Stellar’s XLM Token: A Resilient Player in the Crypto Market

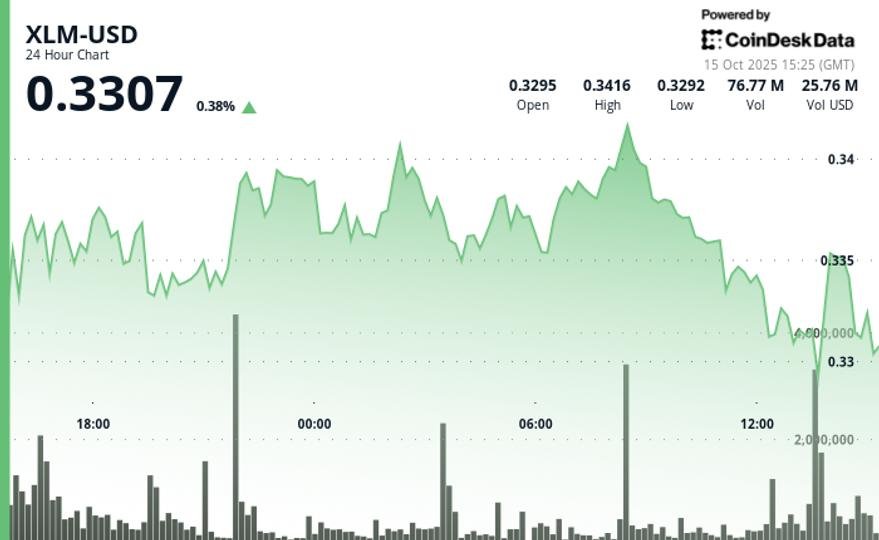

Stellar’s native token, XLM, has demonstrated remarkable resilience in the face of market fluctuations over the past 24 hours. Trading within a narrow range of $0.02—oscillating between $0.33 and $0.34—XLM has shown a pattern of consolidation. After briefly surpassing the $0.34 mark during early trading, it retreated back to $0.33, primarily due to modest profit-taking. This movement can be interpreted as a necessary correction following a recent short-term breakout, emphasizing how market participants are strategically responding to intraday shifts and momentum.

Surge in Trading Volume

During this recent trading period, XLM’s trading volume witnessed a notable increase, surging to 44.04 million—almost double the daily average of 22.35 million. This spike indicates heightened participation and a growing interest from institutional investors. Much of this activity coincides with Stellar being included in WisdomTree’s recently launched exchange-traded product (ETP), which has added an extra layer of legitimacy and visibility to XLM. This development not only garners attention from professional investors but further solidifies XLM’s relevance in the ever-evolving digital asset landscape.

Intraday Volatility and Recovery

On October 15, XLM experienced a particularly volatile 60-minute stretch, during which it dropped sharply to $0.33 before making a rapid recovery, fueled by strong buying interest. During this period, over 4.8 million tokens changed hands, indicating significant institutional accumulation near the critical support levels of $0.32 and $0.33. Such swift recovery from intraday lows is a promising sign, showcasing sustained market confidence in Stellar’s technical underpinning, even amid broader market uncertainties.

Support Levels and Future Outlook

As XLM grapples with current market pressures, the $0.33 level has emerged as a critical support zone. This development suggests that buying interest around this price point will be pivotal in determining whether Stellar can maintain its upward momentum in upcoming trading sessions. Technical analysis indicates that further consolidation at this level could pave the way for future growth or at least stability, thus making it an important focus for both short-term traders and long-term investors.

Technical Indicators Showing Ambiguity

Throughout the 24-hour analysis period from October 14 to October 15, XLM-USD exhibited considerable volatility, trading within a 4.45% range, with highs reaching approximately $0.34 and lows at $0.33. The early session momentum was bolstered by above-average trading volume, establishing formidable support around the $0.34 price point. However, as selling pressure increased later in the session, XLM saw a decline from $0.34 to $0.33, a contraction of about 2%. Importantly, despite this bearish momentum, the asset found significant support around $0.33, closing stable at this point.

Institutional Interest in XLM

The surge in trading volume and the ability of XLM to rebound signifies robust institutional interest in the cryptocurrency marketplace. As institutional players position themselves at vital support levels, it highlights the growing trust in Stellar’s platform amidst broader market uncertainties. This reinforces the narrative that XLM is not merely a speculative asset but a serious player in the digital asset ecosystem, driven by real backing from institutional capital.

Conclusion: A Promising Future for XLM

In summary, Stellar’s native token XLM has showcased notable resilience over a turbulent trading period. With significant trading volumes, critical support levels, and a burgeoning interest from institutional investors, XLM stands poised to navigate upcoming market conditions adeptly. As we look ahead, the combination of strong buyer interest at $0.33 and the potential for sustained upward momentum presents a compelling case for both traders and investors alike. Stellar’s positioning in WisdomTree’s ETP further underscores its growing viability and relevance in the increasingly competitive digital asset landscape.