momentum, the overall market sentiment remains cautious, influenced by various factors, including regulatory developments and macroeconomic indicators. The contrast between the leaders and laggards could imply a temporary rotation of investor focus, often seen during volatile periods in the crypto space. Market participants are advised to stay vigilant as price movements could signal the shifting landscape.

AAVE and APT: Spotlight on Growth

Both AAVE and APT’s recent surges can be attributed to growing enthusiasm among investors. AAVE’s technical innovations in decentralized finance might be attracting additional interest, while APT’s performance may reflect positive news or advancements in its underlying technology. Future developments for both assets will be of interest to analysts and investors aiming to capitalize on trends in the cryptocurrency market.

Conclusion: Navigating a Volatile Market

The daily updates from CoinDesk Indices provide essential information for understanding market dynamics. As seen today, while certain assets are experiencing gains, others are witnessing diminishment, highlighting the inherent volatility in the cryptocurrency space. Stakeholders should remain aware of both developments and market sentiment to navigate these fluctuations adeptly. Observing the implications of these movements within the CoinDesk 20 Index will be vital for informed decision-making in this fast-paced environment.

In summary, the current trading environment within the CoinDesk 20 Index underscores a mix of opportunity and risk, necessitating continuous monitoring and strategic action from investors.