Understanding Hedera’s HBAR Token: Recent Market Trends and Implications

Overview of Recent Trading Activity

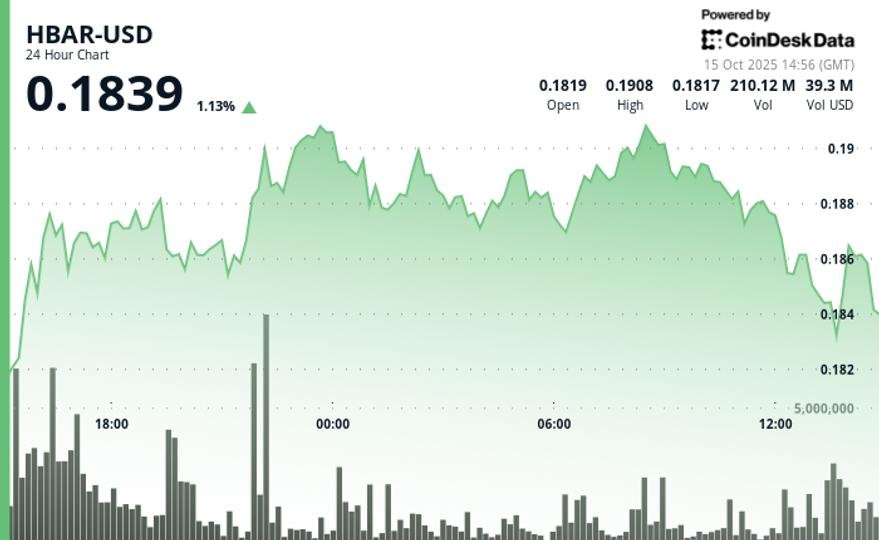

Hedera’s HBAR token has experienced significant volatility recently, with sharp price movements observed between $0.18 and $0.19 over a critical 23-hour period from October 14 to 15. During this timeframe, HBAR reached a peak of $0.19, facing resistance that prevented further upward movement. Ultimately, the token stabilized around $0.19, securing a modest gain of about 2%. The fluctuating price dynamics illustrate the complexities within crypto trading, where rapid shifts and market sentiment play crucial roles in price behavior.

Technical Analysis and Key Levels

Technical indicators reveal that HBAR is currently in a consolidation phase. The token displayed a 5% trading range, with a high of $0.192 and a low of $0.181, indicating critical resistance at the $0.19 level—characterized by multiple failed breakout attempts. On the support side, the $0.19 zone has proven robust, maintaining stability through repeated tests. Elevated trading volumes, particularly reaching peaks of over 8.9 million during selloff phases, suggest heightened activity among traders, frequently prompted by profit-taking strategies.

Market Influences and Geopolitical Factors

The broader cryptocurrency market exhibits sensitivity to macroeconomic influences, including ongoing geopolitical tensions and changes in trade policies that have dampened investor sentiment. Global capital flow disruptions pose challenges for blockchain networks like Hedera, which fundamentally depend on cross-border transactional stability. These external pressures contribute to an environment where cryptocurrencies, including HBAR, are susceptible to risk aversion among traders and investors alike.

Price Dynamics and Risk Appetite

The recent trading patterns of HBAR underscore difficulties in navigating a market characterized by fragile risk appetites. The late-session rebound in HBAR’s prices illustrates traders’ ongoing struggle to balance between profit realization and potential gains amid external uncertainties. As risk sentiment fluctuates, HBAR’s price movements provide insights into trader behavior and broader market trends, reflecting a continuous evaluation of risk versus reward.

The Future Outlook for HBAR

Analysts indicate that HBAR’s consolidated state may present opportunities for future growth, provided that it can break above established resistance levels. However, the pressing question remains whether supporting conditions will sustain bullish sentiments or if negative market forces will exert further influence. As traders remain cautious, closely monitoring geopolitical developments and market trends is essential for anticipating HBAR’s trajectory in the coming days and weeks.

Conclusion

The recent trading of Hedera’s HBAR token encapsulates broader themes in the cryptocurrency landscape, including volatility, the impact of macroeconomic conditions, and the critical importance of technical analysis. HBAR’s experiences over the past 23 hours reflect not just the dynamics within the token itself, but the interplay of factors shaping the wider crypto market. As HBAR navigates these periods of uncertainty, its ability to establish and maintain critical support and resistance levels will be vital for future price movements, attracting a diverse array of traders seeking opportunities in a challenging environment.